nlopchantamang.com

Plant-Based Protein: Why It’s Far From a One-Shoot Wonder

Shân Osborn

The Signal: Funding in the alternative protein space hit an all-time high of $3.1B in 2020.

Plant-based proteins have been leading the race, with a 70% ($2.1B+) share of the year’s capital.

US retail sales of plant-based foods have climbed 43% over the last 2 years. They’ve outpaced total food sales by ~2.5x. Meanwhile, the global meat supply chain is expected to record a loss of $20B+ for 2020.

Opportunities: Perhaps surprisingly, meat eaters are the largest alt protein market.

A Nielson study found that 98% of alternative meat buyers in the US also purchase meat. Ninety-five percent of Americans who order vegan burgers at restaurants aren’t even vegetarians.

And there is room for significant growth: Just ~21% of US households are currently purchasing meat alternatives.

While soybeans (and, to somewhat mixed sentiment, insects) have dominated the alt protein space thus far, new plant-based players are fighting to reach the sunlight. Two stand out:

Pea: In contrast to a 6% decline in consumer interest for soy (and 4% for insect protein) over the last decade, interest in pea protein has soared by 30%.

The pea protein market is expected to reach $554m+ by 2028 (a 12.7% CAGR).

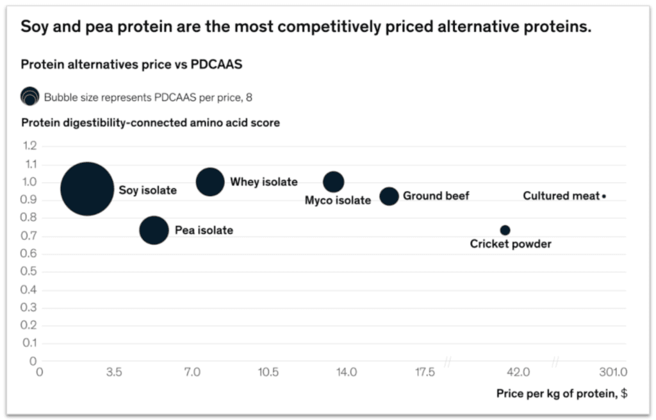

Pea isolate is one of the most affordable alt options. Much like soy, its digestibility and emulsification properties lend it to a wide range of end-product applications.

Entrepreneurs could play directly in the faux-meat space (where sales surged 264% during lockdown), or compete with whey in the protein supplement industry -- a market forecast to exceed $30B by 2027.

Demand is high: 97% of Americans who exercise report that they purchase protein shakes each month. The average monthly spending of this group on protein-rich shakes, food, and snacks is ~$50 (and rising).

Sports nutrition is not the only protein-hungry market. In the US, ~3% of the population follows a plant-based diet, which amounts to 9m+ consumers who may look to protein isolates to supplement their intake.

