nlopchantamang.com

The Modernization of Death Care

Shân Osborn

Sources: PitchBook; GeekWire; Crunchbase; TechCrunch; Sifted

The Signal: Death care is a small and traditional world. Roughly 22.5k funeral homes and 10k cemeteries process the ~2.8m deaths in the US each year. The industry has enjoyed decades of high markups and limited pricing transparency. But modern needs are shaking up the market as Americans move away from traditional burials.

Startups across the globe are attracting venture and seed capital in the death-care space. From software that writes wills to human composting, this year has seen $77m+ raised across 5 firms.

This may seem like a relatively small amount, but it’s the largest funding year for the space yet. And capital raised does not paint the full picture of growth: Numerous ecommerce startups already serve the expanding market without funding.

The Death Positive Movement: Death wellness is a new and growing concept. Baby boomers, creators of the wellness industry, control ~70% of disposable income. They are now aging, number ~73m in the US, and refuse to have a terrible death.

Enter end-of-life practitioners, or “death doulas,” who fill the gap between medical and hospice care. Emotional support for patients and family before, during, and after death can cost anywhere from $100/hour to $5k for a set of days. Demand is soaring, and the few doula training programs out there are struggling to keep pace.

International End of LIfe Doula Association (INELDA)’s online course routinely sells out. The University of Vermont launched their professional certificate in the fall of 2017; now they can’t keep up with their waitlist. Applicants crashed the system when their last online program opened. US search volume for “death doula” has risen to 9.9k/month according to Keywords Everywhere.

The profession is largely unregulated, and online courses offer no hands-on experience. Entrepreneurs could:

- Offer in-depth training programs

- Create platforms that match patients to doulas and other support services -- Near just launched

- Form partnerships with medical institutions and care homes

- Focus on doula specialization

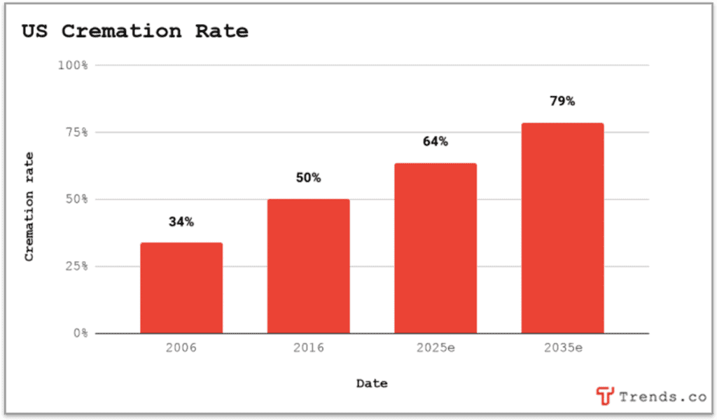

The Ash Opportunity: An estimated 56% of Americans who died had their remains cremated in 2020. This figure is forecast to rise to nearly 80% by 2035 -- ~2.8m cremations a year. And people are increasingly looking for ways to immortalize ashes.

