nlopchantamang.com

Flares from Andreessen Horowitz’s 2021 Marketplace 100

Ethan Brooks

Each year Andreessen Horowitz publishes the Marketplace 100, a ranking of the biggest marketplace startups from around the world.

Using transaction data from Bloomberg Second Measure, they rank winners according to gross merchandise value (GMV) -- the total amount of money users spend on their platform.

2020 was an interesting year for marketplace startups, with some (like food delivery) thriving amid the COVID-19 lockdowns while others (like event tickets or travel marketplaces) floundered.

This week, we’re looking at some of the most interesting opportunities and unexpected insights from a16z’s findings.

Cabin Fever Has People Crazy for Camping

While some travel marketplaces struggled during 2020, many that specialized in outdoor travel saw incredible growth.

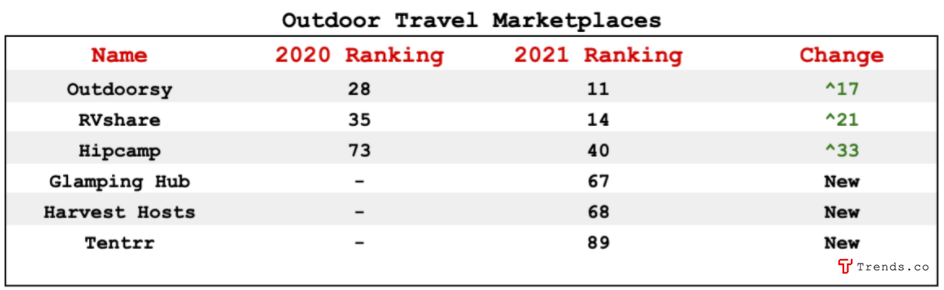

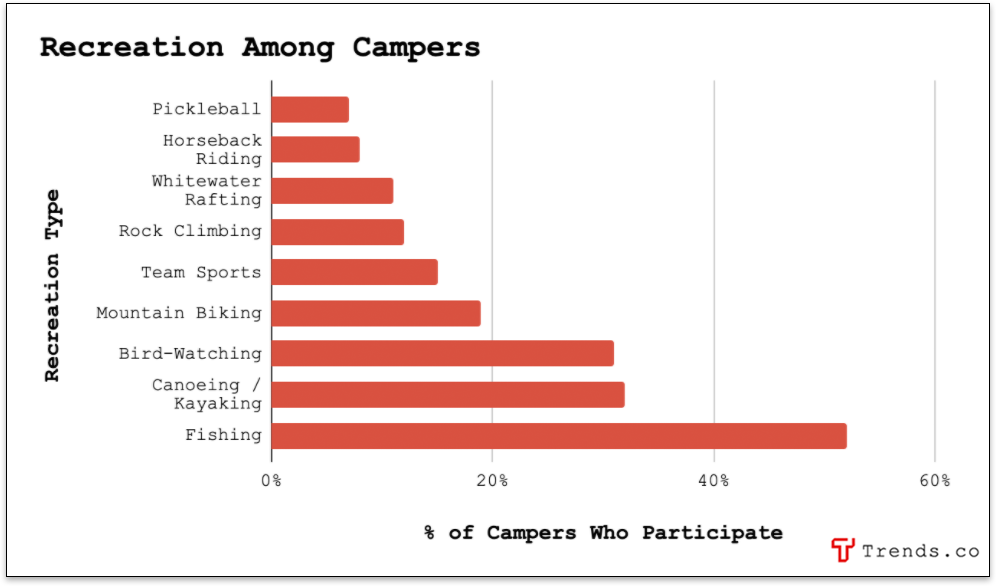

Hipcamp, for example, rose 33 spots on the list from 73 to 40, and shared the podium with other 5 other camping platforms:

Of these, the most interesting is Harvest Hosts, an RV club that connects campers with the owners of wineries, breweries, and other businesses willing to host campers. Here’s how their unique business model works:

- RV owners pay $99-$139/yr to join and get access to Harvest Hosts’ database of hosts.

- Members can stay 1 night with any host, parking their RV for free in exchange for spending money with the host’s business.

- Bookings are not made through the app. Campers contact hosts directly, meaning members are pretty much just paying for the host contact info.

The app has been installed 50k+ times on the Android store alone, and has 14.5k ratings on the Apple store. With those numbers, this is easily a $1m/yr business, with practically zero overhead.

According to KOA’s annual camping report, RV ownership rose 37% YoY in 2020, and private land is the fastest-growing destination type campers choose, meaning there’s still plenty of room to replicate this model.

