nlopchantamang.com

Construction: The $10T Market Still Using Excel to Manage Projects

Aja Frost @ajavuu

Source: CB Insights

The Signal: Last month we wrote about the global looming shortage of skilled tradespeople. We got a ton of responses, one of which was from Trendster Eric Whobrey, the director of technology at construction firm Arco/Murray.

We interviewed Whobrey, who dished on the biggest opportunities in construction tech, which is on track to see a rebound in VC funding despite the economic downturn. The industry has attracted ~$6.3B since 2015.

Not Big on Buzzwords: The first thing you need to know is that you don’t need to be super high tech to compete.

Listening to Whobrey, it’s clear that there is plenty of white space in this market for simple tech solutions.

“I love artificial intelligence and machine learning -- it’s definitely on its way -- but there’s just plenty to do ahead of VR, AR, AI, and ML. That stuff is good for marketing, but not quite established enough because the industry doesn’t have the foundation to really utilize a lot of those things, yet.”

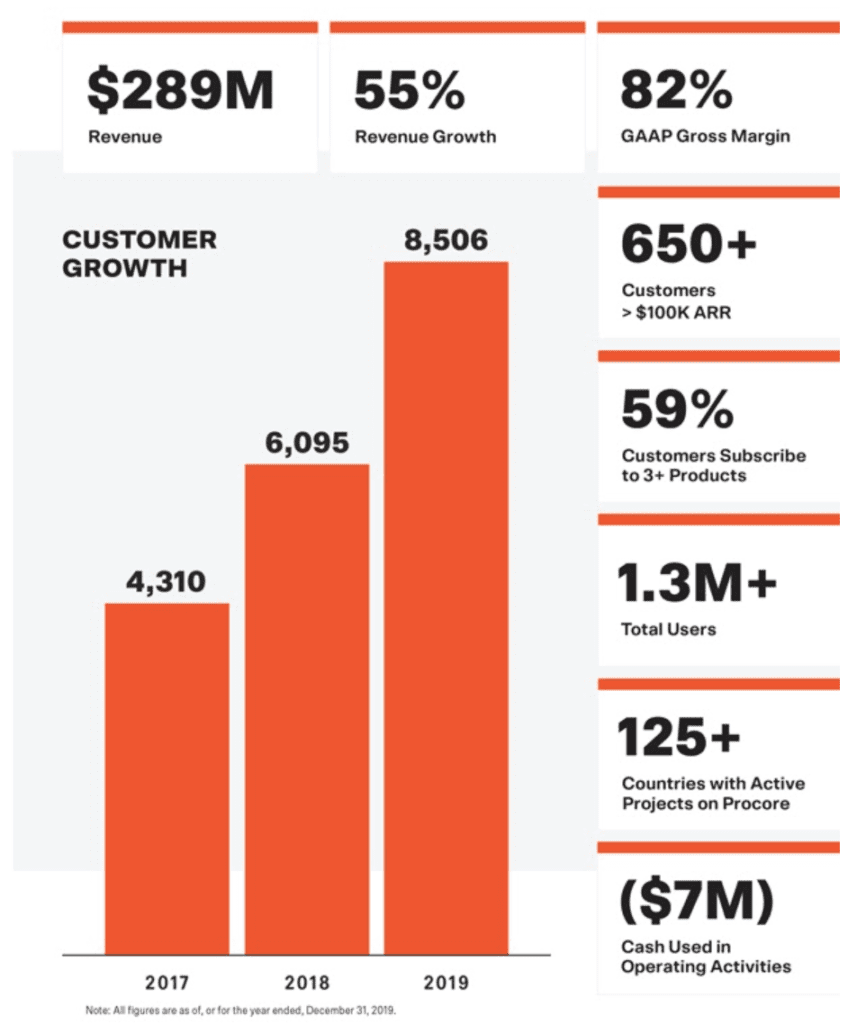

Construction Management Software (CMS): According to a 2018 survey, 82% of construction companies plan to spend the same or more on technology in the future. Forty-one percent of respondents plan to upgrade their CMS in the next 12 months.

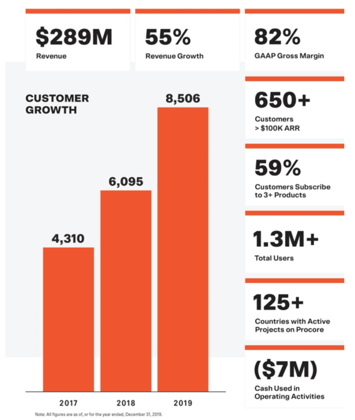

One of the biggest opportunities, according to Whobrey, is in project management software like CMiC, InEight, and Procore, which reportedly raised $150m+ at a ~$5B valuation in May after putting off its plans to go public amid the economic downturn.

“For a long time, the construction industry has been using email, Excel, and not much else to manage humongous projects. So centralizing that information so that it’s easier to access the underlying data is a big win,” says Whobrey.

Project management software does not only serve as an organizational tool. It can also double up as a skills supplement.

