nlopchantamang.com

August 2020 Startup Funding

Ethan Brooks

Source: Data Compiled from Axios Pro Rata Newsletters for August 2020

The Signal: Since March, we’ve been tracking Dan Primack’s startup funding repors in order to analyze VC trends (here are insights from March, April, June, and July, along with our funding database).

This month, we looked at 223 venture deals from August. As in previous months, the most-funded industries are:

- Health care (11.7%)

- Biotech (9%)

- Fintech (8.5%)

But they’ve given up some ground as funding returns to nonessential industries. Property management, for example, made up nearly 2% of VC deals in August, and we saw deals done in the pets, textiles, cannabis, and even courier service industries.

The Opportunity: We’ll focus on companies inside 2 surprising startup hubs -- Israel and Finland, including actionable insights from their biggest deals -- as well as a brief overview of some unexpected contenders.

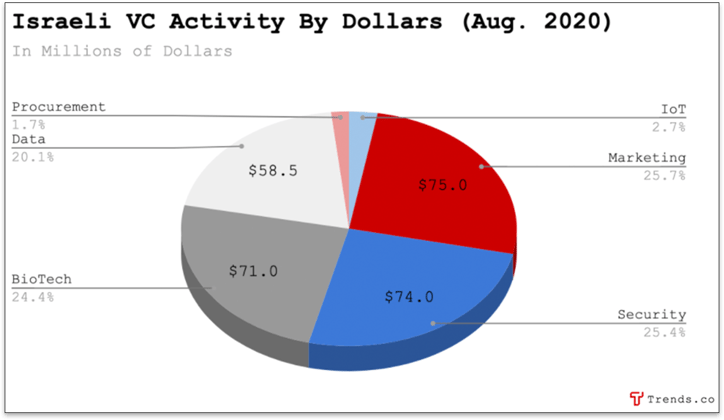

Israel

In August, Israel was 4th on the list for most VC deals done, coming in ahead of typical incumbents like Canada (7th) and Germany (10th). There was $291.5m deployed across 9 deals. Most deals were either in the security (3) or data (2) industries, but the biggest went into a single marketing company called Yotpo.

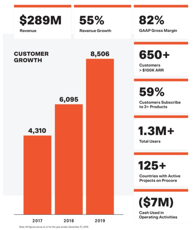

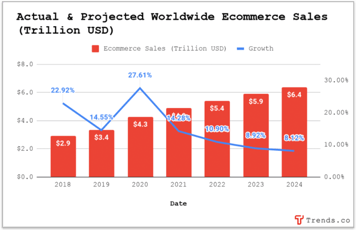

Yotpo (raised $75m): Yotpo offers a suite of marketing tools specifically to ecommerce and D2C companies. They’ve raised a total of $176m so far, and are on track for $100m ARR in the next year. Their user base increased by 250% over the last year, largely due to the ecommerce trends driven by the pandemic. Our recent analysis of the tools used by Inc. 5000 winners found that Yotpo was used by 23 of the top 1k fastest-growing companies.

