nlopchantamang.com

A Retail Revolution: Acommerce

Ethan Brooks

The Signal: Coronavirus has changed a lot about the way we live, work, and shop. As one example, a recent consumer survey found that 7-20% of buyers in different age groups are planning to sign up for more product subscriptions to manage purchasing in the wake of the issues caused by the pandemic. That, combined with other changes in buyer behavior, is ushering in a paradigm-shifting possibility in the way we do business: acommerce.

Acommerce, or automated commerce, is the next evolution of retail in which companies use connected (IoT) devices to monitor customer activity and automatically ship products before buyers ever realize they need something.

Think a printer that automatically orders ink when levels get low, or a Nespresso that sends your favorite coffee pods straight to your door when it knows you’re nearly out.

This innovation rewrites the story of retail as we know it, shifting the purchase decision from the buyer to the seller, and is building on 2 ongoing trends:

- Booming Subscription Market: People want to buy on autopilot. From 2014 to 2018 the ecommerce subscription market grew at 60% CAGR to an estimated $12B to $15B, according to McKinsey, with lots of room left for continued growth.

- Voice Commerce: People are increasingly willing to let smart devices like Amazon’s Alexa help in the buying process. A report by Voicebot.ai found that ~4% of smartspeaker owners use them to purchase products daily, while 15% make purchases monthly.

Acommerce combines the 2, enabling smart devices to order products without conscious manual input, and in the process, offers buyers a more convenient experience while helping sellers decrease friction, improve sales forecasting, and boost recurring orders.

While this is still nascent technology, there are already several opportunities for entrepreneurs to explore, including:

Acommerce At Home: The smart-home market was valued at $64B in 2019, and is projected to quadruple by 2025, according to Mordor Intelligence. Companies that produce smart devices can equip them with acommerce abilities in order to stand out to customers.

To do this, you can use tools like Amazon Dash Replenishment, a service that can be integrated into devices, enabling them to automatically order products from Amazon when supplies are running low.

Companies like Wagz (automatic dog feeder) and Epson (printers) use Dash in their devices, and highlight their automatic dog food or ink reordering features as major selling points.

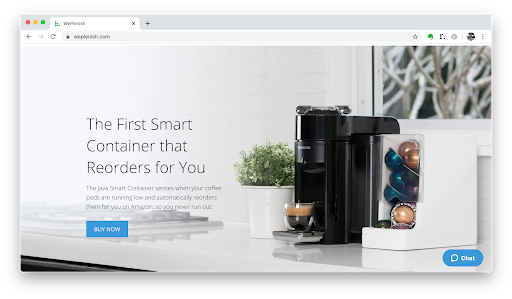

There’s also an opportunity to create ancillary products that add value to existing appliances. Weplenish, for example, is a smart container that tracks your inventory of coffee pods. When your supply runs low, the device automatically orders you more.

One could imagine other smart containers for products that are crucial to people’s routines, like laundry detergent pods or athletic protein powder. Because these devices would be a value-add (rather than a competitor), they could be positioned well for acquisitions or partnerships with larger brands.

Acommerce on the Go: Acommerce isn’t limited to bulky home appliances -- there’s one smart device that 45% of the world’s population carries with them everywhere. Companies are now experimenting with services that are automatically triggered using some of the many sensors that smartphones have onboard.

Revolut, the $5.5B fintech company, recently launched pay-per-day travel insurance, which automatically kicks in any time your phone travels abroad. By using the phone’s geolocation features plus automation, customers pay only for the days they’re actually abroad without ever having to think about it.

This reveals something important about quality acommerce opportunities: They will likely be found in industries that are crucial, yet tedious to shop. Not having insurance abroad exposes you to enormous risk. But buying it is a hassle, so many don’t. Solutions that bridge similar gaps automatically will prove promising as acommerce is adopted more broadly.

Smartphones are loaded with other types of sensors that can offer companies unique acommerce connections with clients.

Consider the importance of mental health, another trend we reported on recently. One in 5 adults face a mental health issue in any given year, yet most never get treatment. Perhaps there’s a market for a telepsychology service that automatically books a session when the heart rate sensor on a user’s phone is above baseline for too many days in a row.

Or, on a lighter note, essential clothes (like socks) need to be replaced periodically. The pedometer on a client’s phone can monitor how far they’ve walked, and send replacements after every 1m steps, building a unique relationship with customers based on their activity.

Seller Services: If acommerce takes off, it will rewrite the rulebook on retail, reports Flux: "Retailers will increasingly find themselves selling to algorithms as well as humans."

For years sellers have worked to master the art of capturing human attention. But how do you sell detergent to a laundry machine?

Will visual cues like logos and packaging still matter? Or will these acommerce-enabled devices care more about other factors, like a track record of timely shipping, or reviews from other networked devices?

There’s much that’s still to be determined.

As always, companies will need help navigating this new arena. For those who become knowledgeable in this space, getting hired for consulting and other services will be almost as automatic as the acommerce itself.

Leave a Comment