nlopchantamang.com

Is This (Finally) Telemedicine’s Moment?

Trung Phan

Source: Yahoo Finance

The Signal: Telemedicine -- the practice of remote care via video, calls, texts, email etc. -- has been hyped for years and seen billions of investment dollars. But as recently as 2017, fewer than 20% of consumers used it. The coronavirus outbreak is likely the catalyst that pushes telemedicine into the mainstream for good.

In China, leading telemedicine apps have seen widespread adoption since the start of the year. Ping An Good Doctor, which touts its "mobile health + AI technology" online healthcare ecosystem, increased new users by 9x as news of coronavirus circulated through China in December and January.

In America, Teladoc -- a US-based firm that provides telehealth and virtual care -- has seen a 50% YoY surge in use while its stock price has nearly doubled year-to-date.

During the current health crisis, Teladoc is activating thousands of doctors onto its platform, operating virtual COVID-19 clinics (to assess initial patient symptoms and determine if further testing is needed) and installing its hardware directly in hospitals and clinics.

Last week, the firm’s CEO told CNBC that "demand has shifted forever in virtual care."

A number of factors are contributing to this shift:

- Patient Awareness: Amid vast quarantines and social distancing measures, patients are more willing (and often have no choice) but to try telemedicine options. Virtual care allows patients to be diagnosed from the safety of their homes and allows doctors to serve larger geographic areas.

- Reimbursement: In the US, rules around telemedicine reimbursement have been quite restrictive. However, the federal government’s recent $8.3B funding bill to combat coronavirus allows the Department of Health and Human Services (HHS) to "suspend rules that restrict access to remote care" for Medicare patients. Moving forward, reimbursement for a wider expanse of telemedicine services will be a boon for the industry as patients know they will be covered and doctors can receive comparable payment as an in-person visit.

- Doctor Liquidity: Typically, telemedicine providers have to be licensed in every state that they want to practice in. In response to the current crisis, "many governors have relaxed licensure requirements related to physicians licensed in another state and retired or clinically inactive physicians," according to this guide from the American Medical Association (AMA). If these relaxed guidelines stay in place, the supply of telemedicine services can rapidly expand across the country.

The Opportunity: To better understand the post-crisis healthcare landscape, we reached out to Nikhil Krishnan, formerly a healthcare analyst at CB Insights. Krishnan provides a wealth of ideas in the healthcare space via his healthcare newsletter Out Of Pocket (a must-subscribe) and related writing:

Virtual Primary Care Apps: In recent years, a number of virtual primary care apps have received significant funding. These telemedicine solutions typically treat a number of low-risk conditions, including allergies, constipation, cough, diarrhea, fever, flu, headaches, and nausea (more serious conditions are escalated to in-person care and testing).

Unsurprisingly, the spread of coronavirus has spiked usage on many of these platforms.

One major player in the space is UK-based Babylon Health, which has raised $635m. With an annual payment of $185 (one-off payments also available), customers get access to personalized health assessments, treatment advice, and face-to-face appointments with a doctor 24/7.

Source: American Well

In the US, notable virtual primary care providers (other than Teladoc) include American Well (raised $517m) and MD Live ($124m). Pricing for telemedicine services are tied to insurance providers but -- as an example -- a one-time dermatologist consultation costs $69.

One issue with telemedicine conducted through video calls is that doctors have finite time. To expand their ability to treat patients, asynchronous communication will play a vital role.

Apps like 98point6 ($86.3m) and OhMD ($3.3m) facilitate asynchronous text-based communication with primary care providers. Not only does the asynchronous nature of the medium help doctors meet higher patient demand, it also allows the conversation to take place where it will be seen; according to OhMD, "98% of patients will read a text message, and 90% of those patients will see that text message within three minutes."

