nlopchantamang.com

The Not-So-Boring Business of Niche Call Centers

Aja Frost @ajavuu

The Signal: When we asked the Trends community for some of their favorite “boring” businesses, John Wolf suggested niche, outsourced call centers, like “a call centre for health professionals (kinda tele-secretary service).”

Our research quickly surfaced a recent report, which revised the anticipated growth of the global call center market in light of COVID, as customer interactions moved from physical to digital, and virtual contact centers became the norm. It estimates that the outsourced call center market will grow at a compound annual growth rate (CAGR) of 5.9% from 2020 to 2027.

The number is slightly higher than the 5.6% anticipated for in-house call centers over the same period, and much higher than the 4.7% growth that the outsourced industry has experienced since 2013.

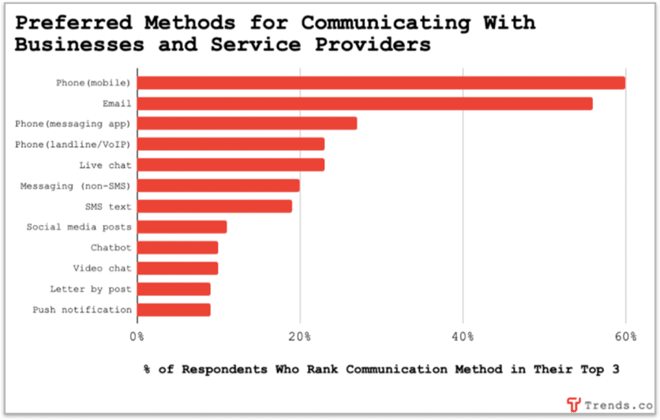

The Opportunities: While AI, chatbots, and other disruptive technologies are providing more communication channels than ever, phone calls remain consumers’ favorite way to connect with businesses. Per John Wolf, “Phone remains important for a lot of customers, and it induces trust to be reachable. It’s also a great way to sell.”

We spoke to a number of other Trendsters in the space about where they see opportunities, including TJ Larkin, founder of Game Plan Leads, who confirmed John’s assertion that phone calls are a powerful sales tool.

Lead Generation: Last year, TJ bought a call center in India and started Game Plan Leads. The company initially focused on selling live transfer calls to insurance agents, but has since expanded into other niche industries, including solar roofing and mortgages.

The business operates on a pay-per-lead model, charging $20-$25 per insurance lead and up to ~$200 per solar lead. TJ also sees a lot of opportunity in a percentage-of-sale model (earning a percentage of the total sale if the lead converts), especially in higher-ticket industries, like solar.

One cohort where TJ sees potential is the 65+ demographic. With 10k people in the US turning 65 every day, TJ believes there are call center and lead-generation opportunities in niches such as retirement villages, Medicare, and even burial insurance.

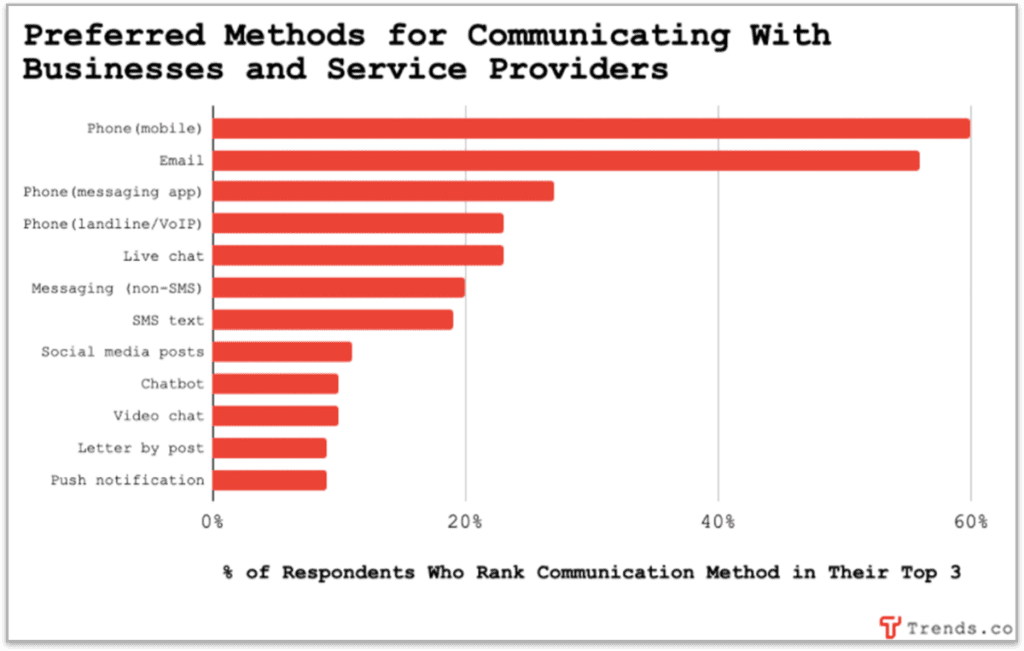

Integration and Software: We also spoke to Chad Capp and Todd Huna, the co-founders of HelloGym. The company started as an overflow answering service for gym franchises and has since evolved into a turnkey customer service platform for gyms, including inbound and outbound calls, lead generation, appointment bookings, and analytics.

By targeting gym franchises, the company is able to expand quickly and provide a tailored solution at scale. You could leverage the same model to grow niche call centers in other industries with a ton of franchises, including home repairs, cleaning services, real estate, package shipping, printing services, and more.