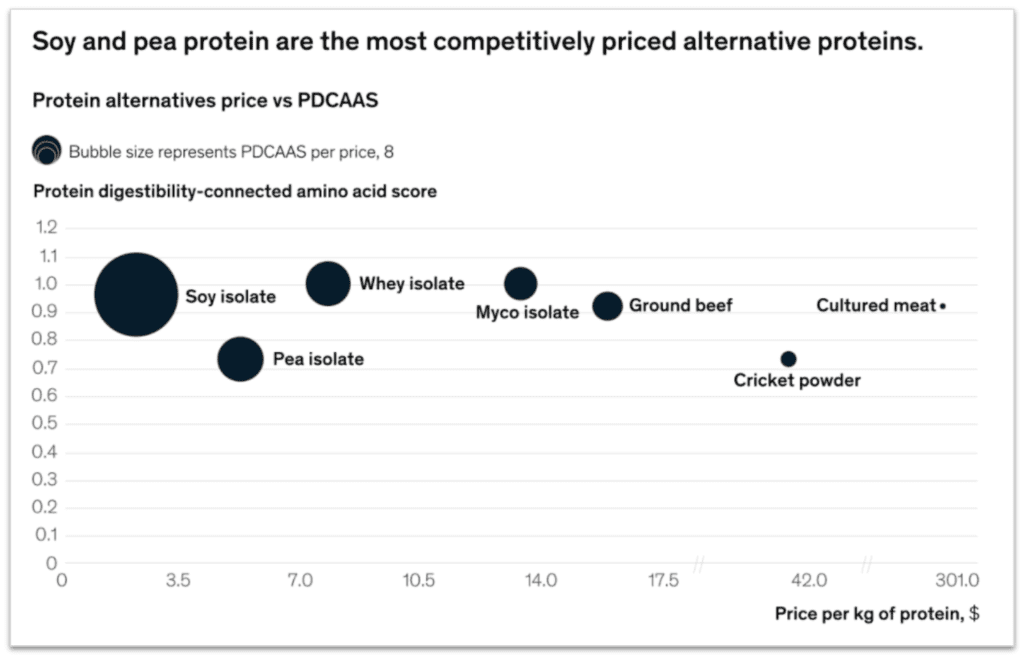

Google searches for “vegan protein powder” have been steadily rising and now number 110k/month, per Keywords Everywhere.

Entrepreneurs could focus on powders, bars, snacks, and meal replacements. Pea isolate can be used in everything from ice cream to vegan jerky. Some Amazon examples:

- Pea-based protein powder ($410k+/mo.)

- High-protein plant crisps ($145k+/mo.)

- Vegan protein bars ($74k+/mo.)

- A high-protein, soy-free vegan snack care basket ($48k/mo.)

Algae: Far from your average pond scum, algae protein is expected to become a $1B industry by 2026.

Algae has a high growth rate, requires minimal raw materials, and can be cultivated using food waste. Recent advances in methods are also expected to lead to a 90% cost reduction in commercial algae cultivation.

Growth in the retail space will largely be driven by Chlorella. Beyond use in foods, nutraceuticals, and skin care, Chlorella is also gaining traction as a superfood that boosts both immune function and collagen production.

Interest is piqued: US Amazon searches for “Chlorella powder” have risen by 35% over the last 90 days, per Jungle Scout.

Entrepreneurs could take advantage of Chlorella’s refreshing taste in beverages -- this would pair perfectly with the kombucha, low-alcohol, and seltzer trends we recently covered.

You could combine the Chlorella and pea trends: Powdered products containing both are receiving rising interest on Amazon.

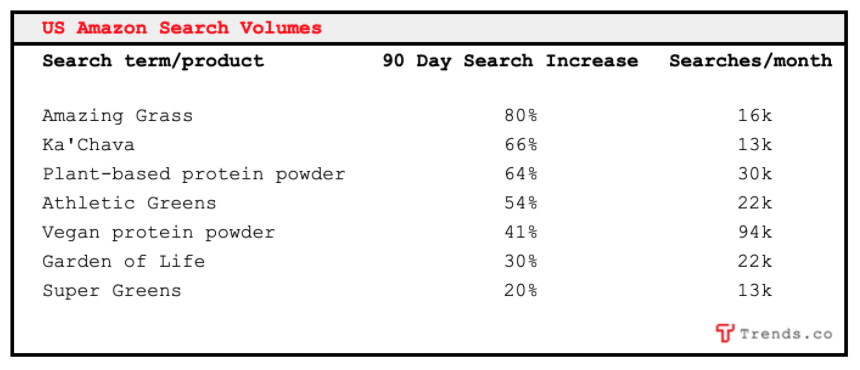

Entrepreneurs could take a (literal) leaf out of Trendsters Yulia Dan and Ruslan Nazyrov’s book and develop Chlorella supplements. They started their sea moss capsule business, Take Sea Moss, based on this Signal we wrote last year.

Beyond peas (and ponds), other alt proteins to keep an eye on include:

- Oat protein, trending on Google (12.1k searches/month)

- Duckweed: OK, we’re back in the pond. Plantible raised $4.6m last year to explore the “world’s most sustainable protein”

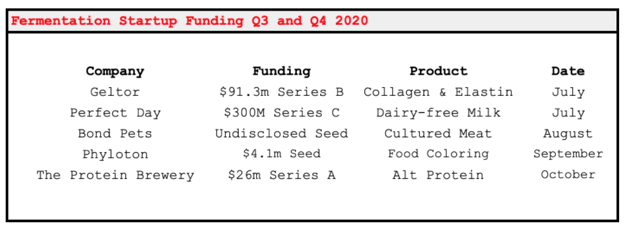

- Fermentation is already a crucial part of synthesis for many alt proteins, and is now being used to manufacture protein out of air (coming 2021)

- Mycoprotein, AKA mushroom-derived protein (18.1k searches/month)

Leave a Comment