nlopchantamang.com

The Multibillion-Dollar Problem of Unused Subscriptions

Ethan Brooks

Source: Blissfully’s 2019 Annual SaaS Trends Report

The Signal: People today have more subscriptions than you (or even they) might first suspect. When asked to estimate their monthly subscription spend, West Monroe found that Americans guessed on average that they spent ~$80/mo. However on closer review, their actual spending ended up being close to $240. COVID-19 is accelerating this trend, as people in quarantine sign up for entertainment, grocery delivery, digital fitness subscriptions, and even mail-order games, like the recent Inc. 5000 winner, Hunt A Killer.

Along with these new conveniences comes a new problem -- money wasted on unused or forgotten subscriptions -- and a new (somewhat meta) opportunity: a subscription that manages people’s subscriptions.

As multi-time SaaS founder Suhail Doshi recently tweeted:

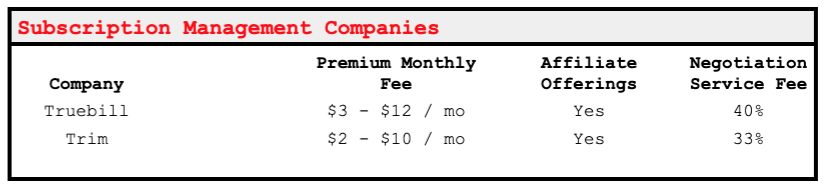

Background: It turns out that unused subscriptions account for billions of dollars in global spending each year. Britons alone are estimated to spend £25B/yr (~$33.3B) on unused memberships of all kinds. Some companies, like Truebill or Trim, aim to help people save money on their subscriptions, but there are 2 key differences between them and Suhail’s idea:

- They are not automated: Platforms inspect bank statements to find recurring charges and flag them to users. While users can cancel some memberships through Truebill’s platform, the process is manual.

- Business model: Rather than the straight $10/mo fee Suhail mentions, these providers make money via

- Affiliate Fees: Recommending new, less expensive subscriptions based on charges in your bank account such as your cable bill.

- Negotiation Services: Negotiating on your behalf with phone, internet, and cable companies to lower your costs in exchange for 33-40% of your first year’s savings.

- Optional Premium Services: Truebill charges for full access to its app features, whereas Trim offers savings accounts and debt pay-down programs with small monthly fees.

