Business Trends 2021 Predictions

What do we expect for 2021? Here’s what our analysts had to say…

What do we expect for 2021? Here’s what our analysts had to say…

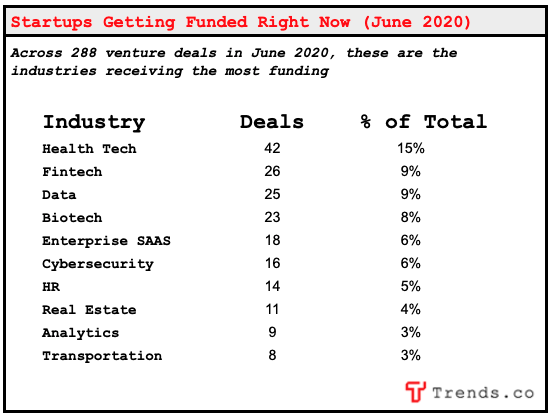

The Signal: Since the start of the pandemic outbreak in the US, we have been tracking startup funding data. Based on Dan Primack’s indispensable Pro Rata newsletter, our latest analysis looks at 288 venture deals closed in June 2020.Over the month, the industries that have received the most funding were Health Tech (15%), Fintech (9%), Data (9%), Biotech (9%), Enterprise SaaS (6%), Cybersecurity (6%), HR (5%), and Real Estate (4%).

In 2014, the Harvard Business Review published an oft-cited article titled “At Amazon, It’s All About Cash Flow.” The article set out to address the sentiment that Amazon “didn’t make any profit.”

In analyzing Amazon, the article argues that observers should focus on the e-commerce company’s free cash flow rather than its net profit, which doesn’t properly take into account investments in capital goods.

The article continues by identifying the best metric to measure a company’s ability to generate cash: the cash conversion cycle (CCC).

* * *

Venture capital can be deeply complex, but most firms still operate off the familiar model: make smart bets and hope that one pays off in the unicorn hunt. For that very reason, many firms will only bet on businesses that at least have the potential to “be the next Uber” or at least enter unicorn territory.

Pitchbook recently released their quarterly venture monitor report. The 37-page report is full of insight, so we pulled out the key points for you here. (You’re welcome!)

After a failed Y Combinator application in 2017, Pat Walls decided to bootstrap his next business. Hustling around his full-time job as a software developer, he built up Starter Story as a “solopreneur.”

Have you ever wanted to create your own podcast? How about one that brings in $100k a year while helping small businesses grow?

Her last job was technically for Walmart. Catharine Dockery, the founder of VC fund that specializes in vice, was chief of staff for Bonobos founder Andy Dunn. After Bonobos was bought by Walmart, she worked several months for the company that cared so much about maintaing a squeaky clean image it didn’t sell music with explicit lyrics in the 1990s.

Andrew Wilkinson has sold only two of the 20-plus companies he has founded. In a different world, one where private equity groups and hedge funds didn’t act like the private equity groups and hedge funds they are, he might have sold all of them.