nlopchantamang.com

Logistics Tech Is Booming. Here’s What You Need to Know.

Aja Frost @ajavuu

Source: Crunchbase

The Signal: Last year we wrote a Signal about Fetch, a mail delivery startup focused on delivering packages to apartments, which had just raised $18m.

In the ~5 months since we wrote that article, VC funding in logistics startups has boomed. Young companies in the space have attracted a whopping $5B, of which $2.7B was raised in 2021.

Some of the biggest funding rounds so far this year include Hive Box express lockers ($400m), Sennder digital freight forwarders ($160m), and Getir grocery deliveries ($128m).

The Big Picture: The global logistics industry is fraught with inefficiencies -- 50% of the US’ largest importers use spreadsheets to manage complex international shipments. It’s not surprising that disruptors have been challenging large players in logistics for years.

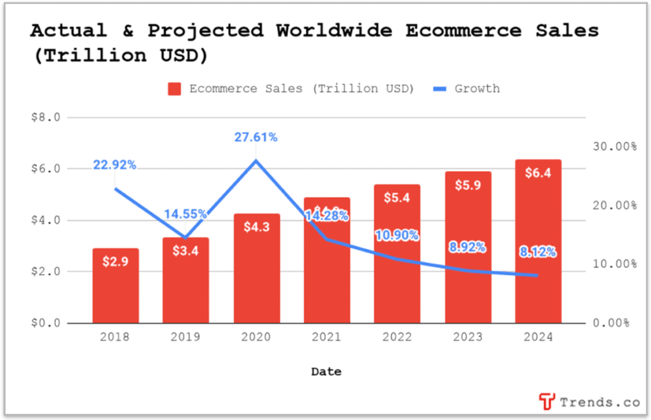

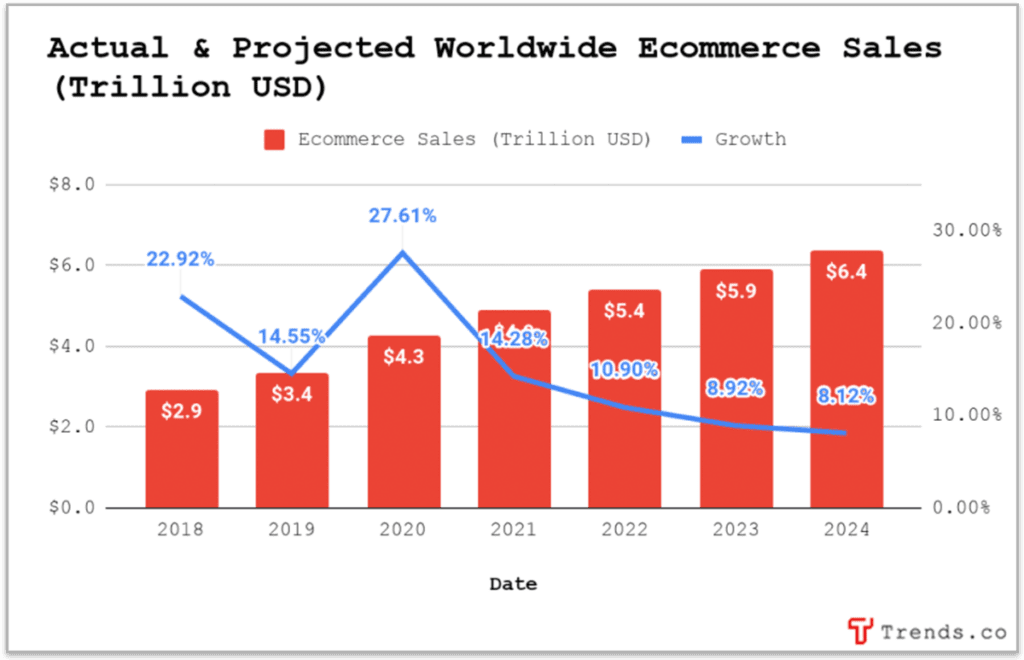

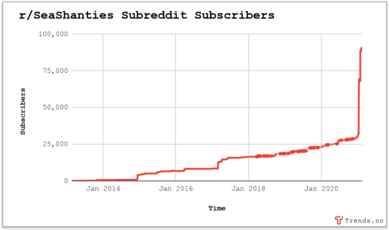

But a COVID-inspired boom in ecommerce is ushering in a new wave of competitors.

Focus on Small and Medium-Sized Businesses: A small group of incumbents (Agility, DB Schenker, DHL, Kuehne+Nagel, and UPS, according to a 2021 industry report), have gradually been developing SMB-centric digital solutions over the last 5 years.

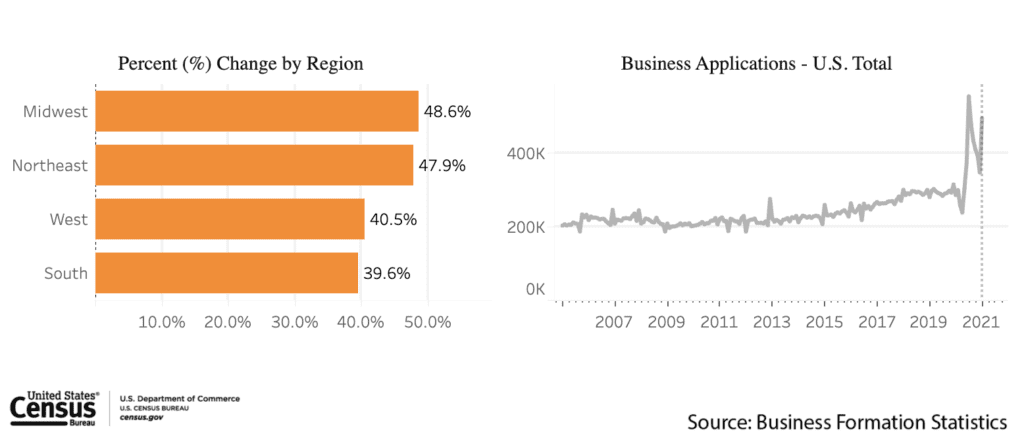

Last year, for better or worse, the pandemic forced many into entrepreneurship.