HelloGym custom-built their gym management software to provide a fully integrated solution to their customers. The founders see a lot of opportunity for others to do the same in other niche service industries like HVAC, construction, and health care practitioners (e.g., chiropractors or any other niche with a bunch of solo practitioners or small offices who want to outsource the front-desk functionality).

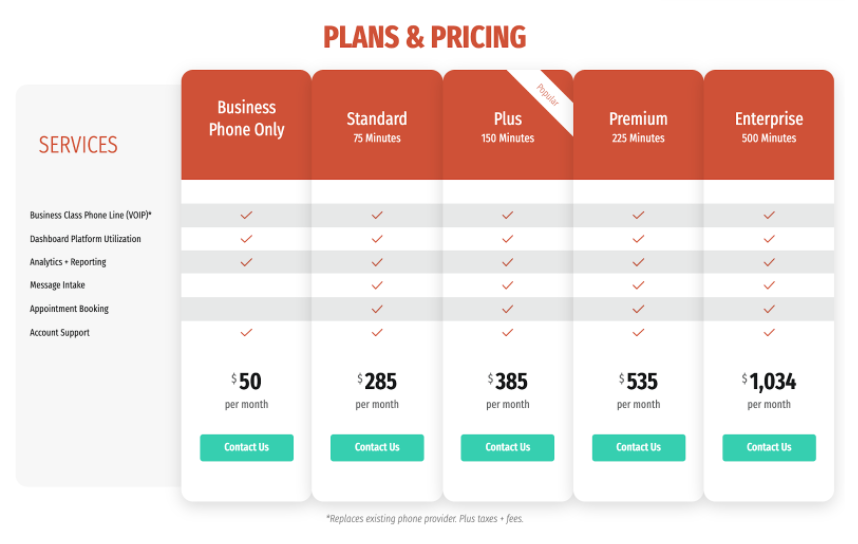

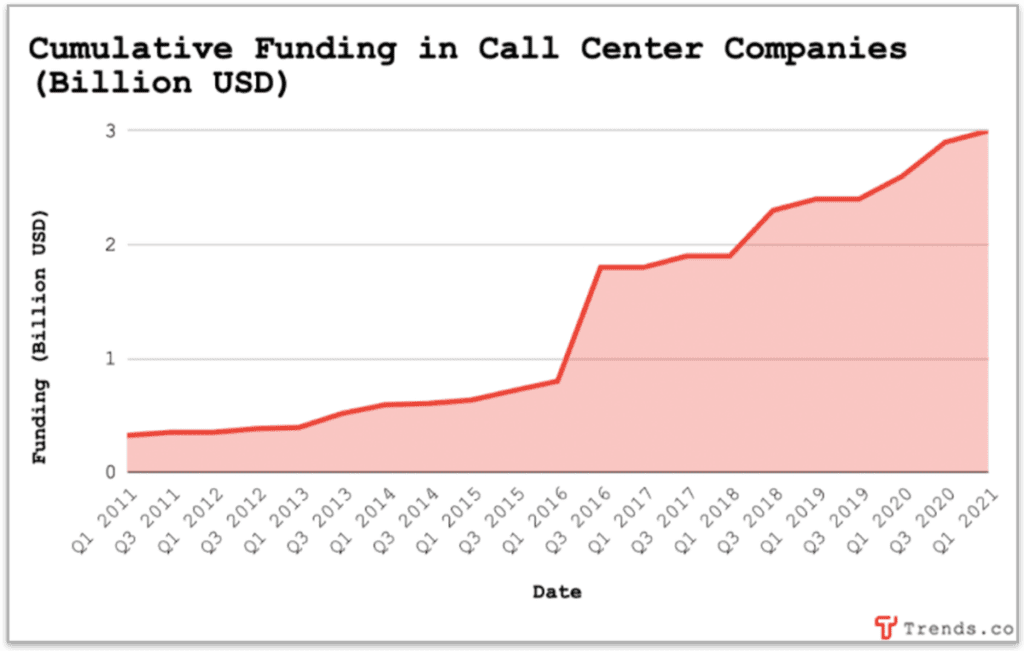

Institutional money also sees opportunity in call center software.

The call center industry attracted ~$400m in funding over the last year. That’s ~15% of the industry’s total $3B in cumulative funding in just one year, most of which has been allocated to call center software companies. Noteworthy deals include:

- Talkdesk in July 2020 ($143m at a $3B valuation): Provides cloud-based contact-center software for enterprise clients

- Dialpad in October 2020 ($100m at a $1.2B valuation): Provides voice, video, and contact-center software and services

- Aircall in May 2020 ($65m): Provides cloud-based call center software that integrates with CRM, productivity, and help-desk tools

High-Growth Industries: Todd Huna of HelloGym told us that ~35% of calls to gyms will go unanswered. Of those unanswered calls, ~75% will not leave a voicemail. This presents a massive cost in missed leads, especially in industries like HVAC where the average lifetime value of a customer is ~$15k.

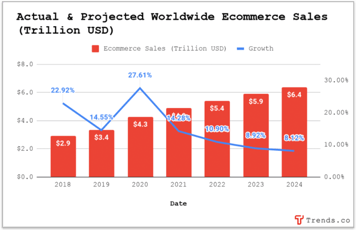

Even if you don’t want to provide a fully integrated service like HelloGym, there is still an opportunity to provide outsourced call center services or call overflow services to other high-growth industries. For instance, spaces such as food delivery, ghost kitchens, and ecommerce (highly specialized in small/medium D2C brands) are benefiting from massive COVID tail winds.

Leave a Comment