nlopchantamang.com

The Rise of Niche Sports and the Future of Sports Programming

Shân Osborn

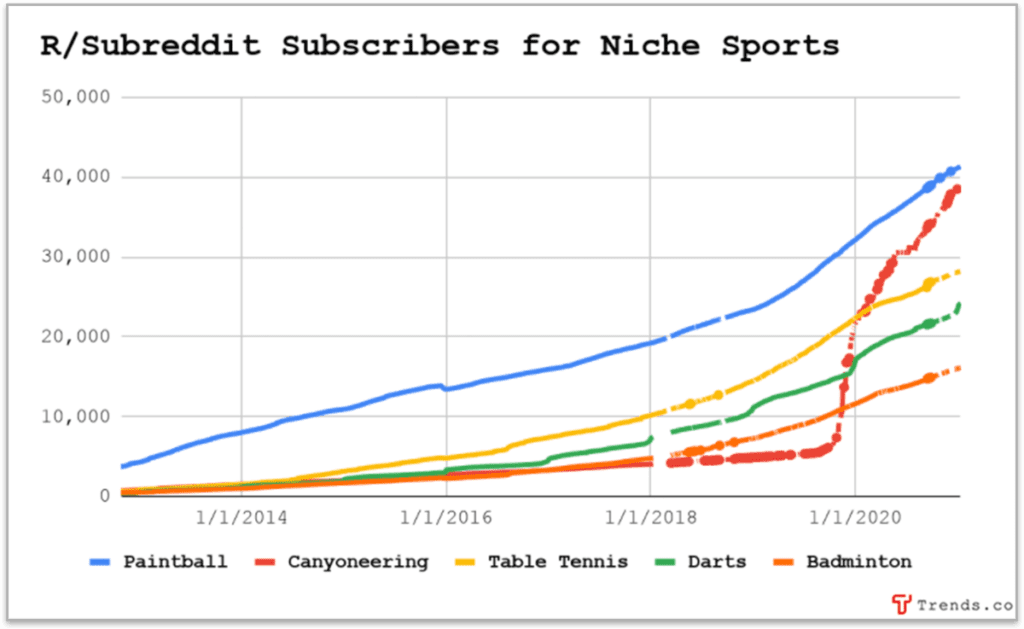

Source: Subreddit Stats

The Signal: Niche sports are gathering fans -- and fast.

Disc golf has seen its following on Reddit balloon by 100% since January 2019. We’ve covered the sharp rise of Everesting, Teqball, and Padel.

Trendsters discussed the surge of pickleball, especially within retirement communities, in this Facebook post. Sam’s recent tweet about the sport also generated a bunch of responses.

Opportunities are not limited to selling equipment, training, and merch for emerging sports. More interesting is the fact that these sports represent a shift in viewership preferences.

Fans are looking for better ways to interact. Independent producers can capitalize on media companies’ need for original content that isn’t tied to huge rights deals with pro leagues.

The future of sports programming, especially for niche sports that can package their content in new ways, is ripe with opportunities.

