nlopchantamang.com

How to Capitalize on the Billion-Dollar Open Banking Industry

Aja Frost @ajavuu

Source: Open Banking

The Signal: There’s a new wave of consumer-facing tech companies that are providing a range of add-on financial services to their core offering -- while heavyweights like Amazon (e.g., Amazon Lending and Amazon Cash) and Apple (e.g., the Apple credit card) continue to invest in the financial services space.

Just last week, Google announced that it would be expanding its digital banking services in the US. The company has teamed up with a further 6 banks, adding to its existing banking partners Citi and SFCU, to offer bank accounts to Google Play users.

By teaming up with Mastercard to offer debit cards to drivers in Mexico, Uber is another example of a non-fintech company that is dipping its toes in the financial services pool. Doing this allows the company to diversify its revenue by making margin on banking services in addition to rides.

This phenomenon is not exclusive to tech companies. Fitness studios and law firms alike are starting to offer financial services (more on that below). As Angela Strange, general partner at Andreessen Horowitz, predicted at the a16z Summit in November 2019, “In the not-too-distant future, I believe nearly every company will derive a significant portion of its revenue from financial services.”

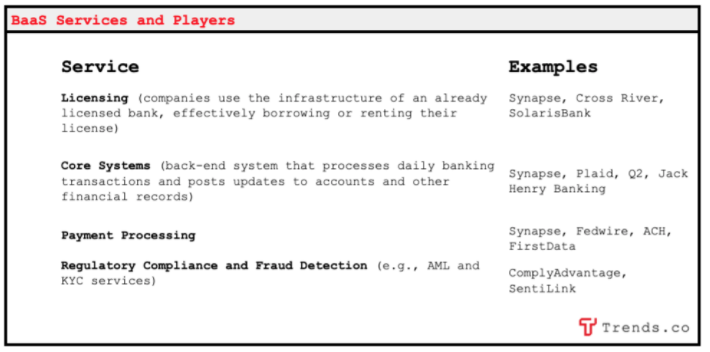

The Big Picture: The open banking industry, which was worth ~$7.3B in 2018, is expected to reach ~$43B by 2026 -- a compound annual growth rate (CAGR) of ~24%. Open banking is a system in which banks and other fintech infrastructure companies make their application programming interfaces (APIs) accessible to third parties. Third parties develop apps, products, and services based on the information made available through the APIs.

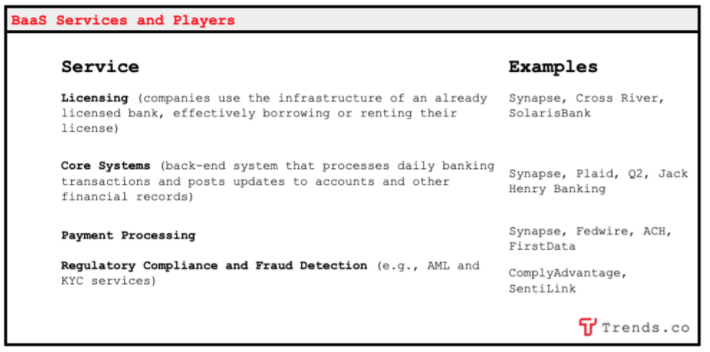

Fintech infrastructure companies, also referred to as “fintech enablers,” build white-label, modularized banking infrastructure (e.g., licensing, core systems, payment processing, and compliance services) that can be rented out to consumer-facing companies.

Instead of every fintech startup building a bank from scratch, they can get to market quickly and cheaply by plugging into services offered by fintech enablers, freeing up time and resources to focus on customer service and experience. By “renting” an existing banking license from a fintech enabler, startups can also avoid complex and costly regulatory hurdles.

Fintech enablers -- the “plumbers of the fintech world,” which build the infrastructure that enables the open banking industry -- are believed to be Europe’s next unicorns. Also referred to as Banking as a Service (BaaS), these companies provide:

This year, Visa announced that it will be acquiring US fintech enabler Plaid for $5.3B at a sales multiple of 35x -- one of the highest in recent history for a private company. Plaid, which enables apps of all kinds to connect with users’ bank accounts, plugs into ~10k banks. It is the infrastructure that supports the likes of Venmo, Coinbase, and Robinhood.

The Opportunity: The industry is still evolving, and there is ample opportunity for new players to emerge to support fintechs. But fintechs will not be the only beneficiaries of this infrastructure -- any industries in which money moves or requires managing are up for grabs.

According to a report by The Sift, everyone “from law firms overseeing M&A and house purchases, to general corporate back-offices managing salaries and supplier payments” will have uses for custom-built embedded fintech solutions. In Europe, for example, Shieldpay works with companies offering high-ticket products (used-car websites, art galleries, high-end fashion stores, etc.) to offer simple digital escrow accounts.

API Marketplaces: Bond, another US player in this space, provides other companies with the software and API tools to offer a range of financial services such as deposits and credit cards. The company, already backed by Mastercard, Canaan, and Goldman Sachs, just raised a $32m round led by Coatue’s VC fund.

Unlike “pure play” BaaS providers discussed up to this point, companies like Bond represent a new model in which unregulated BaaS providers create an API marketplace by partnering with a large number of fintech enablers and banking partners in order to offer a wider range of banking services and reduce the risk associated with relying on one provider.

B2B: While many applications of the technology provided by fintech enablers will be used by consumer-facing companies, there are also opportunities for B2B solutions to emerge. Mindbody, for example, is an online scheduling and business management SaaS product for fitness studios. In addition to this, the company also offers studios a payment processing service, from which it generates almost half of its revenue.

Just as the internet used to be a platform with very specialized applications before every industry found ways to build and rely on it, banking infrastructure as a service will make its name in fintech before becoming ubiquitous. The opportunity to invest in and become part of the foundations of the emerging open banking industry is like having the opportunity to invest directly in the HTTP protocol 30 years ago.

Leave a Comment