nlopchantamang.com

A Fermentation Trend Is Bubbling Up

Shân Osborn

Source: Subreddit Stats

The Signal: It's been a while since kombucha and kefir hit the mainstream -- but the fermentation space shows no signs of slowing.

A 2019 study reported a 149% YoY increase in US consumption of fermented foods. R/Fermentation subreddit subscribers doubled over the last year, to hit 100k this October. The global fermented food market is expected to swell by $58.15B in 2018-22.

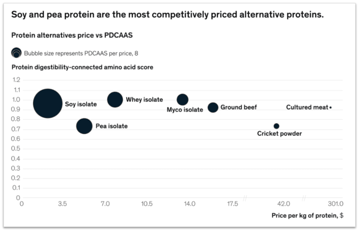

Demand for alternative protein, which often relies on fermentation, is surging. Startup Solar Foods is set to launch their fermented protein, made using air, in 2021.

Interest in human microbiomes is also propelling market growth, as the r/Microbiome subreddit accelerates past the 20k subscriber milestone. The list of conditions affected by microbes is rising -- from rosacea to autism -- and the positive effect of probiotic-rich fermented foods on microbiota is well documented.

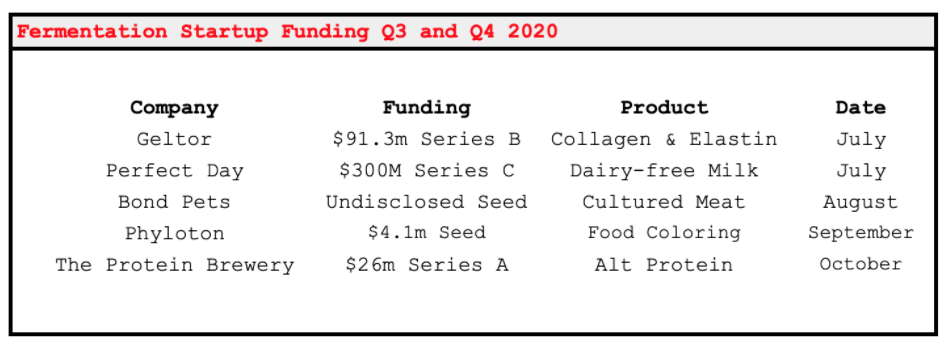

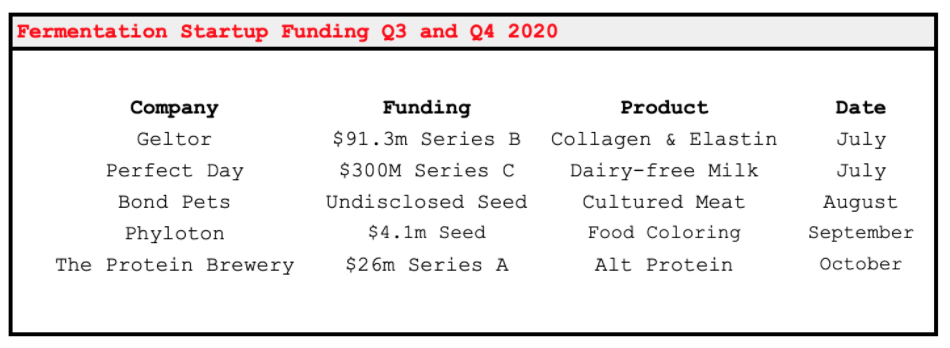

Companies focusing on fermentation technologies raised $435m over January-July 2020 -- already outstripping the $274m for all of 2019. Funding has continued to flow in Q3 and Q4.

We break down opportunities in all things fermented.

