nlopchantamang.com

Make Room for Grandma: Opportunities in the Imminent ADU Boom

Aja Frost @ajavuu

The Signal: Feeling smothered by your elderly in-laws who have just moved in? Why not put them in the backyard?

In January 2020, California signed into law a new series of landmark state bills making it easier for residents to build ADUs (Accessory Dwelling Units, AKA granny flats, in-law suites, and carriage houses) on their properties.

By removing barriers and shortening approval periods, the new regulations are designed to ease the housing crisis in the state.

California is in the company of other states and cities (e.g., New Hampshire, Minneapolis, and Portland) that have recently introduced more ADU-friendly legislation.

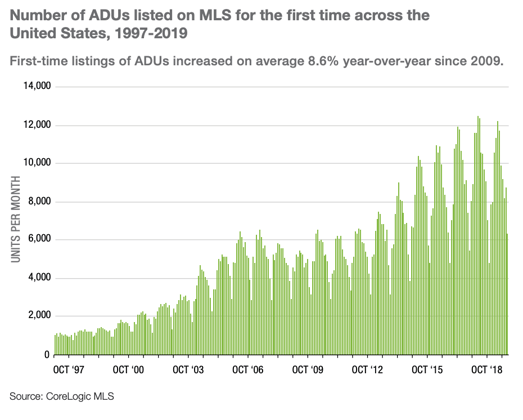

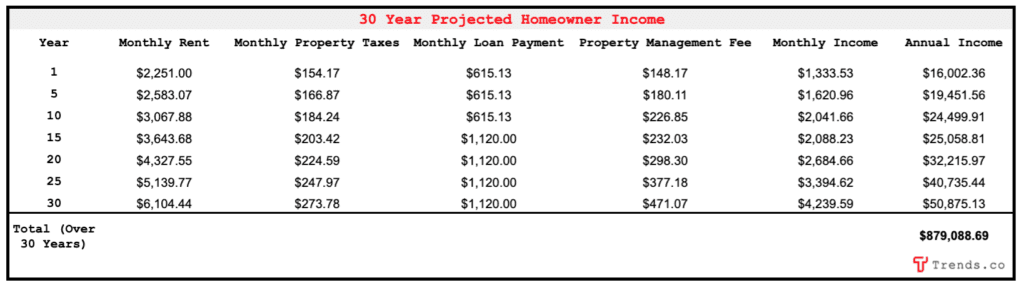

Of the 1.4m total distinct single-family properties with ADUs in the US, more than half are currently located in California, Florida, Texas, and Georgia.

