nlopchantamang.com

Building a 7-figure Short-Term Rental (STR) Side Hustle

Trung Phan

Source: STR

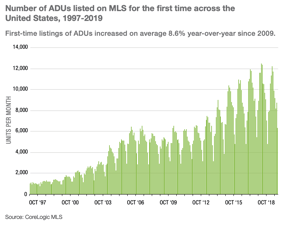

The Signal: According to hospitality analytics firm STR, hotel occupancy in the US (top 25 markets) has more than doubled from a pandemic low of 22% to 46% in the second week of July. This news coincides with an announcement from Airbnb that guests booked 1m nights globally on July 8th, the first such 1m-booking day since early March.

With signs of recovery in the hospitality space, there’s renewed interest in short-term rental (STR) operations.

The Opportunity: The STR industry has attracted a number of players outside of Airbnb and hotel chain-operated brands. Also known as aparthotels, pop-up hotels, or corporate leases, these STR businesses operate under what is known as a master-lease model.

According to Short Term Rentalz, a master lease model “denotes an arrangement whereby a branded service provider promises to rent all available space in a building from the landlord for a predetermined price, before subleasing it to third parties. The brand then takes control of the full tenant experience.”

Brands in the space differentiate themselves from hotels (by being less cookie cutter) and Airbnb (by having more amenities and hotel-like services). Notable names include:

- Sonder ($560m in funding; 1.2k rooms)

- Domio ($166m; 2k)

- Sweet Inn ($44m; 600)

- Lyric ($160m; 200) has shuttered all but one location.

- Stay Alfred ($68m; 2k) has shut down for good.

- Landing ($45m) is a slightly different model. For a yearly membership of $199, Landing members can choose to stay among the company’s different apartments in 20+ US cities (all with varying rates for different stay lengths).

Launching a STR Side Hustle: In a recent FB group thread discussing the STR space, Trends member Naseem Shaik provided some insight based on his experience operating an STR brand (StayOvr).

Based in Texas (Frisco, Plano, Dallas), Shaik started StayOvr as a side hustle in 2016. Even as he’s maintained a full-time job in the years since, the business did 7 figures in revenue in 2019 with a mid-teens EBITDA margin.

The firm offers short-term stays but targets corporate clients with an average stay of 4 days for business travel and 45 days for relocation (Shaik estimates the US extended stay market is worth >$12B). Corporate clients are stickier customers, provide predictable cash flows, and are less likely to damage the rooms.

While COVID-19 significantly impacted StayOvr’s growth, the hospitality firm is seeing its occupancy rates reach pre-pandemic levels across its 60+ rooms (managed by 10 employees).

We spoke with Shaik to see how he launched his 7-figure short-term rental business:

- Identify locations by researching big industry players

To find opportunities that can accommodate corporate rental clients, it’s key to find locations that have a good mix of entertainment, walkability, amenities, and -- of course -- corporations.Shaik starts by researching where Simon Property Group -- America’s largest mall operator -- already has a property (see list here). From here, Shaik will look for other notable companies that invest significantly in location research (e.g., Tesla with their walk-in stores).

Finally, Shaik makes sure there are an adequate number of corporate offices nearby and then targets new (built within <3 years) apartment buildings in the area.

- Engage property management with credible plan and sufficient capital

Not all apartment/condo buildings are open to master lease arrangements. Those that are will want to make sure that a STR operator has: 1) a rigorous background check process for renters; 2) adequate capital to cover 3 months of rent for each room; and 3) sufficient cash flow (e.g., pay slips, tax forms). - Start with online travel agencies/Airbnb but move to direct bookings…

To build an STR brand from scratch, you’ll almost certainly have to list on online travel agencies (OTAs) including Expedia and Bookings, or on Airbnb. These platforms will provide distribution, but they will cost you 15-20% of the room rate and provide limited ways for differentiation.

- ...by providing an incredible experience

Avoiding OTA/Airbnb fees allows Shaik to charge more competitive room rates (in the $120-150/night range).

Here is Shaik’s strategy to create the brand and drive direct bookings:

-

- First, he builds local relationships with corporates, travel management companies (TMCs) and relocation management companies (RMCs) to drive word-of-mouth and referrals to the StayOvr service.

- Second, he hyper-focuses on the customer experience by providing a seamless booking/check-in process, client-specific amenities and great communication.