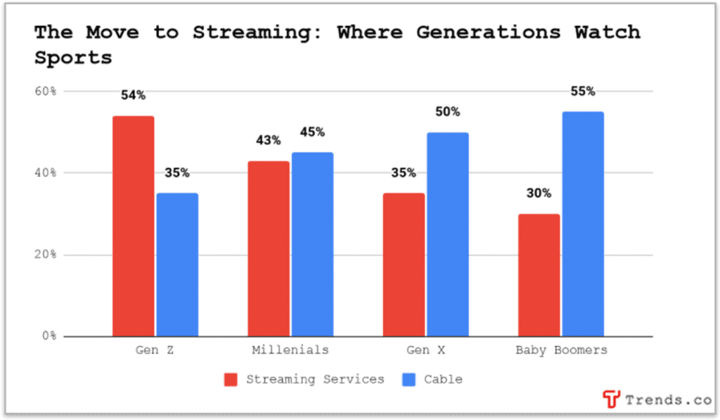

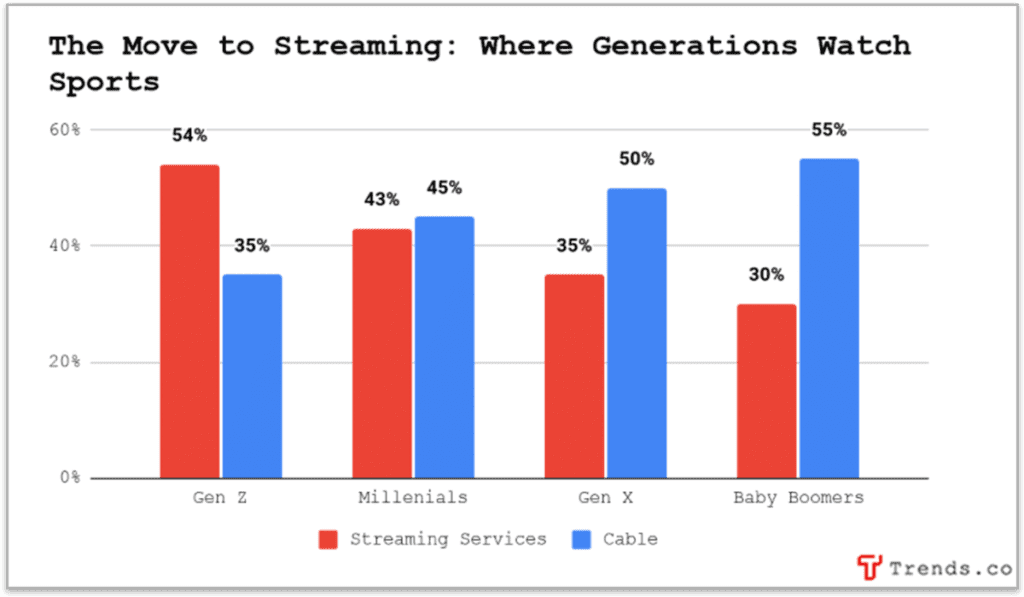

The Big Picture: While the surging success of streaming is old news, sports viewership has been slower to move over from cable.

Until now.

According to a 2020 study, 56% of fans who stream sports would pay more for online streaming than traditional TV. In households with kids this jumps to 70%, and to 78% for those identifying as “intense” sports fans.

Interest in online postproduction sports content is also rising.

In 2018 YouTube searches for sports highlight videos climbed 90% YoY. Time spent watching YouTube sports interviews rose by 60%, and watch time for “funny” sports videos grew by 50% over the same period.

We outline 4 opportunities within this evolving landscape.

Streaming Subscriptions: Niche sporting bodies have just begun to jump on the bandwagon by exclusively livestreaming their own leagues.

The Disc Golf Pro Tour (DGPT) launched the Disc Golf Network (DGN) last year -- to roaring success.

DGN, which charges fans a monthly subscription fee of $9.99, had hoped to attract between 1.5k-3k subscribers by the end of 2020. They reached 17k+ by October, which means it’s generating a minimum of $85k/month in subscription fees, assuming each subscriber receives the 50% off Professional Disc Golf Association (PDGA) member discount. The actual amount is probably much higher.

According to Jeff Spring, CEO of DGPT, this has taken away the pressure to land a TV partnership -- the traditional monetization route for sporting bodies.

“Pushing past our current model to network broadcast is fairly unnecessary… We can wait for the right deals and the right approach and prioritize what we’re doing right now, because it’s working.”

The cash flowing in is sufficient to alter the economics of the whole DGPT media landscape. It also increases the Tour’s leverage in negotiations with postproduction companies.

Other niche sports will be quick to follow suit. As viewership grows, organizations will provide fans with more options (e.g., tiered subscription services with varying levels of access, and mobile-centric streaming apps).

There are also opportunities for tech and media companies to assist with everything from filming logistics to platform development.

Streaming Platforms: As new sports enter the fray, the number of events and even entire genres left out of media coverage will grow.

There is an opportunity for streaming platforms to provide fans with one-stop access to a wide range of more obscure sports.

FloSports has made streaming niche sports its USP. The platform was launched by 2 brothers in 2006 with $10k.

They now have 500k+ subscribers and bring in ~$75m annually via their $150/year subscription. FloSports subscribers more than doubled last year.

The network’s focus is on fans who want coverage of both local teams playing established sports, and events from niche sports (think rodeo and marching) -- 2 highly underserved markets in sports coverage.

Entrepreneurs could enter this nascent space as demand skyrockets, and even specialize within it -- incorporating better viewer interaction, and providing coverage in overlooked areas.

Viewer Interaction: Sports and streaming are social activities: Just look at the power of the Twitch community in esports.

Entrepreneurs who leverage the social side of sports streaming will win big. Platforms could incorporate live community chats, and even exclusive online access to stars.

Better ways to monetize will also be on the streaming radar, as technology allows networks to augment the viewer experience -- think personalized on-screen banners, holograms, etc.

Postproduction Content: Independent producers can work to release niche sports content on platforms like YouTube: highlights videos, bloopers, and interviews.

There are also opportunities for niche sporting bodies to develop their own curated content platforms, much like the NFL Game Pass.

This idea has already been leveraged by the International Table Tennis Federation, which worked with media companies to launch itTV after more than half a billion viewers watched table tennis at the 2016 Olympics.

Content diversification (e.g., branching out into short-term video) will also be key for niche sports to gain media traction. The time is right for tech and media firms specializing in diverse content production to target sporting bodies and teams.

Leave a Comment