nlopchantamang.com

Touchless Technology is the Norm in Asia. Is North America Next?

Trung Phan

The Signal: Interest in touchless (or contactless) technology has risen sharply since the outbreak of coronavirus.

Proxy, an SF-based startup which raised $42m in March (and $59m total) is a fast-growing player in the touchless technology space. In recent weeks, it has seen referring domains to its website spike.

Founded in 2016, the company provides a suite of products to enable touchless access for commercial and residential properties:

- Hardware: The firm sells a Mobile Reader, which can be used on any type of entrance, including doors, elevators, turnstiles, or garages. Its product line ranges in price from $299 to $349.

- Software: To operate its hardware (e.g., open doors), Proxy has a mobile access plan provided through an accompanying app. Mobile access is priced between $49 and $69 per mobile reader, providing permissions, settings, tracking, etc.

According to The Information, Proxy’s technology solution is rapidly expanding use cases outside of business solutions. The site reported that the California governor’s office recently called Proxy to see if it could help set up hygienic security systems in temporary hospitals or other sites.

If this is truly an inflection point for touchless tech in the US, it would bring this part of the world up to speed with what has long been the norm in other parts of the world.

In Asia, the rise of touchless technology -- whether that be through automated faucets, doors, or toilets -- was driven by at least 2 factors: 1) the continent’s experience with SARS in 2003; and 2) more recent building construction that can utilize the technology.

Perhaps the most notable divergence in "touchless" technology is America’s low adoption of non-cash payment methods. In the US, major mobile payment app adoption by consumers is stuck at 10% (vs. 80% for China).

The Opportunity: Based on the above, opportunities in the touchless technology space include:

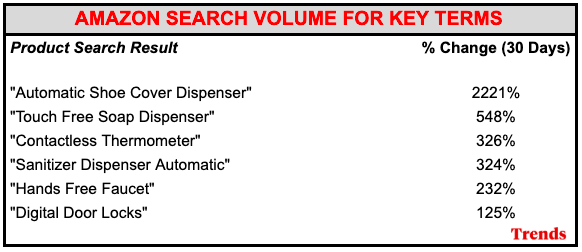

Touchless Products: Using data from Jungle Scout -- an Amazon product finder and research tool -- we searched for which categories have seen the most growth over the past month for the following terms: "automatic," "touchless," and "contactless."

With quarantine measures in effect, Amazon has seen a surge in interest for products that limit the amount of touching involved. The items in the above table all have dual uses, for both commercial and residential settings.

Automatic shoe cover dispensers saw the fastest gains in search interest, followed by touchless technology for soap dispensers, sanitizer dispensers, thermometers, faucets, and door locks.

Moving forward, there is an opportunity to create "better" mousetraps for these touchless technologies and, also, to have expertise in outfitting new property builds that are optimized for hygiene (in the same way Proxy is being asked out to outfit government buildings).

- Holograms & Augmented Reality (AR): More generally, there is spatial computing, which includes hologram and augmented reality (AR) technologies.

Hologram technology, which is already being used in China, has been implemented in place of physical elevator keys. Notable companies that offer hologram solutions include Lightfield, Leia, Holoxica, Provision Interactive, CY Vision, and BI3D.

The larger opportunity is in AR, with major technology platforms being built by Magic Leap and Hololens. It’s not terribly practical to compete with these firms head-on (the former has raised $800m while the latter is part of Microsoft); rather, the business move is to build on top of these platforms, which both have robust developer tools (Magic Leap, Hololens).

And while these platforms are not specifically meant for touchless tech (key solutions are currently meant to facilitate hands-on manufacturing work) and also require hardware (headsets), the opportunity is there to build such solutions as AR hardware becomes cheaper and more accessible. - Non-Cash Payments (e.g., Mobile, Digital): The Bank for International Settlement (BIS) -- often called the bank for central banks -- published a report on how concerns over COVID-19 transmission via cash has renewed interest in digital payment options.

If this crisis catalyzes a change to non-cash payments in America, what opportunities exist surrounding that?

Because the mobile/digital payment space is so lucrative, the competition is fierce, with Apple, Paypal, Google, Amazon, Visa, Stripe, Square, and others competing for market share.

Opportunities to enter the market can be centered around specific pain points for consumers. Based on research from Pew Trust in October 2019, reasons for low mobile/digital payment adoption in America include:

- Lack of trust: A belief that non-cash payment options are easier to hack, are poorly protected, and can lead to a loss of funds.

- Payment issues are difficult to resolve: Consumers felt that dealing with merchants re: overpayment, disputes, and fraudulent transactions was difficult.

- Lack of trust: A belief that non-cash payment options are easier to hack, are poorly protected, and can lead to a loss of funds.

Solutions for these issues that complement (rather than compete with) existing payment players can center around educating consumers (e.g., NerdWallet, Card Ratings) or scalable customer service solutions (e.g., fintech chatbots such as Kasisto, Trim, and Finn.ai).

Leave a Comment