nlopchantamang.com

Insights from Europe’s Fastest-Growing Companies

Aja Frost @ajavuu

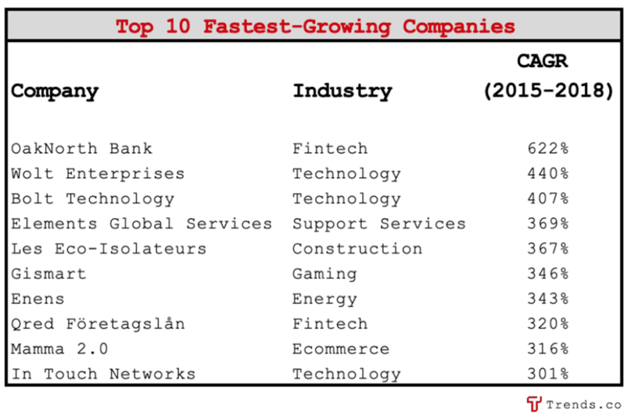

The Signal: Every year, the Financial Times releases a list of Europe’s fastest-growing companies. We analyzed its 4th-annual list, which contains 1k companies. To be included on the list, companies:

- must have a minimum compound annual growth rate (CAGR) of 38% from 2015 to 2018

- must have generated revenue of at least €1.5m in 2018

- must be independent (not a subsidiary or branch office)

- must have experienced primarily organic growth (i.e., "internally" stimulated)

- and should not have seen a share price decrease of more than 50% since 2018, if publicly listed

The Opportunity: Below, we flag 3 of the fastest-growing companies in 3 industries (Fintech, Technology, and Ecommerce), and dive into what gives them their edge.

- OakNorth Bank | CAGR: 622% | Rank: 1 | Age: 5 | Industry: Fintech |

This 5-year-old challenger bank from the UK tops the list of the fastest-growing companies in Europe. The profitable fintech unicorn reported a 95% jump in pre-tax profit from £33.9m in 2018 to £65.9m in 2019.

"We believe that if you’ve found a market that is underserved and you are solving that problem it will grow organically and virally," explained Amir Nooriala, chief strategy officer at OakNorth, at the Unbound innovation festival in London last year.

The company attributes its success to its narrow focus on an under-served market niche. It provides business loans to small- to medium-sized enterprises, the so-called "missing middle." This strategy allowed the bank to be more conservative in its marketing efforts than competitors battling it out in the retail banking space (e.g., Monzo and Revolut).

While the company has been steadfast in focusing on its niche, it has recently branched into mortgages targeted at "asset-rich but regular income-poor" entrepreneurs and high networth individuals. It has also white-labelled its credit decision-making technology, allowing the bank to extend its reach without extending its resources.

- Bolt | CAGR: 407% | Rank: 3 | Age: 7 | Industry: Technology |

This Estonian ride-hailing app has been described as "the thorn in Uber’s side" in key geographies across Europe and Africa. The company, which is profitable or almost profitable in two-thirds of its markets, reported revenue of €80m in 2018.

What sets Bolt apart from its competitors is its cost efficiency, which enables the company to offer lower prices and take less commission from drivers. It keeps costs low by: 1) hiring developers in Estonia and Romania ; 2) forgoing a large research department in favor of posting Facebook ads that help the company decide which cities to open in; and 3) centralizing support operations in Estonia and hiring only 3-5 employees in each country where it operates.

Eastern Europe is becoming one of the world’s most favorable outsourcing destinations, especially for tech talent. Many leading tech companies have opened software development centers in Eastern Europe, where annual salaries for senior developers are ~$50k, compared to ~$200k in the US. This report dives into the best outsourcing destinations based on rates, expertise, and cultural compatibility.

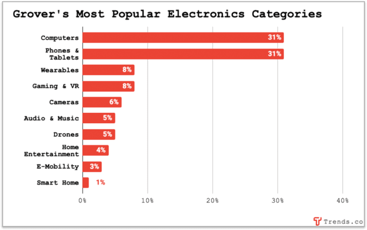

- Mamma 2.0 | CAGR: 316% | Rank: 9 | Age: 6 | Industry: Ecommerce |

Mamma 2.0 (trading name Mukako) is the only ecommerce platform in the top 10. The Italian company, which sells high-end childrens’ products, reported revenue of €7.2m in 2018.

The online store sells third-party brands (e.g., Bébé Confort, Cam, Chicco, Kidkraft) as well as their own products, the MUtable and MUwall. The company has dropshipping arrangements with third-party vendors to allow them to stock a wide range of products without bearing the risk of holding inventory.

Their secret sauce: Focusing on high-margin products allowed them to invest in creating the "best customer service in the country." By focusing on the customer experience value proposition, Mukako set themselves apart from competitors by creating a trusted brand with their customers -- primarily affluent mothers -- and third-party suppliers.

This in turn gave them the foundation they needed to launch their own products at even higher margins. The company wanted to capitalize on the fact that affluent parents were hungry for beautifully designed educational toys. And for good reason: The educational toys market is anticipated to accelerate at a CAGR of 11% to $34B in 2022.

Today, 80% of their revenue comes from sales of these products which they sell in 30 countries, leveraging primarily Facebook and Instagram advertising to reach their target customers.

Leave a Comment