There are several opportunities in this space, including…

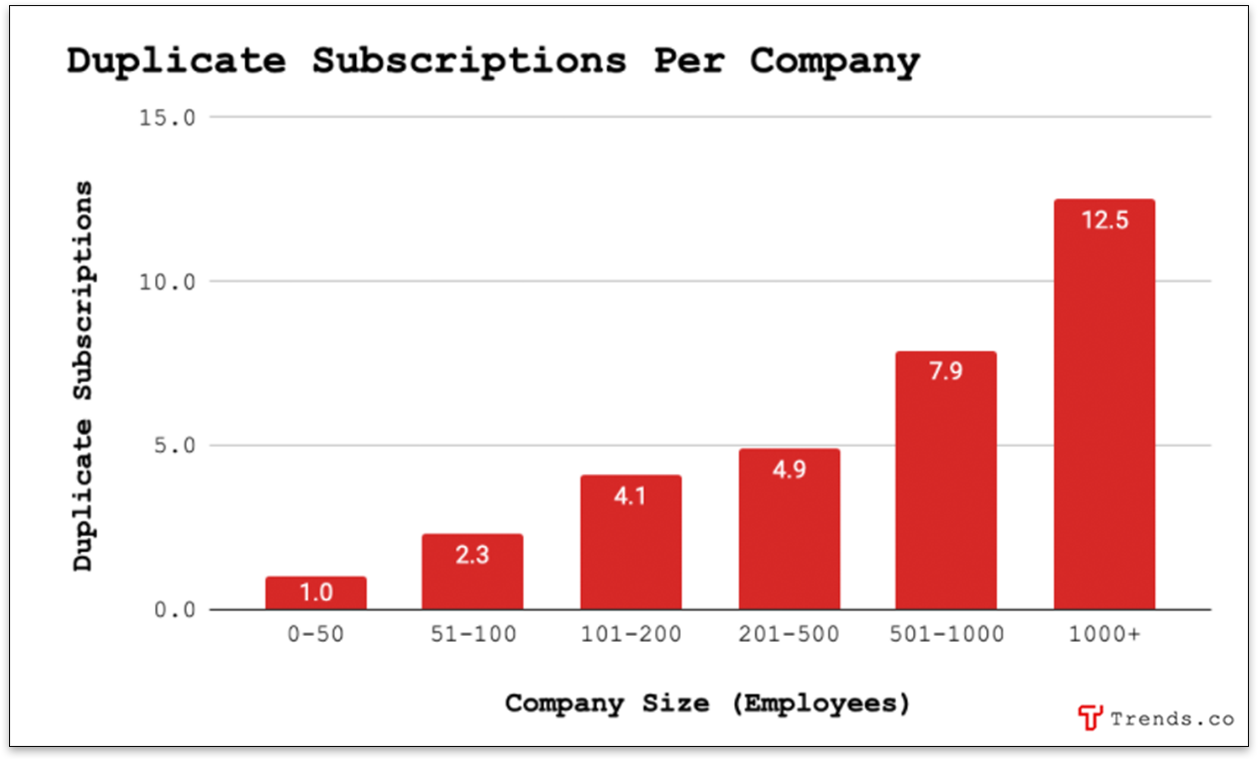

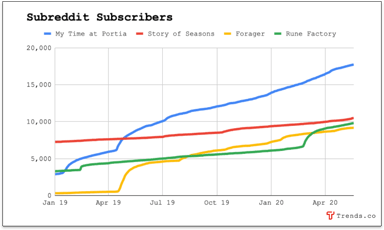

B2B SaaS Management: Several people responded to Suhail’s tweet by pointing out the need for a similar B2B solution, and some companies -- like Zylo, Spendflo, and Blissfully -- are building centralized SaaS subscription management tools for companies.

Research from Blissfully shows that in 2018 the average company spent $343k in SaaS subscriptions, up 78% over the previous year. This explosion in the use of SaaS tools makes it hard for companies to keep track of who’s paying for what, and the average midsize company had 30+ different billing owners.

“No single stakeholder ‘owns’ IT management anymore,” Blissfully reports. Instead, team leaders decide on the tech stack of their department, often leading to redundant subscriptions and unused licenses -- which can really add up. Blissfully’s research found that the average company was paying ~9k/yr on subscriptions it didn’t even use.

While Zylo, Spendflo, and Blissfully target entire companies, there could be an opportunity to build SaaS management software targeted at very specific teams.