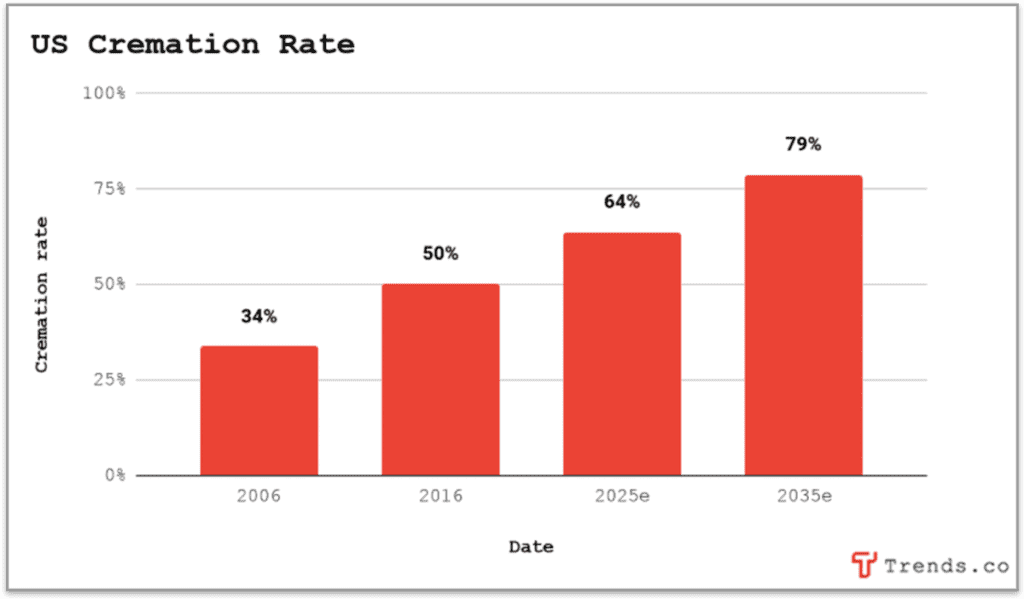

Beyond a slew of sites offering to make your loved ones into various trinkets (your favorite vinyl, perhaps?), only a small number of players are providing solutions with attractive revenue streams. These firms focus on quality and connection in times of loss. And there is room for competition.

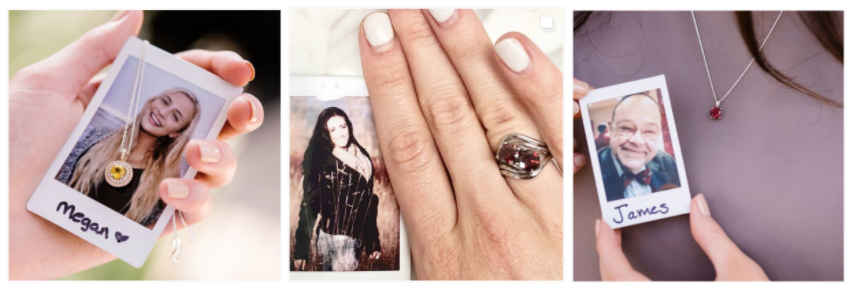

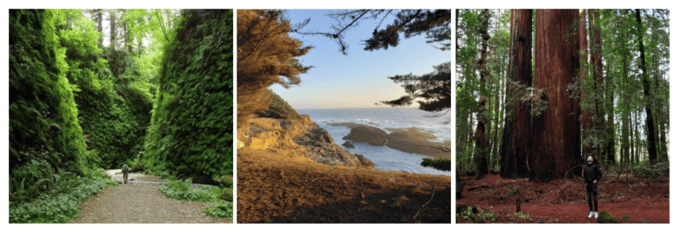

- Memorial Forests: Better Place Forests raised $40m in January. Their service will place your ashes under a private tree in a memorial forest, open to visitation. The firm launched their first 20-acre redwood forest in California last year, where trees are priced at $2.9k-$36k. Thousands signed up. They have since transformed 3 more of their 7 properties into memorial forests.

- You could invest in land where people would like to be laid to rest -- quiet spaces around cities, vacation areas, or national parks. Entrepreneurs could also branch out beyond redwood forests into memorial gardens that grandchildren can play in, inner-city botanical gardens, or even eternal coral reefs.

- Memorial Diamonds: Eterneva raised $3m in an oversubscribed seed round this July. They turn cremated remains into diamonds -- from $2.9k for 0.1 carat. Only a handful of companies offer the service globally. Even after planned expansion, Eterneva will have the capacity to create just 75 diamonds per year. They already have 9k+ followers on Instagram.

- There is a clear need to ramp up operations, and there are no patent barriers. You could also branch out to other (more affordable) memorial gems -- German firm Mevisto offers rubies and sapphires.

Tech After Death: The paperwork involved after death is cumbersome and confusing. Entrepreneurs could focus on industry verticals and software that provides simplification, pricing transparency, and around-the-clock customer support.

UK-based death-care startup Exiztent aims to digitize the legal side and bring together the necessary people and services in one place. They raised their first £3.6m in September. This idea can be leveraged to provide similar solutions in the US:

- There are 200k+ estate law firms in the country; your platform could bring together multiple prescreened, customer-reviewed options

- Work directly with firms to digitize their existing services on a company-specific platform, with the ability to connect to other necessary players

Newly launched Solace will manage cremation for you, with a focus on customer support. They even hand-deliver remains. You could do the same with human composting, gem creation, memorial tree planting, etc.

UK startup PlotBox provides cemetery record-keeping software; they recently expanded into the US. Entrepreneurs could develop a solution for the growing number of memorial forests that will soon require similar management tech.

Leave a Comment