nlopchantamang.com

Insider Trades: Opportunities in Storage Units and Industrial Equipment

Ethan Brooks

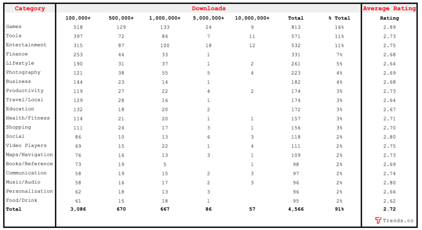

Source: Google Trends

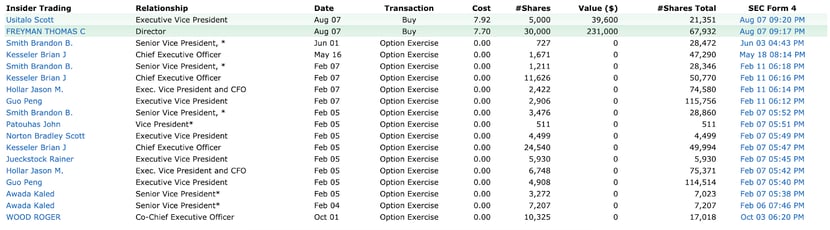

The Signal: Last month, we dug into insider trades at Xerox and Tenneco to reveal emerging opportunities in the workforce management industry, and the world of aftermarket autos in Asia. This month, we return to a list from Finviz of insider purchases to explore more interesting acquisitions:

Public Storage

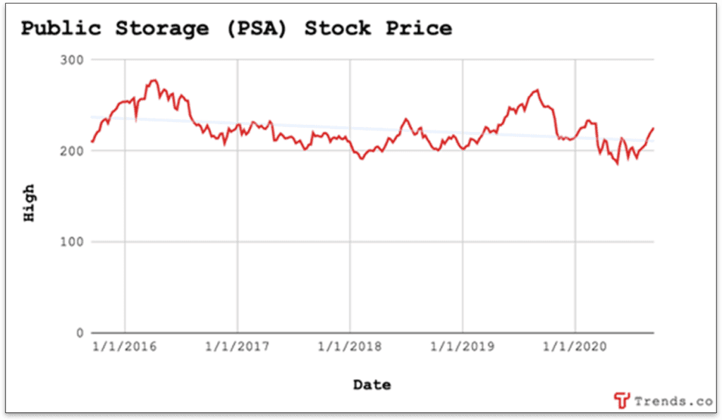

Billionaire Tamara Hughes Gustavson executed one of last week’s largest insider trades, purchasing ~$8m worth of stock in Public Storage. While the company’s share price has been trending down over the last 5 years, Public Storage is still an immensely profitable business.

Its most recent earnings release shows that even with the pandemic, revenue was only down 0.9% with $843m in net income.

