nlopchantamang.com

Signal Update and New Insights: Digital Status Symbols

Ethan Brooks

An actual look at how tired we are of hearing about NFTs… Just kidding, it's Google search volume ;)

The Signal: Last May, we wrote about the rise of digital status symbols, highlighting the success of early projects like CryptoKitties, and ways businesses could capitalize on the digital collectibles space.

Since then, awareness has skyrocketed, leading to hundreds of millions of dollars in sales.

Dapper Labs, the company behind CryptoKitties, struck a licensing deal with the National Basketball Association, creating NBA Top Shot, a platform that sells collectible "moments" from game footage.

In less than a year, Top Shot has sold ~$300m in digital collectibles. Meanwhile, Dapper landed $250m in funding at a $2B valuation, while other digital art projects, like CryptoPunks and Hashmasks have generated tens of millions of dollars in sales.

Background: All of this is made possible by an emerging blockchain technology called non-fungible tokens (NFTs). We talked about NFTs on a recent episode of the My First Million podcast. But if you're looking for a simple explanation, Reuters journalist Elizabeth Howcroft boiled it down nicely...

NFTs are special because they create scarcity that didn't previously exist in the digital world. Widespread awareness of this is creating new value for digital collectibles, and NFT artwork is seeing staggering price run-ups.

Trendster Hunter Fairchild spent $100 on NFTs 9 months ago; they’re now valued at ~$50k. Elsewhere, Trendster Jesse Schwarz set a (then) record for the most expensive purchase on NBA Top Shot, paying $208k for a LeBron James NFT that could already be worth 7 figures.

Everywhere, debate is raging over whether the money being pumped into NFTs is just another gold rush.

The Opportunity: During a gold rush, you don't want to mine gold. You want to sell picks and shovels.

Regardless of what happens to the price of these individual NFTs, one thing is certain -- digital collectibles are going mainstream and there are legitimate long-term "picks-and-shovels" opportunities for those who are paying attention.

Last year, we wrote about another business called Heritage Auctions, which does $800m+ per year selling collectibles. In this Signal, we'll draw on different aspects of their business model to show emerging NFT-related opportunities like…

Niche Auction Houses: Heritage Auctions is not the biggest auction house in the world. Others like Sotheby's, Christies, and eBay do far more business.

But they are the largest in a narrow field -- collectibles. Heritage founders Jim Halperin and Steve Ivy were both collectors and built their business around this niche.

In the NFT world, there are already a few giants jockeying for control over the generalist domain. OpenSea is widely considered the eBay of NFT art, while NiftyGateway (owned by the Winklevoss Twins) is thought of as a higher-end marketplace.

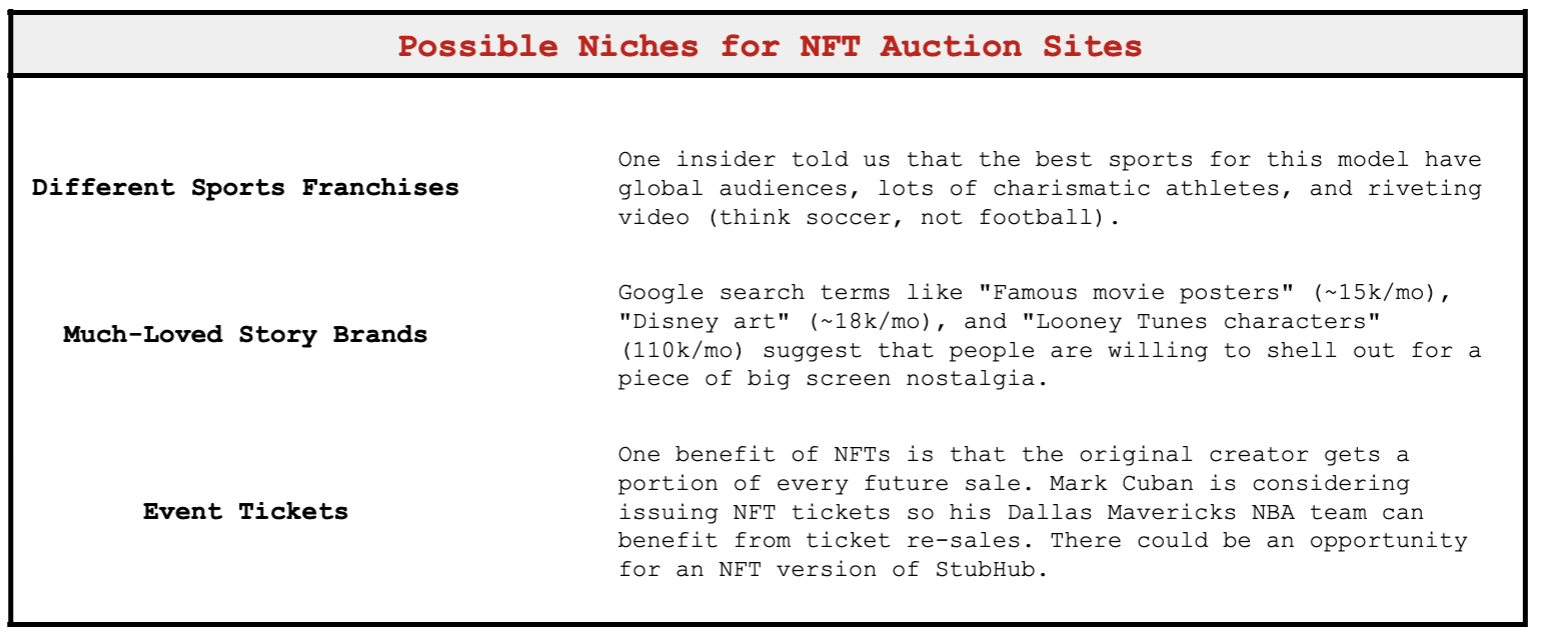

But there will be lots of opportunities to cater to niche interests. Now that NBA Top Shot has proven that niche fan NFT marketplaces can work, other opportunities include auction sites focused on:

The key is to tap into niches you already know well. Tools like Pixura allow you to build a no-code NFT marketplace quickly in order to test concepts.

Valuation and Appraisal: Art is a $60B/yr business, and increasingly common in the investment portfolios of venture capitalists and high net worth individuals. Companies like Masterworks even make it possible to own fractional shares of blue chip art.

If the value of NFTs holds, we could see similar demands among institutional and retail investors.

Heritage Auctions employs 100+ expert appraisers, each of whom must have:

- 5 years experience in the field

- Membership in an appraisal society

- United States Standard of Professional Appraisal Practice (USPAP) certification

There could be an opportunity to develop similar professional communities and certification programs around NFT appraisal.

The American Society for Appraisers charges $545 per year for membership and $1k+ for different valuation training, generating ~$6m in revenue, according to their 2019 tax filings. They also have a job board, which offers additional revenue potential.

For more on how these business models work, check out our deep dives on how executive peer groups and job boards make money.

NFT Display: One glaring issue facing the world of NFTs is that there aren't any easy ways to show off your digital art yet.

Some companies, like Infinite Objects and Netgear, offer digital frames -- but on a recent episode of My First Million, Shaan Puri suggested there was still plenty of room for new entrants that are targeting NFT collectors specifically.

"I think that you could sell $300-$400 frames," he said, "And I think that you could sell probably $5m of them in a month… Easily. Because people need a way to display these."

Leave a Comment