nlopchantamang.com

The Inside Scoop on Insider Trades

Ethan Brooks

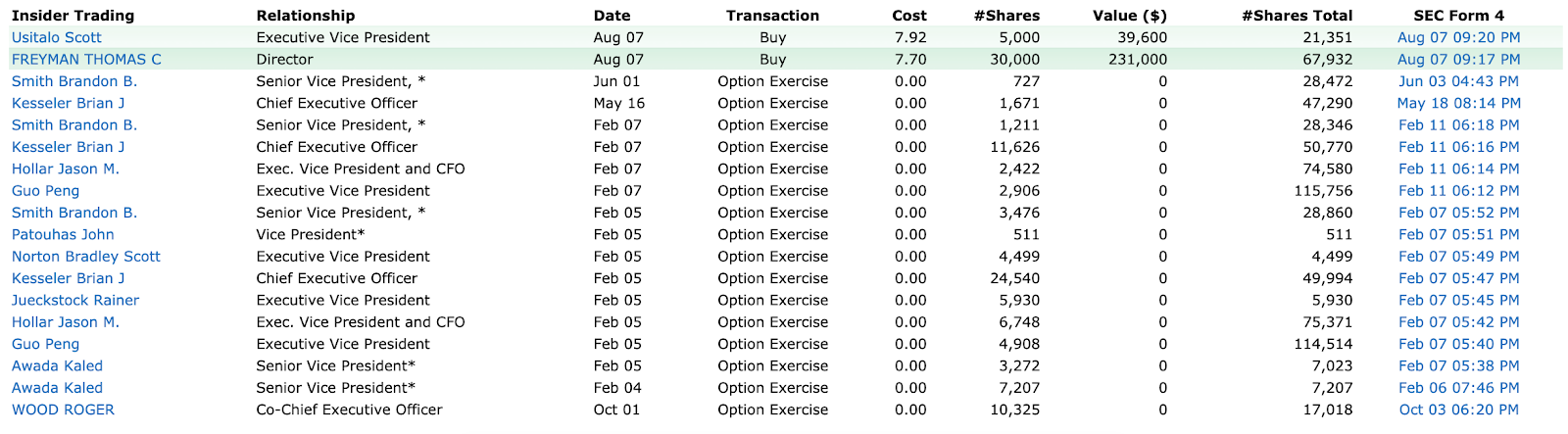

Source: Yahoo Finance

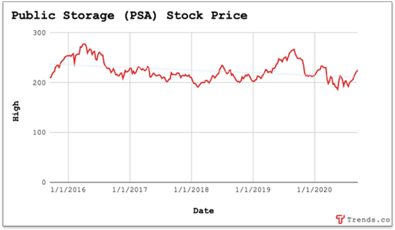

The Signal: While much of the stock market has recovered, Xerox is still trading at less than half of its pre-COVID price. Despite this, investor Carl C. Icahn purchased ~$29m worth of shares between August 5th and 7th -- a vote of confidence in the company, and an indication that Xerox may have found new markets to pursue.

This is one of many “insider trades” that happened last week, each of which offers interesting insights to those paying attention.

Background: Insiders at publicly traded companies -- executives, and those who own 10%+ -- enjoy a privileged position: They’re in the public eye, command large amounts of stock, and are privy to sensitive information about the company’s upcoming activities. Left unchecked, they could exploit these advantages for personal gain, so the SEC imposes several regulations, namely, that insiders must:

- Report any time they buy or sell company stock within 2 days of the transaction.

- Hold their shares for at least 6 months after buying them.

These trades are made public, and while they don’t guarantee that a company will prosper, they can indicate that the people running the company suspect it will prosper.

As investor Peter Lynch once said, “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”

By examining insider stock purchases, along with those companies’ recent reports, we can often identify markets with new and untapped potential.

Xerox

While the name Xerox may conjure quaint images of a bygone era, the company has actually always been at the forefront of workplace technology. They don’t just sell copy machines -- they invented them. They invented laser printers and Ethernet too. Altogether, they’ve been awarded 50k+ patents, receiving an average of 2 per day, and invest $1B+ in innovation each year.