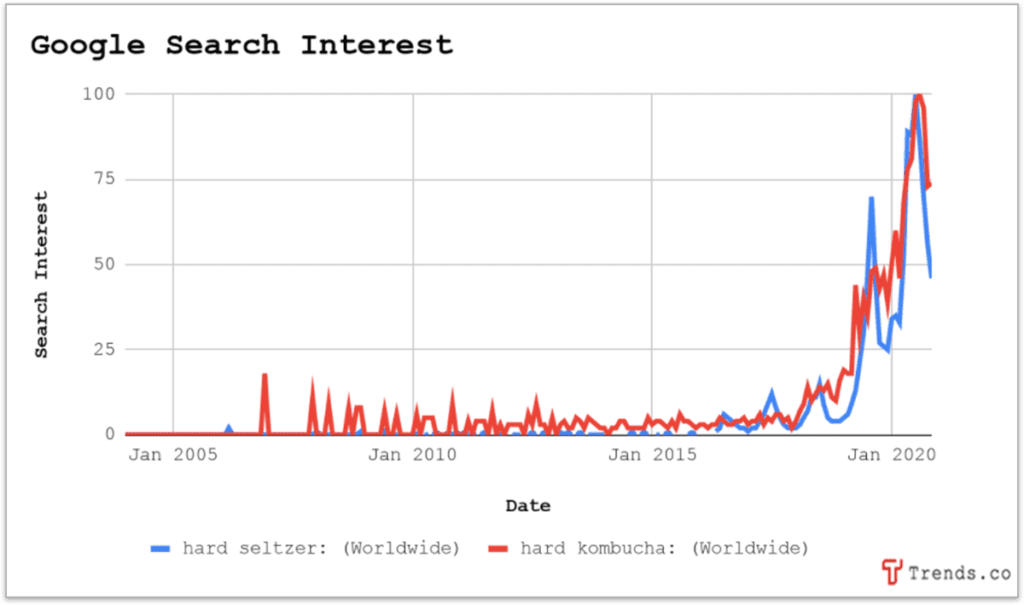

Hard Fermented Drinks: Americans indulging in tipple are veering toward healthier options: fermented beverages that are low-cal and gluten-free. In our special edition newsletter, Steph wrote about the rise of hard kombucha, an alcoholic version receiving soaring interest (with crazy margins).

Hard seltzer, also brewed using fermentation, has experienced a similar spike in demand. Last year saw sales soar 200%+, climbing past $1.2B.

And it’s not just a fad. The recent surge is forecast to be followed by healthy long-term growth: Market CAGRs of 16.2% (2020-2027) for hard seltzer and 42.4% (2021-2026) for hard kombucha are worth raising your glass to.

Entrepreneurs could develop offerings in this booming market. We’d advise you to take a leaf out of market leader White Claw’s book, and focus on gender-neutral marketing. The hard seltzer brand left competitors, with their ultra-feminine campaigns, in the dirt -- and accounted for 54% of 2019 sales.

In line with the recent move of eastern trends to the West, entrepreneurs should take note of the spiking interest in Asian seltzer.

Chinese unicorn Genki Forest just tripled its worth in 9 months, and is now looking to export to 100 countries. You could provide hard seltzer (and kombucha) in a similar line, incorporating Asian flavors (Lunar just launched).

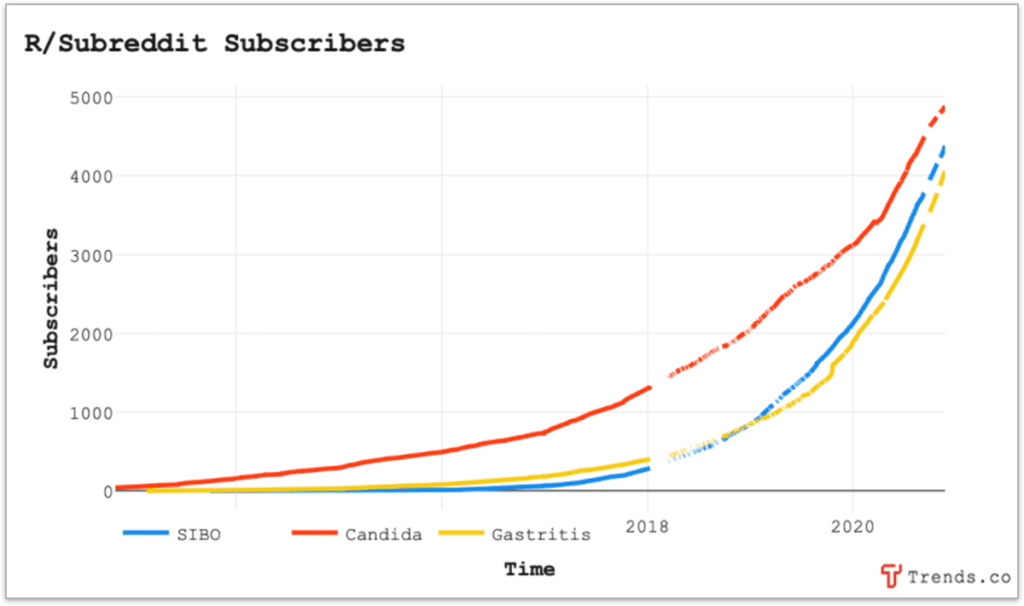

Fermented Products and Gut Health: Gut microbiome imbalances are linked to complaints like IBS, gastritis, and candidiasis -- which are becoming increasingly common.