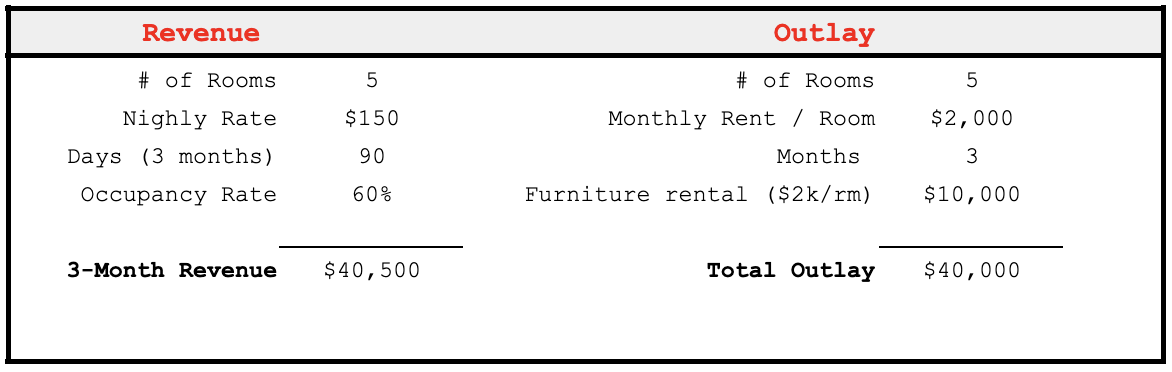

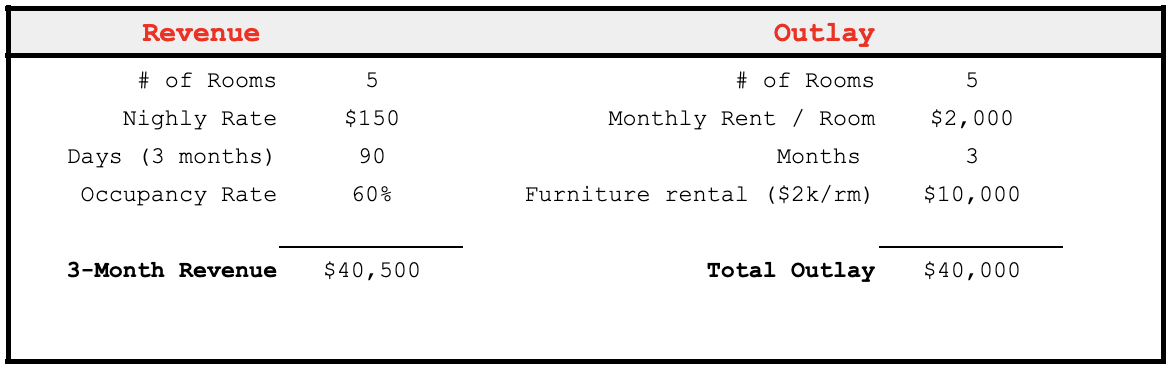

For those interested in starting an STR business, Shaik recommends doing so with a 5-room commitment. Below is a quick-and-dirty model (see here) that shows a 3-month breakeven rate (on a ~$40k outlay) for 5 rooms based on the following assumptions:

- Nightly room rate: $150

- Occupancy level: 60%

- Monthly rent/room: $2k

- Furniture rental (5 rooms): $10k

Risk in the STR Space: To be sure, the entire hospitality space remains high risk likely until a vaccine is found. In the same FB thread, fellow Trends member Gary Fox lays out the downside of the master lease model:

- Risky in falling markets: “The rent to rent model works really well in a rising market and will bankrupt you in a few bad months… This model was VERY common in the early days of Airbnb. I know of at least 5 people who have gone bankrupt when the market turned and they were left with [monthly] outgoings of $60-100k in rental and zero incoming.”

- Margin pressure: “The margins are simply too low when you factor in property furnishing, repairs (which can stack up fast in older properties), and the sheer volume of communications required to handhold a high volume of tenants to make this financially worthwhile.”

- Airbnb still dominates: “People will simply use Airbnb instead. Building a brand in this space would require a huge investment. Airbnb is still people's first choice when searching for short- and medium-term rentals. It simply makes more sense to piggyback on top of Airbnb and use that as your marketing platform.”

Fox does note, though, that “this model will work at some stage in the future.”

Could StayOvr’s localized approach and success in driving direct bookings provide a potential model to pursue in the space? Anyone interested in finding out more can contact Naseem Shaik here: naseem@stayovr.com.

Leave a Comment