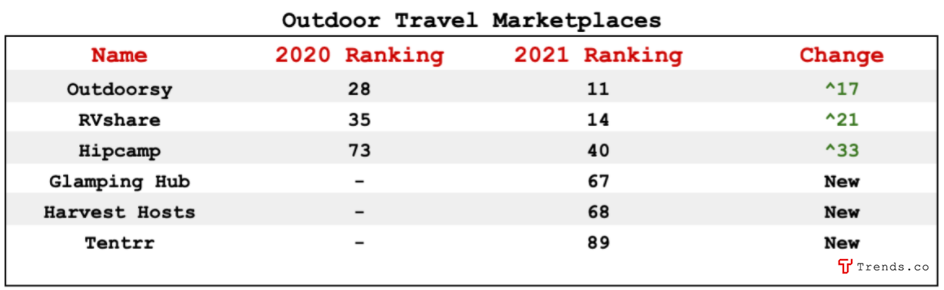

Harvest Hosts currently works primarily with wineries, breweries, and golf courses, but you could target other businesses that campers love, like unique restaurants, horse ranches, climbing gyms, river guides, or pickleball arenas.

There are also opportunities to try to improve on the Harvest Hosts product. Three-star reviews on their Trust Pilot account frequently ask for:

- Better vetting of hosts and photos of their parking

- More locations in the Midwest

- An all-in-one app that allows campers to find hosts, book stays, plan RV-appropriate driving routes, and schedule side-attractions

Child Care Is Poised for a Comeback

The child care industry got hammered during last year’s COVID-19-related shutdowns. Revenues plunged 64% industry-wide and, according to one survey, ~30% of US respondents aren’t confident they’ll survive the next 12 months.

Virtually all of the child care startups on the list dropped 13 spots or more, and now rank 50th or lower on the list.

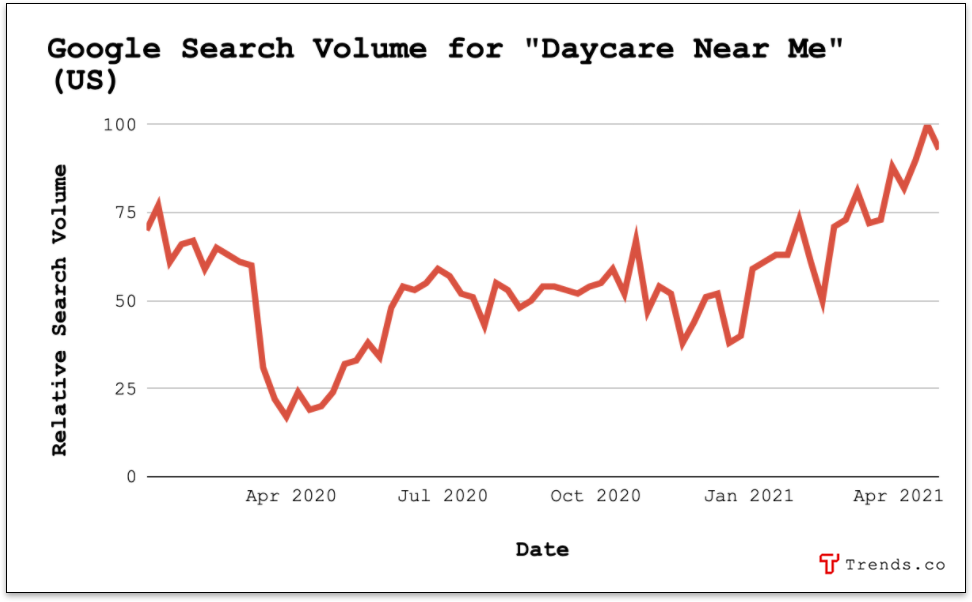

But here’s the thing -- demand for child care is now higher than it was pre-pandemic, according to Google Trends. Like the regrowth following a forest fire, this space is poised for a comeback.

Failing businesses means there’s an opportunity to fill customer demand by either building or acquiring. When revenues fell, child care programs responded by laying off staff, meaning that new startups will find plenty of qualified talent available in the space.

On a recent episode of My First Million, Trendster Codie Sanchez talked about how to acquire distressed assets from gyms for free via a revenue-sharing model. The same could work for child care.

There’s also room to build ancillary businesses that benefit from the rebirth of this industry. For example, data from HiMama’s industry survey shows:

- 64% of child care centers feel they’re currently understaffed, indicating an opportunity for job boards or talent matching services.

- A growing number of programs accept payment subsidies, and may need consulting to help implement this option for customers.