The total number of small businesses in the US grew from 30.7m in 2019 to 31.7m in 2020 (3.26%) -- almost double the growth experienced the year prior (1.66%). Monthly new business applications have continued to peak through 2021.

This, combined with a shift toward ecommerce, has created fertile ground for logistics startups that cater to the specific needs of small and medium-sized businesses (SMBs).

The Opportunities: Analyzing VC funding trends in the logistics market reveals a number of SMB-focused opportunities. Here are several we discovered:

Same-Day Delivery and the Unbundling of Amazon:

Incredibly, Hong Kong-based on-demand logistics and delivery company Lalamove is about to close a massive $1.5B round.

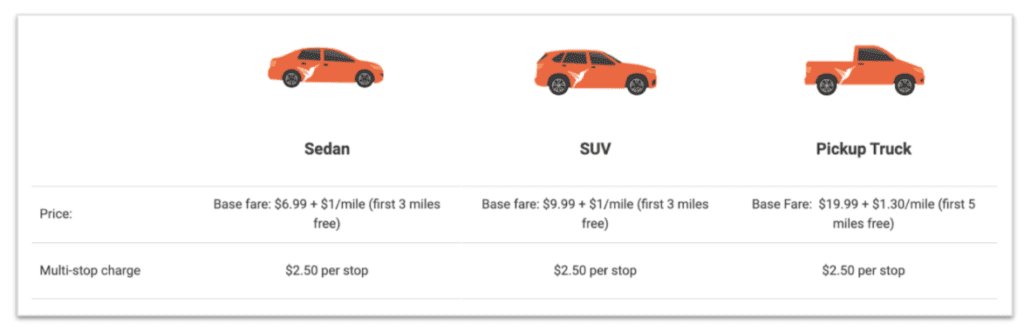

The company, which provides same-day delivery services, has been operating in Asia and Latin America since 2013. Last year, it launched in Dallas-Fort Worth to “empower SMBs with the ability to offer fast, on-demand deliveries to their customers.”

It has since expanded to Houston and Chicago, where it operates across multiple industries, including catering/restaurants, retail, ecommerce, manufacturing, and construction.

The investment confirms that companies that empower small businesses and independent retailers to compete with the likes of Amazon stand to win big.

Per Trendster Saeedreza Abbaspour, “Every piece of Amazon is now offered by a different service: fast checkout is now offered by Bolt, Affirm offers payments solutions, ShipBob is a fulfillment center for ecommerce brands. It’s only a matter of time before someone offers parcel lockers to small retailers.”

SaaS and E-Forwarding:

The logistics industry is no stranger to billion-dollar deals; in 2019, Flexport (the “Slack SaaS for shipping”) raised $1B at a $3.2B valuation. Since then, VC funding in logistics software has boomed, proving that you don’t need to own shipping containers or a delivery fleet to compete.

Freightos, which has raised ~$70m since 2017, is an example of an online freight shipping marketplace and platform that, according to the company, is used by “10k+ small businesses to compare, book, and manage freight.”

Their platform includes SMB-centric features such as:

- Integrated Fulfillment by Amazon (FBA) destinations

- Instant quotes

- Facilities for infrequent shippers and low volumes

Digital forwarders like Flexpost, Freightos, and FreightHub, while often met with indignation by traditional players, are the future of logistics. What’s more, the low-touch/self-service digital model is perfectly suited to the SMB market.

Per a recent McKinsey report, “By 2030, e-forwarding or crowdsourced delivery will become the new normal.” There’s opportunity for more e-forwarders to emerge, and for startups that provide complementing services for SMBs.

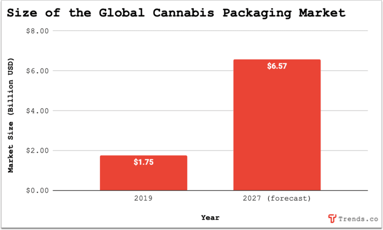

New industries with specific requirements are an attractive niche. Cannabis, with its stringent security regulations, is an example. Nabis, a cannabis distributor that’s raised $10.5m since its 2018 launch, provides distribution, handling logistics, payment, and warehousing services.

As the industry grows and becomes more fragmented with numerous SMB players, there will be an opportunity for online marketplaces that match sellers with qualifying distributors.

Package Consolidation / Mailbox-as-a-Service:

Companies like MyUS, Stackry, and Shipito, which provide package consolidation services for people outside the US, are making bank.

These companies provide consumers with a mailing address inside the US, and then repack and consolidate all of their packages before shipping them to consumers wherever they are based.

Alex Yancher was inspired by companies like these (specifically Egyptian-based Lynks) to start Passport, a startup aiming to “make it easier for [US] brands to reach far-flung customers.” Passport raised $12m last year.

The company has shipped millions of packages all over the world for D2C companies like Betabrand, Native, and Bombas, and claims to have helped its customers grow their international shipping volume by 43% YoY.

There is still plenty of room in the US market to provide package consolidation and forwarding services focused on the fast-growing D2C sector. Beyond the US, there are opportunities to provide the same package consolidation services in centrally located cities like Dubai, and in South America, where ecommerce growth is particularly high.

Aja Frost @ajavuu

Blog posts

Related Articles.

Leave a Comment