Whether or not the current crisis guarantees long-term success for these virtual care apps is up in the air. Per Krishnan:

"I think consumer-facing telemedicine providers will do well if these consumers become repeat customers for events in the future. I don't think we know yet if that's true, and in the short run this spike in utilization is likely costing a lot of these companies money. I do think companies like American Well and telemedicine providers that service hospitals/practices got a big boost during this pandemic because it forced many physicians who have never tried telemedicine to use it."

- At-Home Diagnostics: Increased usage of telemedicine and virtual care will boost a complementary healthcare vertical -- at-home diagnostics.

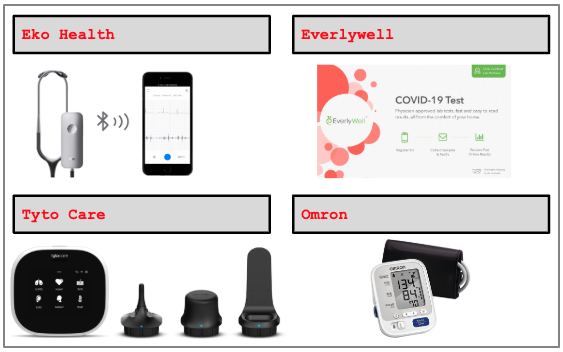

Source: Company photos for at-home diagnostic products

According to Krishnan, "we have more and more tools to bring non-invasive diagnostic and screening tools closer to… patients":

- Everlywell: Everlywell -- which makes 30+ at-home testing kits from fertility to food sensitivity -- launched the first at-home testing kit for COVID-19

(ICYMI: Everlywell CEO Julia Creek previously joined Shaan and Sam for a My First Million podcast. We’re planning a follow-up chat for an upcoming report.) - EkoHealth: Eko creates cardiology-grade digital stethoscopes that can be paired with smartphones to provide readings on heart and lung functions.

- Omron: Omron creates a clinical-grade wireless upper-arm blood pressure monitor + EKG.

- Tyto: Tyto offers an at-home exam kit that includes: tongue depressor; app (to contact doctor); hub device (with camera and thermometer); otoscope (ears), and stethoscope (heart and lungs).

An option that doesn’t require physical screening tools is Buoy Health, an AI-powered digital assistant that helps patients self-diagnose and suggests appropriate follow-up care.

Apple is also a major player in the space, positioning the Apple Watch as a go-to for continuous heart health monitoring (via its ECG app). Krishnan has written about Apple’s primary care opportunity and the current pandemic has "strengthened [his] stance that the Apple Watch and a general at-home diagnostics suite is going to be a really key part of Apple's healthcare edge/strategy."

- Caregiver Training Classes: According to the American Medical Colleges (AAMC), the US could face a shortfall between 21k to 55k primary doctors by 2023 (this estimate -- understandably -- doesn’t take into account the effect of pandemics).

In a post-coronavirus world, the US healthcare system can help address the doctor shortage by empowering physician assistants and nurse practitioners to deliver primary care. These medical professionals can often deliver low-risk primary care at a lower cost and comparable quality.

An expanded medical pool will also help to serve rural areas that often have a dearth of primary care options (Krishnan cites Walmart as a potential winner in rural settings, as the retailer was already establishing itself as a healthcare hub prior to the crisis and has since ramped up its clinic openings).

Higher telemedicine utilization combined with new non-invasive diagnostic tools opens the doorway for a greater pool of healthcare practitioners.

A very clear opportunity here is learning management systems (LMS) that can train caregivers.

One example is CareAcademy.

The company -- with an estimated revenue of $2m -- provides up-to-date caregiver training programs that are in compliance with state requirements (here is a FREE Covid-19 certification class).

The business model charges care centers (e.g., nursing homes) a monthly fee to ensure that its caregivers are in compliance with state guidelines. Pricing is based on the number of caregivers trained, ranging from $99/month for 5 workers to $249/month for 25 workers (and beyond).

Other similar offerings include Relias, Ceresti, Rosalynn Carter Institute and Healthcare Interactive.

Leave a Comment