- For owners, marketing fell on the list of business priorities, while the building or acquisition of new locations rose from #10 to #7, making this an interesting niche for financiers or builders.

3 Other Noteworthy Callouts

There were some other interesting changes from the Marketplace 100, many of which we called out in Trends articles early last year, such as:

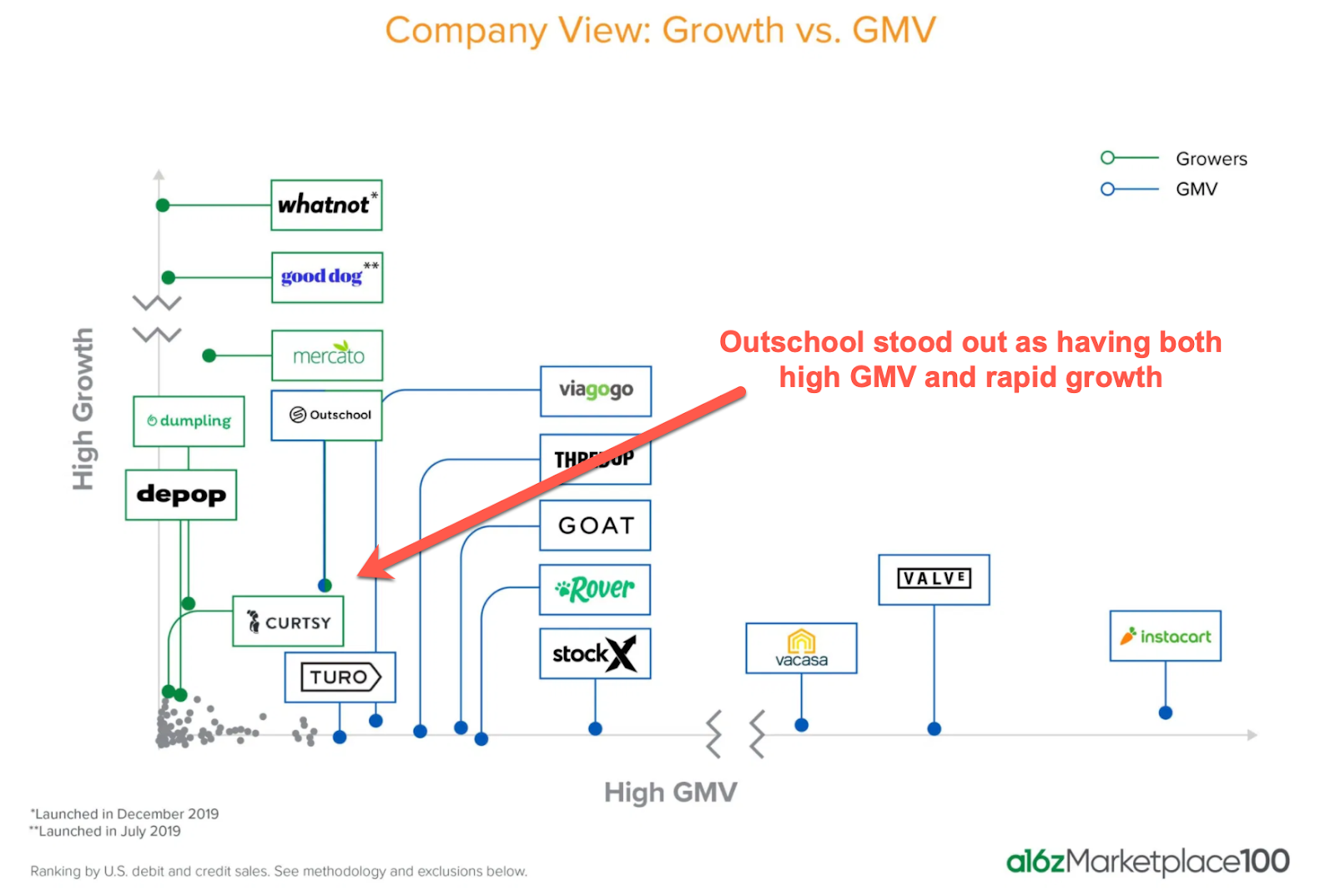

- Edtech Boom: Outschool jumped 59 places to #10 and was the only marketplace to see both fast growth and a high GMV.

- Live Ecommerce: A live ecommerce platform called Whatnot was among the fastest-growing marketplaces last year.

- Online Flower Sales: Flower delivery startup Floom crept onto the list at #97. Meanwhile, 1-800-FLOWERS’ Q3 revenue grew ~70% YoY, leading the stock to surge.

Leave a Comment