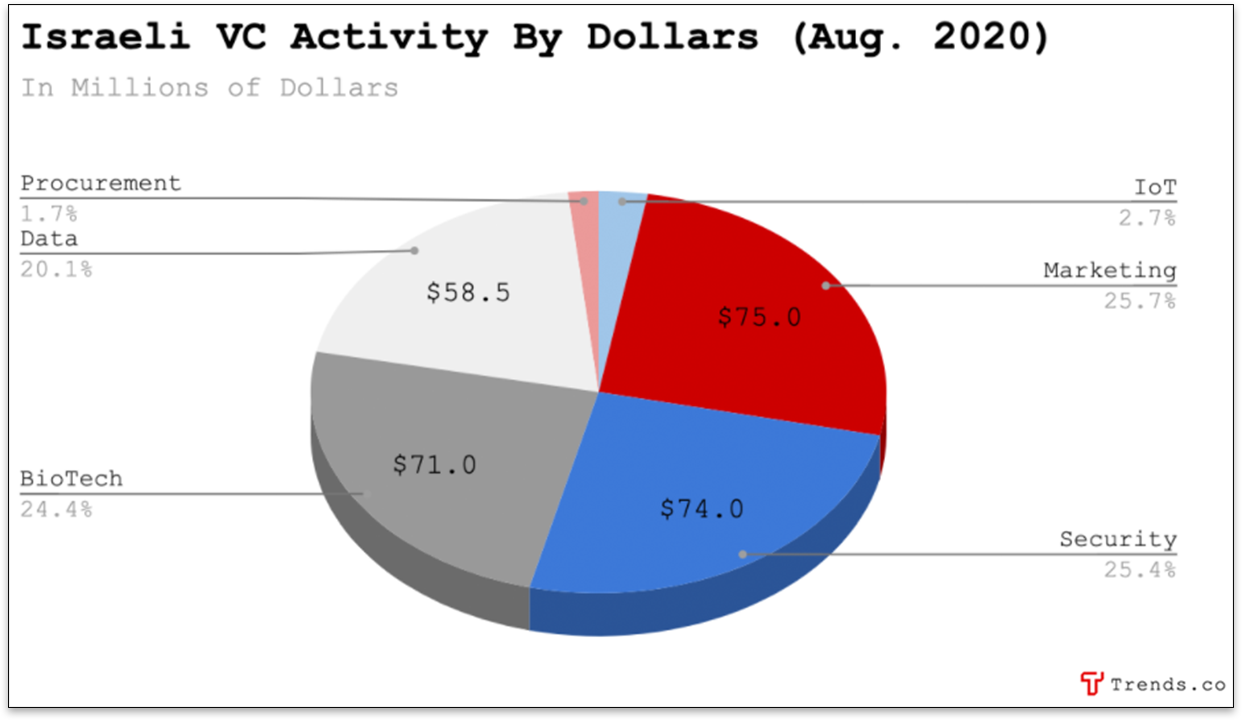

Worth Copying: Quiet Cause Branding

Yotpo runs an entire community just for women in ecommerce. Unlike many brand communities, this one’s not plastered with their logo. Instead, it’s focused on its mission -- supporting Girls Inc. -- and both its Instagram and website hardly mention Yotpo.

By having the courage to let your brand take a back seat, you can lead deeper, more meaningful conversations as people engage more authentically. This willingness to forgo in-your-face marketing ultimately gives your brand more credibility with the people who care most about the cause you’re supporting.

Finland

Finland’s VC ecosystem is diverse, with August deals ranging from entertainment to data and even farming. While they’ve made an appearance on our list each of the last 6 months, it’s often toward the bottom (46th, 39th, and 44th in April, May, and June respectively). This month, they shot up to 11th, just behind Germany and ahead of Austin, Tex.

Of the $358.5m in startup funding, the lion’s share ($230m) went to a single company making a surprising product: Nokia cellphones.

HMD Global (raised $230m): Back in 2016, newly launched HMD Global bought the universal rights to design and sell Nokia phones. They generated ~$2B in net revenue in 2019, and claim to have sold 240m+ phones in less than 4 years.

Worth Copying: ODM Manufacturing

According to the 2019 annual report of FIH Mobile (a 10% owner of HMD), HMD recently switched from OEM to a multi-ODM manufacturing model, enabling it to make a profit for the first time since its founding.

Luke Smoothy -- Trends member and director of the manufacturing partner Get It Made -- told us that the difference mostly boils down to custom design in house (OEM), or effectively white-labeling existing designs from ODM manufacturers.

The benefits of ODM can be substantial:

- You spend less time on design and can get to market faster.

- ODMs are usually experienced in a niche and can produce at scale at lower costs.

But there are drawbacks too:

- You may not own any product innovation IP.

- Competitors will usually have access to the same ODMs and designs.

The decision, he says, comes down to what kind of business you’re trying to run. Smoothy says, “Are you an innovation-led business, or are you simply leveraging the best of every supplier and relying on your marketing to beat the competition?”

Unexpected Contenders

Breezeway (raised $8m): Offers cleaning and maintenance services to the owners of rental properties. Interestingly, they have 80m+ square feet of property under management, despite an apparent lack of integrations for Airbnb owners.

Sendle (raised ~$14m): Package delivery for small businesses. Their competitive advantage? They’re carbon neutral in a world where that is increasingly important.

Dutchie (raised $35m): Like Grubhub but for weed -- Dutchie is an online cannabis marketplace that allows you to order from your favorite nearby dispensaries.

For more insights on startup funding from August, be sure to check out the VC database.

Leave a Comment