nlopchantamang.com

Flares: Drugs and Rock ‘n’ Roll

Aja Frost @ajavuu

Mary Jane Is on the Move

Cannabis distribution is set to explode. We spoke to Vince Ning, the founder and CEO of Nabis, a distributor that ships ~10% of all cannabis products in California.

In the 3.5 years since Ning started the company, Nabis has grown a portfolio of 100+ brands, which collectively ship ~$300m worth of cannabis products per year.

There are 3 areas where Ning sees white space in the cannabis distribution niche:

- D2C Delivery: Cannabis delivery is expected to be the fastest-growing cannabis sub-market. The proportion of cannabis delivery and curbside pickup sales soared during COVID and are still 10% higher than pre-pandemic levels. It’s not surprising that Uber wants its piece of the pie.

- D2C software: There are opportunities to create plug-and-play software solutions that help brands and dispensaries create a D2C experience for their customers. “Whether it be tackling it from a logistics angle or enabling brands to market better… There’s a real opportunity for companies to build D2C models with software,” Ning told us.

- Data consolidation: According to Ning, “One of the biggest things right now is providing the next layer of depth to the industry by connecting everyone’s disparate data silos.” There are plenty of players both upstream and downstream (e.g., from raw materials to POS providers) with datasets that could be combined and leveraged to help brands grow faster.

Papa’s Got a Brand New Bag of Weed

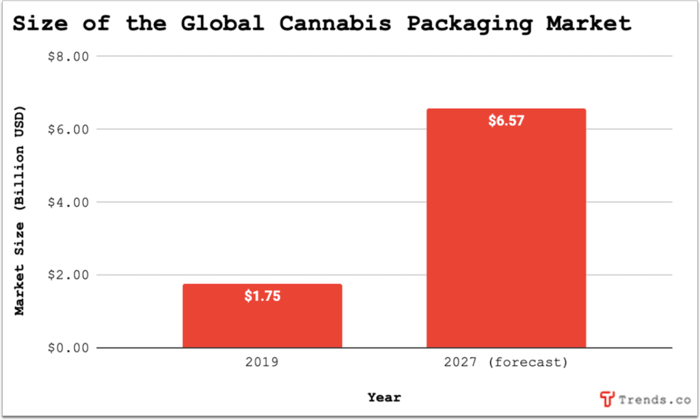

The global cannabis packaging market is set to more than triple from 2019 to 2027 as more countries begin to legalize and formalize the industry. North America should account for 80%+ of the global cannabis packaging market by 2024.

As packaging regulations evolve with the industry, there will be opportunities to provide specialized products and services, including:

- Advanced packaging technologies: As the market becomes more regulated, we will likely see more stringent requirements for safety (e.g., tamper-proof/child-resistant packaging) and stay-fresh features (e.g., that negate the need for preservatives).

- Contract packaging and equipment leasing: If this ~100 page document is anything to go by, packaging and labeling requirements will be complex, from font type and size to warning statements. This presents an opportunity to provide packing services and equipment to producers, many of whom are small companies currently packaging and labeling by hand.

- Materials: Different cannabis products use different types of packaging. Some will become more important than others as the industry evolves. For example, cannabis concentrates in vape cartridges are expected to be the most common format for legal cannabis, which means that demand for specialized glass packaging will increase.

- Digital security: Cannabis companies like Akerna and KushCo are already partnering with and investing in anti-counterfeiting firms to enhance packaging with advanced digital security features, e.g., the use of unique device identifier (UDI) codes that can be validated and tracked (by producers and customers alike) at each stage of distribution.

What’s Goin’ On (with Music NFTs)