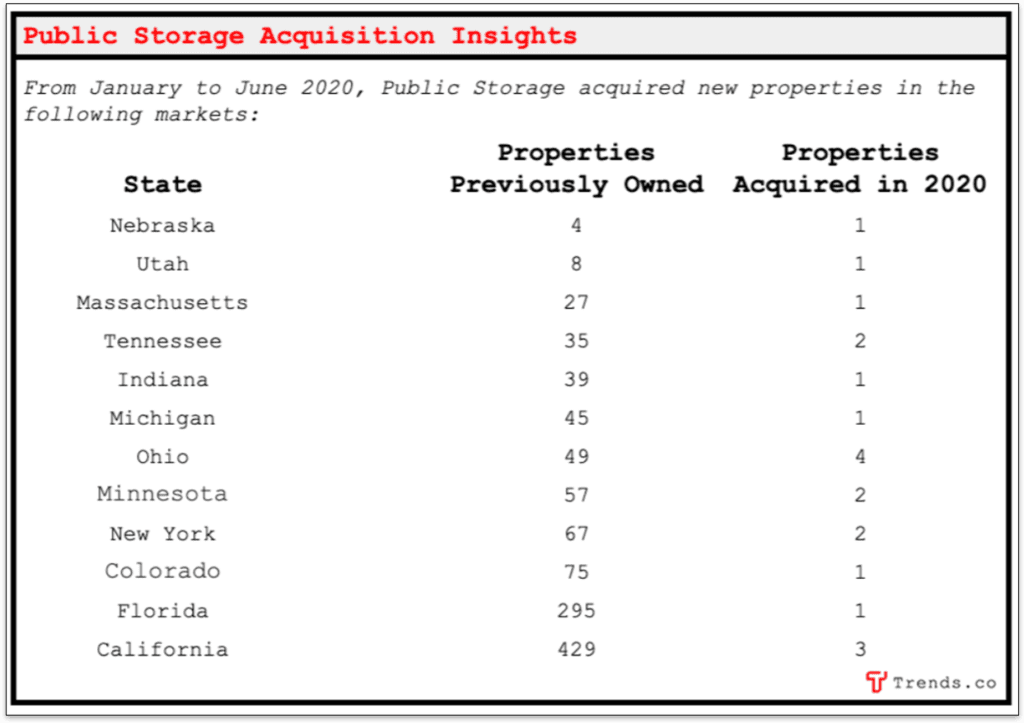

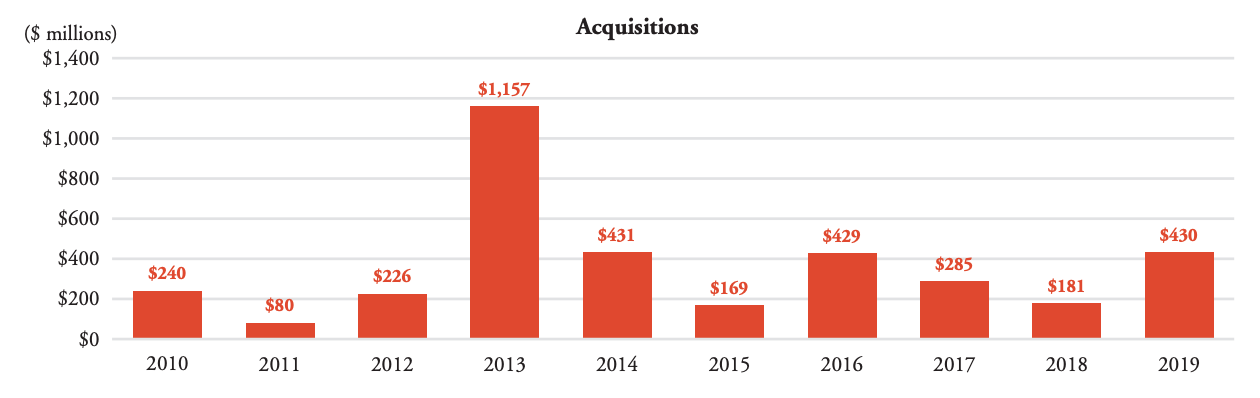

Public Storage has 2.4k+ storage facilities in the US, and the company is growing. Since 2013, it’s spent ~$3.3B acquiring 355 facilities across the US, 20 of those during this year alone. A look at some recent acquisitions offers insight into where the company sees opportunity.

Public Storage’s geographic footprint points to 3 potential opportunities:

- Blue Ocean: Our research on this year’s Inc. 5000 showed that Bozeman, Montana, is an emerging tech hub (with no Public Storage competition) that may need more storage, and Google Trends reveals that Idaho has above-average search volume for the term “storage unit.”

- Follow the Money: According to its Q2 10K filing, Public Storage’s competitive zone is typically a 3-5 mile radius around a unit. Locations like Nebraska, where PS is investing but still has a small footprint (just 5 facilities in Omaha), may offer prime opportunities for grabbing market share.

- Storage Flip: Each year for the past decade, Public Storage has spent an average of $362m acquiring storage facilities. Those with the resources could buy independently owned storage facilities and attempt to sell them to Public Storage later.

Babcock & Wilcox

No fewer than 6 executives at Babcock & Wilcox (BW) bought stock in the company recently. It’s rare that more than 1 or 2 executives buy stock on the same day -- but their trades were even more unusual, given the company’s recent stock market performance.