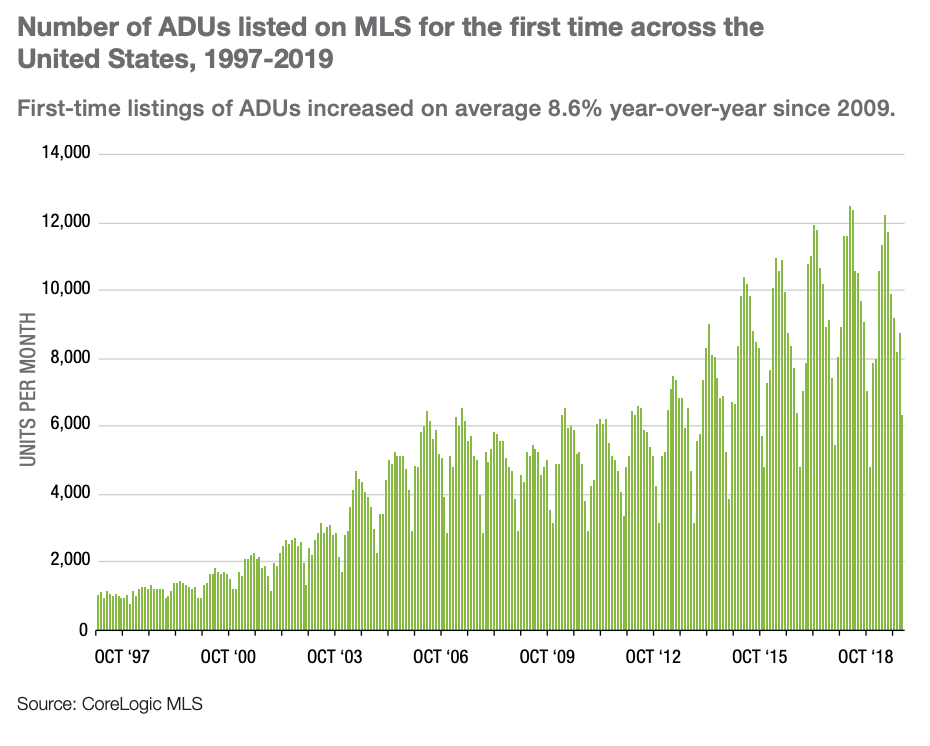

The benefits of ADUs span beyond the provision of affordable housing. The environmentally friendly units also offer homeowners rental income and can boost property values (by as much as 30% in Australia).

The Numbers: Institutional money has already started laying foundations as investors look to capitalize: In 2020, United Dwelling and Abodu raised $10m and $3.5m, respectively.

Y Combinator has also backed startups in this space including Rent the Backyard and Homestead, which reportedly reached $1m in sales within 6 months of launching. Impressive, but only a drop in the ocean compared to other startups seeing ~$5m in monthly revenue after only 12 months, according to one source (who isn’t named Sam -- although Sam is bullish on them).

ADU providers charge between ~$180k-$280k for a single unit. The price includes property assessment, permits, site prep, foundations, utility connections, and delivery. They offer financing for homeowners and make money on rental management of the unit after it is built.

United Dwelling started with a different model. They build their units on lots in low-density areas with no out-of-pocket costs to property owners. Homeowners can then lease their property to the company and earn a share of the rent (between $500 and $1.2k per month), or buy the unit from United Dwelling for ~$88k and have them manage the property for a fee.

The company is set to build 1.5k+ homes in Southern California in 2021. That’s 10x the 150 built in 2020.

The Opportunity: Over time, more states will follow in California’s footsteps, and opportunities in ADUs and adjacent industries will abound.

Modularized Construction: ADUs are a great application of modular construction for the residential sector. Modularized construction, touted by McKinsey as one of the fundamental shifts that will transform the construction industry, can cut costs by 20% and speed up construction time by 50%. It is projected to be a $130B industry in Europe and the US by 2030.

We spoke to Trends member Eric Whobrey, the director of technology at construction firm Arco/Murray, about modularized construction in commercial construction (e.g., hotels, retail, and office buildings).

While the modular movement in hospitality has been curtailed by the pandemic, as signaled by Skender’s modular business shutting down, Eric tells us that it’s not going away.

Technology that streamlines manufacturing processes will continue to lower costs and increase quality on modular buildings and enhance vertical integration of the construction supply chain. According to Eric, Katerra serves as a good case study in this space of “a good idea, executed poorly, and a few years too early.”

Specialization: Targeting specific niches is one way to enter the market.

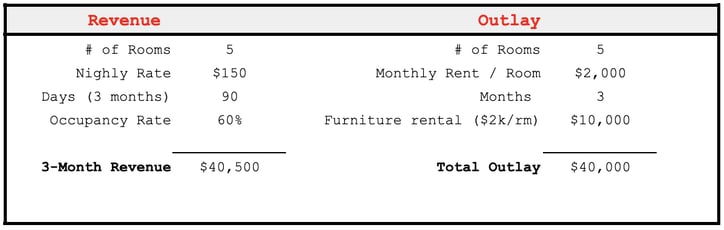

ADUs for the elderly in lieu of expensive assisted living facilities is a well-documented use case. Affordable accommodation for students in college towns or tourism hot spots where Airbnbs are popular are other options.