Interest in natural treatments is also rising. Pre- and probiotic pill supplements are leading the race, but fermented food and drinks are not far behind.

Entrepreneurs could leverage the opportunity by designing treatment lines beyond pills -- think tonics, condiments, and meal plans.

There are also opportunities in personalized gut health. Startups like Viome and Thryve have launched microbiome test-kits for at-home use, and then deliver customized probiotic supplements.

Limited players leave room for competition, and value-adds, beyond the addition of fermented foodstuffs, might include:

- Relevance as a service: Monthly tests/surveys to keep up-to-date with consumer needs

- Focusing on the psychobiome, the next big thing as studies link mental and gut health (psychobiome-boosting stress tonic, anyone?)

- Leveraging the gut-skin connection and providing products to treat breakouts, eczema, and aging

Fermented Skin Care: Studies now show imbalances in the skin microbiome can trigger conditions like acne and rosacea. The list of benefits associated with fermented skin care is seemingly endless -- and firms are getting stuck in.

According to Mintel, 28% of “skin care products launched between December 2018 and November 2019 contained fermented ingredients.”

Mother Dirt, a probiotic skin care brand, has experienced double-digit sales and YoY growth since its launch in 2015. Azitra just raised $17m for the development of skin care products using fermented “wild-type bacteria.”

Entrepreneurs could enter this nascent space and develop lines containing fermented ingredients: Think soybeans and -- you guessed it -- mushrooms.

Following gut microbiome tests, skin microbiome tests might be next; and brands could offer a host of personalized follow-up products.

Product and Service Innovation: Demetrix has just announced their success in producing rare cannabinoid CBG via fermentation. This September, Bond Pets released the first faux-meat chicken. Perfect Day, creators of animal-free dairy, is considering an IPO.

Entrepreneurs could experiment with product development, or work with suppliers to leverage their end products (e.g., using new cannabinoids in seltzers, or even creating fermentation-focused eateries).

You could develop subscription services for fermented foods, and introduce new products and flavors each month.

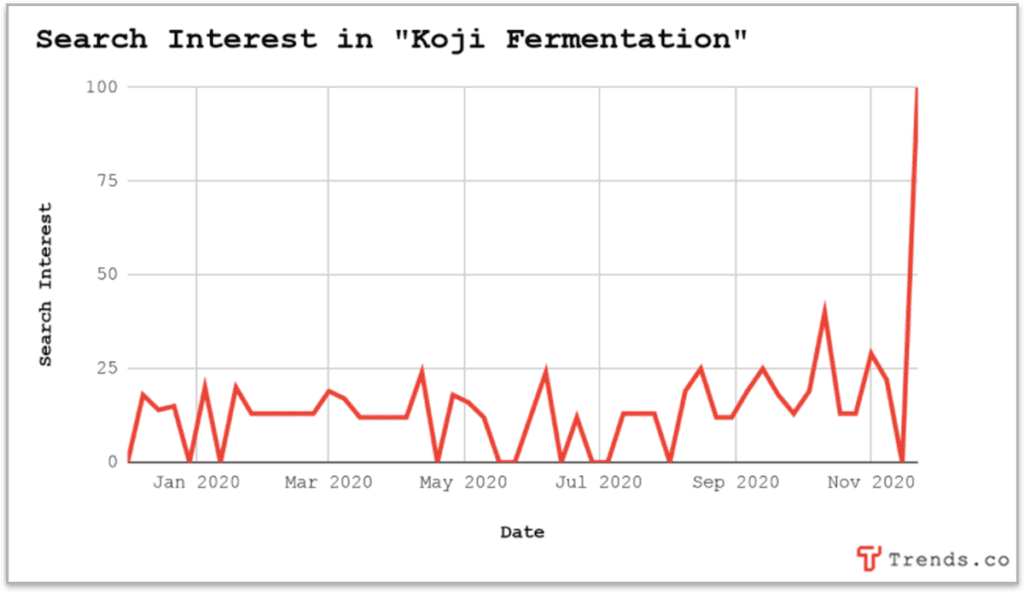

Millennials in particular like to discover unusual foods, and new fermentation trends are continually popping up. A recent example is koji fermentation, which uses a specific bacteria to produce things like vegan charcuterie -- and the trend is soaring.

You could also provide kits for consumers to make fermented products themselves. Google search volume is high, according to Keywords Everywhere:

- “Kimchi recipe”: 135k searches/month

- “Kefir grains”: 27.1k

- “Cheesemaking”: 12.1k

- “Kombucha kit”: 6.6k

- “Tempeh starter”: 4.4k

- “Yogurt starter”: 1.6k

Leave a Comment