Cash is King: Using the Cash Conversion Cycle to Finance Your Operations

In 2014, the Harvard Business Review published an oft-cited article titled “At Amazon, It’s All About Cash Flow.” The article set out to address the sentiment that Amazon “didn’t make any profit.”

In analyzing Amazon, the article argues that observers should focus on the e-commerce company’s free cash flow rather than its net profit, which doesn’t properly take into account investments in capital goods.

The article continues by identifying the best metric to measure a company’s ability to generate cash: the cash conversion cycle (CCC).

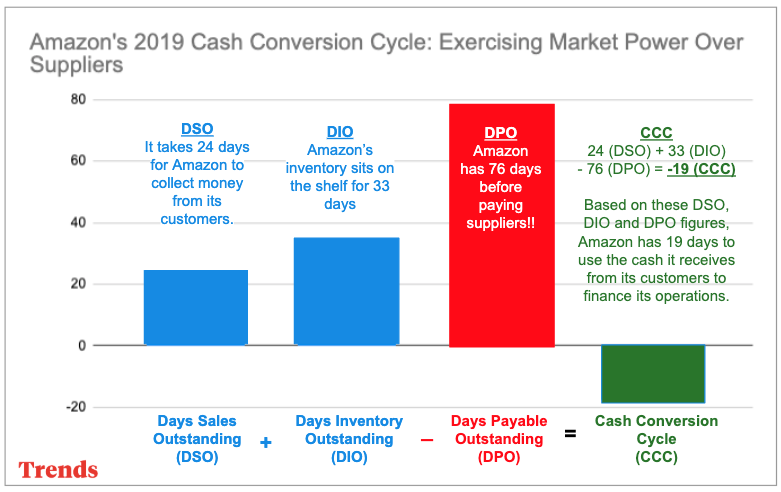

“…the key metric of a company’s cash-generating prowess is the cash conversion cycle, which is days of inventory plus days sales outstanding (how long it takes your customers to pay you, basically), minus how many days it takes you to pay your suppliers [days payable outstanding].

Super-efficient retailers such as Walmart and Costco have been able to bring their CCC down to the single digits. That’s impressive. But at Amazon last year, the CCC was negative 30.6 days.

In Amazon’s case, all this cash is being used to finance the company’s continued explosive growth. The company doesn’t need to borrow, it doesn’t need to issue stock. It can just keep spending its own cash to attack new sectors and upgrade its offerings.”

Here is the breakdown for Amazon’s cash conversion cycle (CCC) in 2019: