nlopchantamang.com

The New QVC: Live Ecommerce is the Chinese Behemoth Poised to Take Root in the West

Aja Frost @ajavuu

The Signal: The Chinese live-streaming ecommerce market, which took off in 2016, was worth $63B in 2019 and is expected to more than double to $129B in 2020. To put that in context, QVC generated $11B in revenue in 2019.

Last year we wrote about how you can capitalize on this billion-dollar industry, in which live-streams take place within ecommerce platforms like Alibaba-owned Taobao Live. Since then, the industry has been given a boost amid the pandemic as thousands of brick-and-mortar businesses attempted to digitize their sales activities. Taobao Live, for example, saw a 110% year-on-year increase in live-streaming events from February 2019 to 2020.

On the platforms, much-loved influencers and hosts display items for purchase for 3-5 hours during each show. Customers click the link on their phone screen to buy as they watch models or shopping guides testing out products or trying on garments. Much like QVC, ease of ordering and incredible salesmanship of the hosts is the name of the game. The difference is that a click of a button replaces a phone call.

The recent pandemic accelerated this trend and unearthed more use cases for live-streamed shopping. For example, this Chinese farmer sold out of $6k worth of his mahogany leaves (similar to red spinach), in 10 minutes. Some farmers have since gone from selling 10% to 90% of their produce online.

The trend has been going global since 2017: South Korea, Thailand, Russia, Japan, Sweden, and Singapore were some of the first countries to follow suit. The launch of Amazon Live in 2019 and Instagram Shopping last month (which is expected to generate $30B in revenue for the company) signal that the West is fully embracing social ecommerce.

The Opportunity: There are opportunities to leverage live shopping to sell all kinds of products, from fresh produce to handbags. Welden, a high-end US handbag startup, first tapped into Chinese live-streaming 2 years ago. It now sells 20% of its products through China’s live-streaming market. Conversion rates of live-stream shopping are over 30%, compared to other content-driven platforms that are closer to 5%.

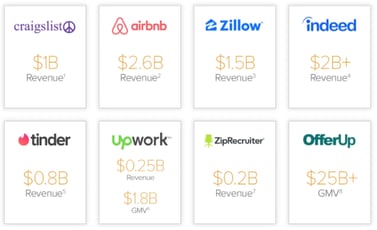

For those who want to capitalize directly on the growing industry, it will be difficult to compete with the likes of Amazon, Instagram, and Facebook (although some argue that growing disillusion with these incumbents creates opportunity for challengers). But there is an entire ecosystem of social shopping opportunities to be explored:

Influencer incubators: Creating influencers and providing them with the infrastructure and resources to sell products is big business. Ruhnn (which raised $125m last year), is a Chinese startup that “makes” influencers (or key opinion leaders as they’re called in China). Talent managers then jostle to sign the best influencers.

Group shopping: The pandemic has accelerated the online group activities trend (e.g., Netflix Party). Companies like Squadded Shopping Party, which lets users go shopping together on ecommerce sites, are hoping to capitalize by bringing the concept of shopping parties to the West.

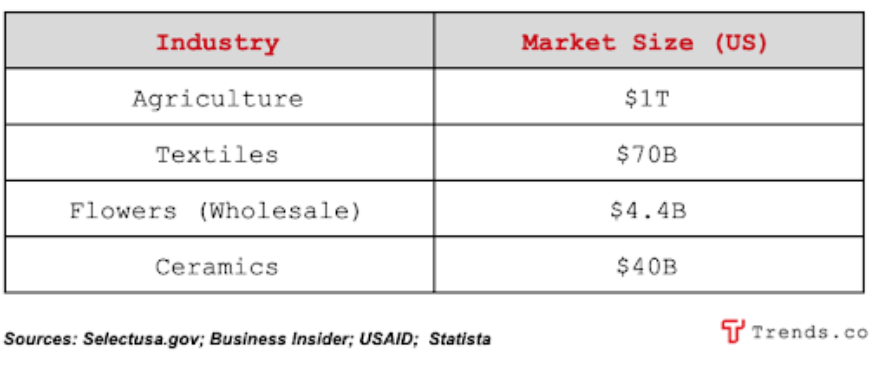

Niche streaming platforms: The fact that live-stream shopping helped Chinese farmers survive COVID signals that there are opportunities to create more niche platforms for verticals that don’t typically advertise or operate on social media. For example, cattle farming and trade in the US is worth ~$70B. There’s an opportunity to create a niche platform custom-built to serve this and other traditional markets, including:

Leave a Comment