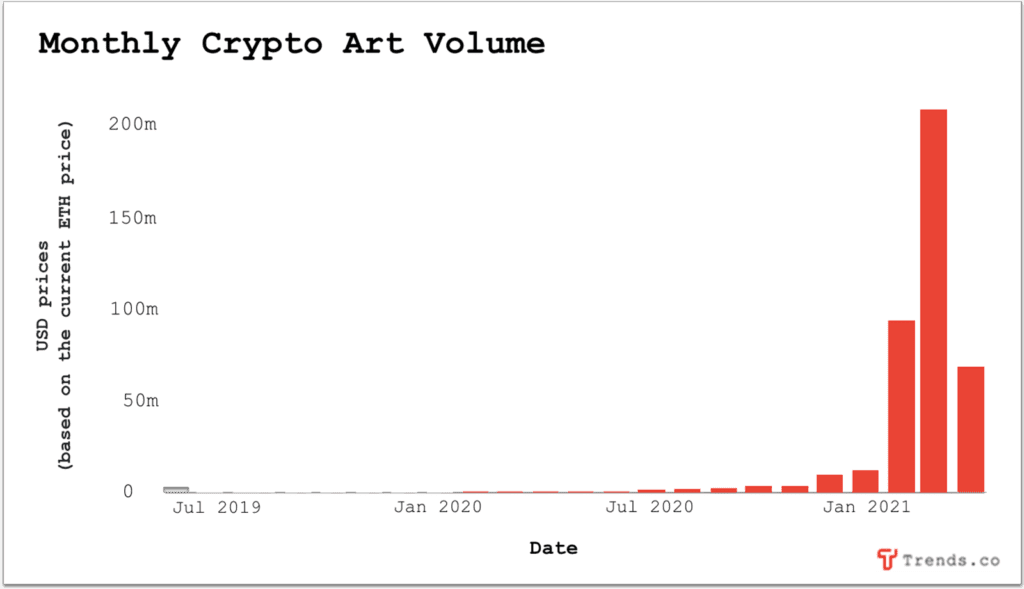

Musicians are singing that sweet, sweet, NFT tune. Back in February, electronic pop artist Grimes sold ~$6m of music and art NFTs in ~20 minutes. More recently, The Weeknd sold $2.3m worth of clips of a new track as NFTs.

Though it may seem like hype, music is a genuine NFT use case. Why? Traceability around ownership, rights, and royalties matter, a lot.

The future of the music industry will address payment transparency among stakeholders, including artists, songwriters, producers, and session musicians.

One example is the merger of Bluebox and Opulous, which will enable artists to prove ownership and split copyright sales to raise funding.

Two opportunities that will sustain beyond the hype include:

- Support and management: Just as musicians need professionals to manage anything from finances to PR, NFTs open up a new need for expertise. Musicians will need education, guides, and legal support for their NFT sales process.

- Value assessment: The NFT music market will stabilize, relying on other valuation methods besides hype. There’s an opportunity to combine human appraisal and data-backed valuation (e.g., number of streams) to measure how much a music-based NFT is worth. For other art appraisal business models, read last month’s Signal update on NFTs.