Modern large-scale residential developments are starting to surface, like the one that Trendster Codie Sanchez wrote about in her newsletter.

According to Codie, “If I was a developer I’d be copying this model. Hipster millennial compounds are full of modular homes… Put up one sample unit in 4 weeks, take a bunch of pictures, buy land outside of city centers, use a lot of terms like ‘nature’s splendor,’ and presell the entire place before you’ve built much of anything.”

Prefab: According to McKinsey, a large share of incumbent construction value will shift from construction job sites to off-site prefabrication facilities, thanks to new lighter-weight materials and digital planning technologies.

The industry is set to explode in the US in particular, where there is a dire shortage of skilled tradespeople and where penetration of prefabrication is only 3% compared to European countries where it ranges from 30% in Germany to 80%+ in Sweden.

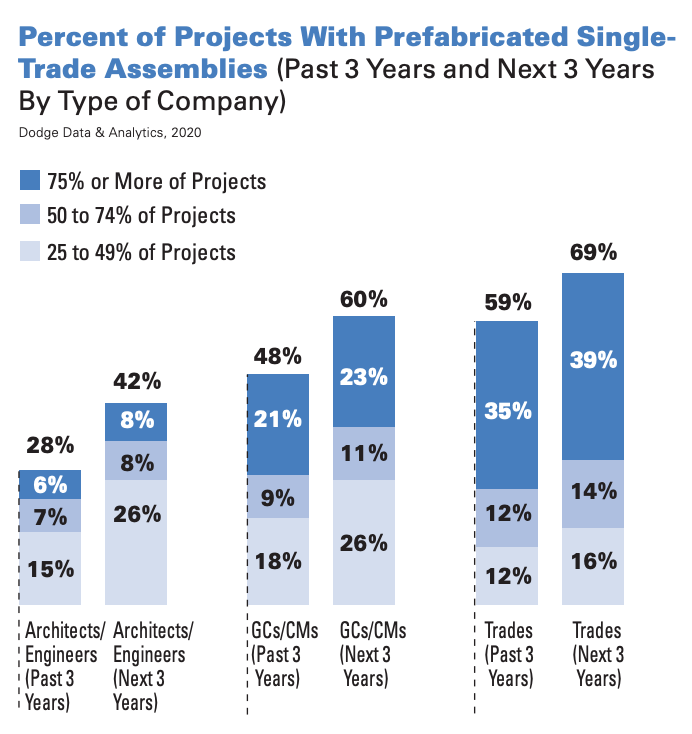

A big jump is expected in the use of specialized, single-trade prefabrication facilities (e.g., Modern Plumbing Works provides prefab plumbing that can save up to 65% on installation time) relative to multi-trade assemblies.

Architects, general contractors, and trade contractors all predict significant growth in the use of single-trade facilities over the next 3 years, whereas design professionals anticipate only 16% usage on most of their projects -- signaling an opportunity for products and service providers to bridge the gap.

Quickfire Opportunities: We also spoke to Trendster Jason Francis, who built tiny homes and ADUs for 5+ years and runs tinyhouse.com. Opportunities that Jason sees in the space include:

- ADUs on wheels: ADUs on wheels are not seen as permanent structures in the eyes of most cities. Depending on the city they are much quicker to move in and out and don’t require permits. They’re a good option for cities where there is still regulatory red tape around permanent ADUs, and they can double up as mobile vacation homes for owners.

- Education: There are opportunities to educate homeowners and property investors on ADUs. The space is new and not yet well-understood. Inspired by Shaan’s All Access Pass, Jason is building Build Rent Repeat, which will educate people on all things ADU, from property development to permits and construction.

- Remote work: ADUs can be rented out as office space with flexible rental terms. As the remote work trend continues, there will be opportunities to provide backyard office space to digital nomads.

Leave a Comment