You may not have heard of BW, but you’re definitely familiar with some of their work. They’re an industrial equipment manufacturer, and for 100+ years, they’ve been quietly powering some of the most pivotal events in history.

They made the boilers that powered the very first NYC subway, as well as those that powered the SS United States, the fastest ocean liner ever to cross the Atlantic. When the Japanese surrendered at the end of WWII, 95% of the US ships in Tokyo Harbor had BW boilers in them. They dealt in nuclear reactors too, supplying the Manhattan Project and building parts for the world’s first nuclear sub and nuclear commercial ship.

In May 2016, BW stock hit highs of ~$220+ per share. After reporting lower-than-expected earnings a few quarters in a row, their stock plummeted, and by August of the following year, it was just ~$11 per share. Yesterday, it closed at $2.62.

So what explains the executives’ apparent optimism? It’s hard to say for sure, but a read of their recent financial reports shows that BW has narrowed its focus to core products in sustainable energy and innovation tech -- both industries with emerging demand.

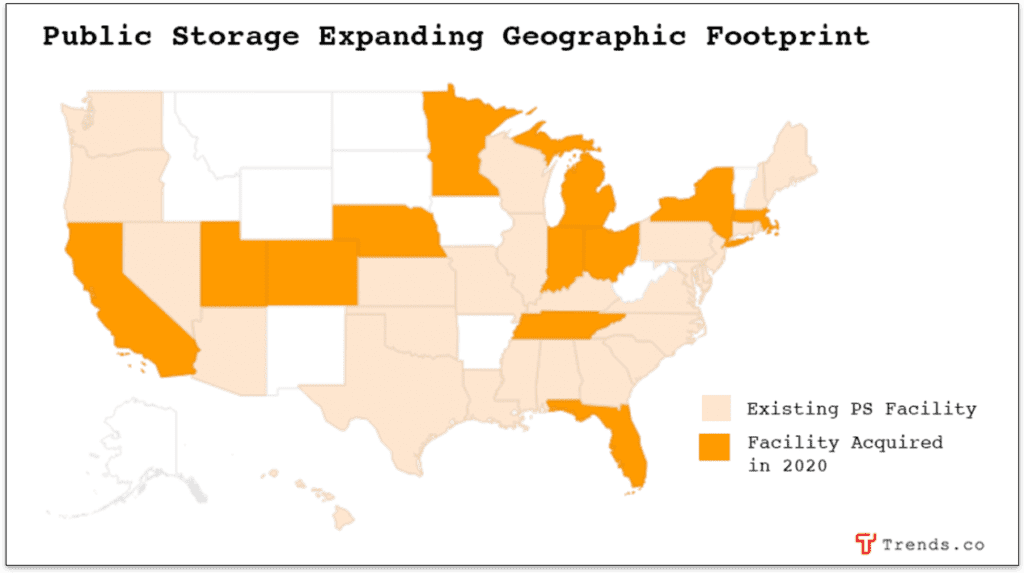

The map below shows some of BW’s global expansion plans.

This map reveals at least 2 interesting opportunities:

- Emerging Clean Energy Markets: BW has sales reps in Nigeria and is planning more for Kenya, Turkey, and Vietnam, indicating these may be promising markets for clean energy products.

- Building Sales Teams: BW is planning the most future sales/support teams for the Middle East (in Saudi Arabia, Oman, Egypt, Iraq). According to BW’s quarterly reports, the cost of selling is their second-largest expense ($30m-$40m per quarter). There could be opportunities to build contract sales teams in these regions with an eye on serving enterprise clean-energy clients.

Other Interesting Insider Trades:

- Wayfair - From September 2 to 9, Wayfair’s CFO, COO, and Chief of Product/Marketing sold, respectively, ~$1m, ~$4.5m, and ~$5.2m worth of shares.

- EA Games - On September 8, Andrew Wilson, CEO of EA Games, engaged in his largest options exercise to date, flipping 250k shares for a profit of $24.5m. He frequently carries no shares.

- Home Depot - On September 10, Matt Carey, EVP and CIO of Home Depot, sold about half his shares for ~$14m, then exercised an option to buy 28k more.

Leave a Comment