The Show Must Go On

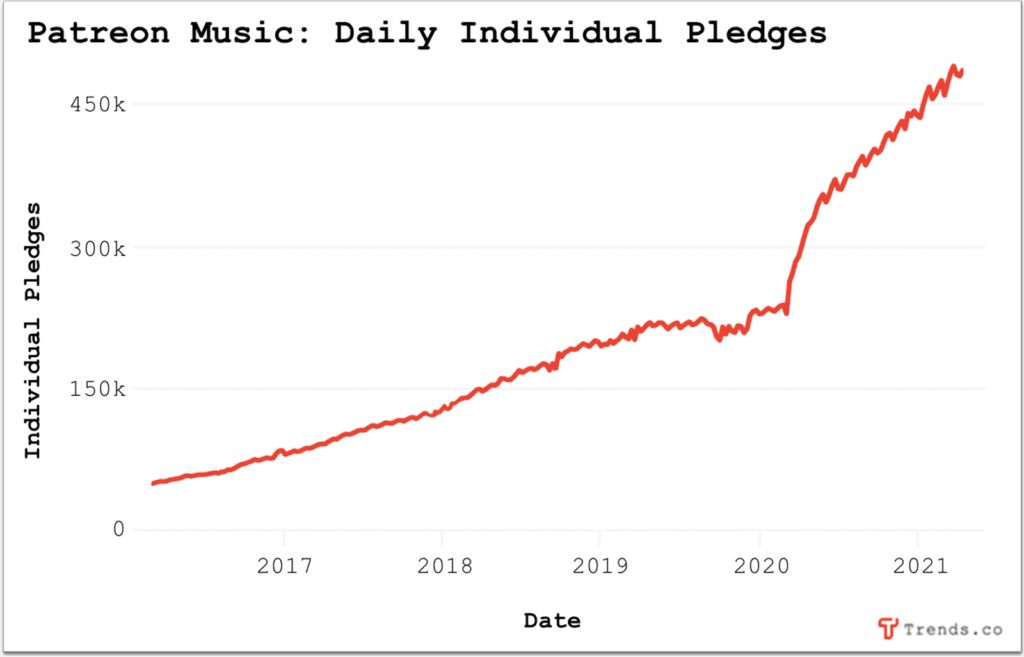

Musicians are going direct to fans at a rapid rate. There are now 14.2k+ music artists on Patreon, and monthly individual pledges to musicians have increased 64.9% in the last year.

Two areas of innovation to streamline the artist-fan relationship include:

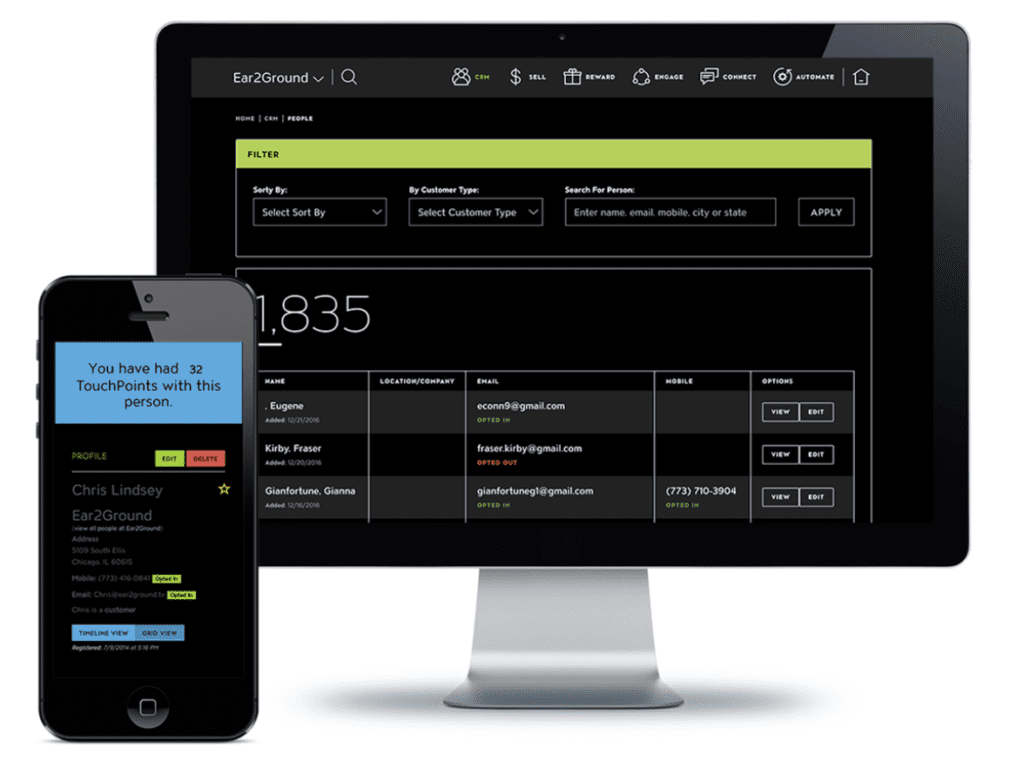

- Customer Relationship Management (CRM): Many musicians have audiences across multiple platforms, making it hard to keep track of fan engagement. Ear2Ground, the “Salesforce for artists,” allows artists to manage audiences in one place and create marketing campaigns to drive sales. The website doesn’t look like it’s actively taking customers, so there’s white space to revamp a similar platform. There are also opportunities to expand a CRM platform for musicians, with integrations like Apple Music, Spotify, social commerce, to track listens, gather audience feedback, and sell merch in one place.

- Events: Help artists with online or in-person event logistics. When one concert platform, Side Door, pivoted to online shows last year, sales climbed 30x to $1m+. To elevate the online concert experience, add a virtual waiting room where customers can purchase drinks and food for delivery, or integrate with an ecommerce platform to sell merch before and after performances. For in-person events, take Sofar Sounds, which provides intimate shows in secret locations, one step further by facilitating connections between attendees, hosts, and artists.

Leave a Comment