LinkedField is an example of this: “Its workforce management software that takes input from the workers on the job site and proactively pushes information to the foreman managing that job, to enable him/her to look ahead and plot their schedule,” says Whobrey.

Another upside is that less experienced project managers have immediate access to information and expertise.

There is an opportunity to integrate these and other features with CMS software.

Aggregation: Fragmentation in the industry opens opportunities for tools and marketplaces that aggregate information and people.

Per Whobrey, “It’s a $10T industry globally, but nobody owns more than a couple percent in terms of market share. There are hundreds if not thousands of general contractors across [America] playing in this world.”

There is an opportunity to create a centralized database of subcontractors. A game-changer for the industry would be a repository that is also customizable, allowing general contractors to track their relationships with subcontractors over time.

“A major push we’re making internally is centralizing subcontractor relationships, so that we can understand where all of those relationships reside across all of our [30 offices nationwide].

“BuildingConnected is almost entirely focused on putting together a database of subcontractors… But what we don’t necessarily like about it is that it doesn’t come with our data. So what would be really meaningful for us, would be to look at that dataset and see what we’ve done over the last 18 months with a specific subcontractor.”

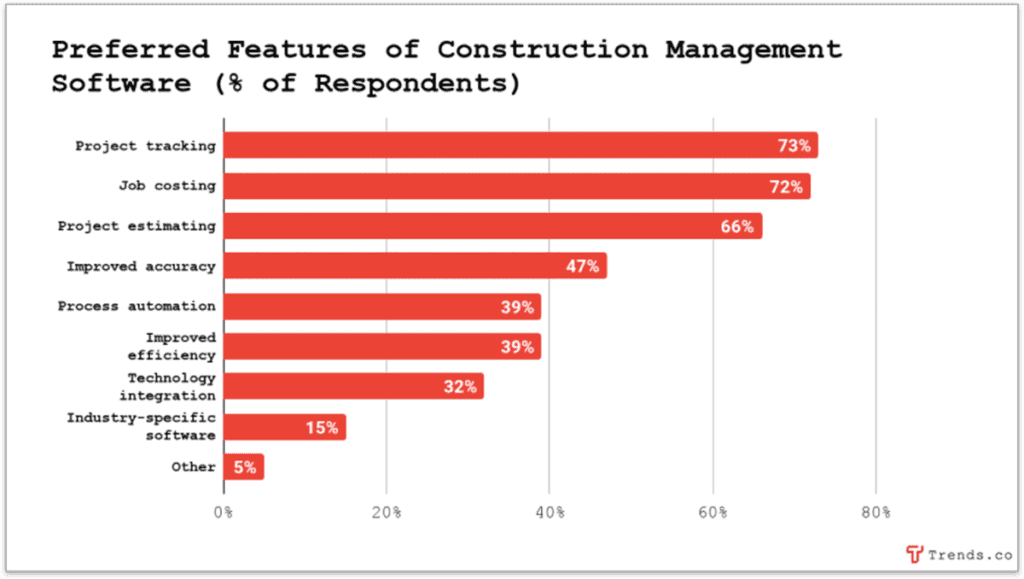

Uber for Dirt: Any applications that remove shady brokers capitalizing on the market fragmentation also stand to win.

An example is Soil Connect, the “Craigslist for dirt that eventually wants to be the Uber for dirt,” per Whobrey.

Believe it or not, there are millions of cubic yards of dirt moved around the country every year, according to Whobrey.

Soil Connect aims to connect construction sites that have rubble with those that need it, thereby disintermediating the rubble game by removing brokers who “drive around looking for piles of dirt in the city and charging a fee on both sides.”

ERP Software: When we asked Whobrey where he would start a business in this space if he were to go it alone, he did not hesitate to respond, “Creating a QuickBooks equivalent for the construction industry is a huge opportunity. In the construction world, all of the financial systems are absolute garbage… There are 3 or 4 major players that have captured most of the market, and they’re all terrible.”

While it would be difficult to extract construction firms entrenched with their existing providers, Whobrey insists it’s where he would start, “because there’s huge potential that could be unlocked, not just as a software provider, but as a data source and partner to the business.”

Integrated Invoicing Tools: Nearly a fifth of tradespeople in the UK lose money due to poor financial admin, which equates to ~£929m (~$1.2B) in losses across the industry as a whole in the UK.

This problem is not unique to the UK. Whobrey described how subcontractor invoicing often works in the US:

“They do incredible work. They’re very reliable and very good at what they do. But when they invoice, they usually fax it in, if they’re really sophisticated. Or they may take a picture of the handwritten invoice and text that to the project manager. They may walk the invoice into the trailer of that job site and hand it to the superintendent.

“It takes up a ton of time to mitigate the problems that come with that. And you can take that scenario, and multiply it by a factor of 25, because it exists all over the country.”

There is clearly an opportunity to create a simple invoicing tool that is easy to use and integrates seamlessly with new and existing project management and ERP software.

Leave a Comment