A new problem they’re solving: helping employers safely manage large workforces as offices reopen. Their Q2 2020 report highlighted their new team availability software, which allows enterprise companies to track how full their buildings are and manage staggered work shifts in response to COVID-19 safety regulations.

With everyone from Amazon to state offices adopting staggered shifts, there’s likely room in this space for other entrants, especially niche SaaS providers focused on the needs of specific industries (like meat processors). Schools may also need software like this, as many are staggering everything from days on-site to time in hallways and use of the cafeteria.

Tenneco

Tenneco is a multibillion dollar car part manufacturer. Their Q2 earnings report shows a 41% YoY decrease in net sales and operating revenue, yet on August 7 Director Thomas Freyman invested $231k in 30k shares, nearly doubling his holdings, and EVP Scott Usitalo purchased 5k shares for ~$40k.

To make matters more interesting, insiders at Tenneco haven’t sold any of their stock in the last year.

One opportunity that may have them optimistic: car parts in Asia.

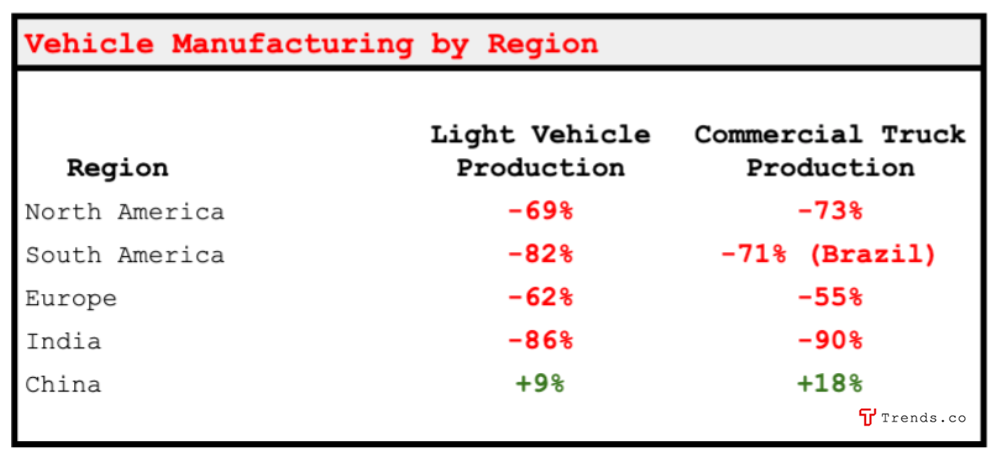

“The Asia Pacific region, particularly the high-growth markets of China and India, presents a significant opportunity for us to expand our business,” their Q2 report says. They say that Asia was the only region that saw a YoY increase in vehicle production during Q2 of 2020.

A recent report on China’s aftermarket automotive industry (the largest in the world) predicts it will be worth ~$282B by 2022, and says there are growing opportunities in B2B and B2C ecommerce.

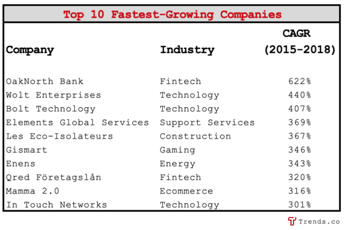

“[The Asian] vehicle aftermarket industry is fragmented with a large number of small distributors and installers,” Tenneco’s Q2 report says. Ecommerce solutions introduce efficiency into this fragmented space, and are growing quickly. Examples include:

- CassTime -- A search engine for car parts that has raised ~$225m.

- Tuhu -- On-demand car-service platform valued at ~$1.1B-$1.8B.

- Chexingyi -- Offers business services to small- to medium-sized auto repair shops.

Other notable insider trades include…

- August 3rd-4th: Jeff Bezos sold $3.1B of Amazon stock.

- August 6th-7th: Cliff Sosin invested ~$1m in Party City (Q2 ecommerce party supply sales were up 5.7% YoY without including the COVID online bump).

- August 5th-7th: The same investor, Cliff Sosin, bought ~$20m worth of Cardlytics -- an app that runs native ads inside banking apps.

Ethan Brooks

Blog posts

Related Articles.

Leave a Comment