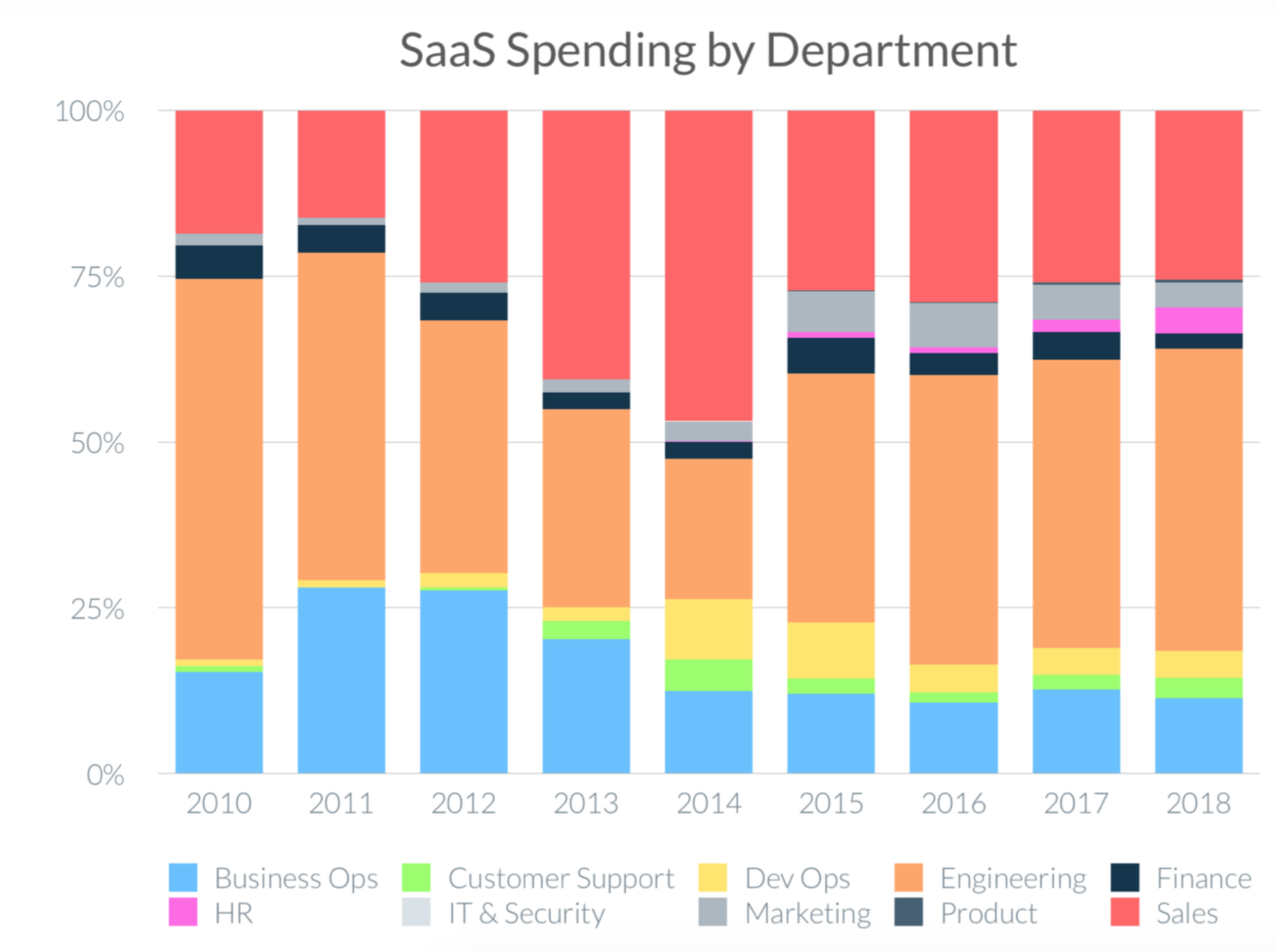

As the chart below shows, engineering and sales teams make up the bulk of SaaS usage at companies, and so might have the greatest need. Conversely, HR and CS SaaS spend is growing the fastest, indicating that teams in those fields may find themselves in need of subscription management solutions.

Geographically Specific Solutions: In Australia, many employees have what’s called a Superannuation Account. This is a compulsory retirement account to which they and their employers must make contributions and on which they pay fees.

Of the 15m Australians with Superannuation Accounts, 40% have unnecessary 2nd accounts (often arising from job changes), amounting to a whopping $2.6B/yr in unnecessary fees.

Use a model like Truebill’s rate negotiation service, and help people condense their accounts for a fraction of the money they save each year. A business that captured just 1% of the $2.6B wasted annually, and charged 40% to fix it, would generate $10.4m/yr.

Other Possibilities:

- Managing Free Trials: One common complaint is that people sign up for free trials then forget to cancel and end up spending money they didn’t intend to. A simple trial-tracking app could help remind people when their free trials are ending.

- Industry-Specific Solutions: Certain professions -- like journalism or finance -- require subscriptions to several publications. Tools like Substack and Patreon are lately being added to that subscription list. Build a tool to help professionals organize their subscriptions, find new ones, and automatically unsubscribe from those they don’t actively read.

Leave a Comment