nlopchantamang.com

The $30B Industry Set to Profit from the Mass Migration of Americans

Aja Frost @ajavuu

Source: Austin Chamber of Commerce

The Signal: We are only 6 months into 2020, and already 61 companies have relocated to, or expanded in Austin, Texas -- not bad considering the country has been locked down for much of that time. This number is likely understated, since it only includes known relocations that were publicly announced.

The rate of company relocations to the city has been on the rise since 2016 and includes tech heavyweights like Amazon, Apple, Tesla, and Google, which love the city’s “lower costs and laid-back lifestyle.” These movements have created ~36k new jobs in Austin since 2018.

The Big Picture: The influx into Austin is only a symptom of the wider mass migration of people and companies across the country. Employers, employees, and freelancers alike are finding that they don’t need to be in big job centers like the Bay Area or New York anymore, with many flocking to less-dense cities.

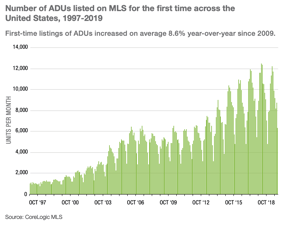

While this trend was already on the rise before 2020, COVID-19 has further catalyzed it. This shift is reflected in recent real estate numbers: Bay Area rents are down ~12%, while new leases in Manhattan are off ~62%.

A recent Hustle poll found that 33% of respondents plan to move within the next 6 months. Here’s a snapshot of where they’re going:

More than 170 Trendsters weighed in on a subsequent Facebook post, with many people predicting what American cities will look like in 5-10 years. Trendsters debated whether the migration to “B and C level cities like Austin, Denver, Nashville, and New Orleans” is permanent, or if New York and the Bay Area will be business as usual after the pandemic.

The Opportunity: Employee relocation management is a $32B industry. Even before the effects of COVID-19, this largely unknown industry -- whose operators work behind the scenes to support domestic and international moves -- was projected to grow at a 4% compound annual growth rate (CAGR). North America alone accounts for half of the industry, with a market size of almost $16B in 2019.

Players in the industry are split into two categories : Destination Service Providers (DSPs) and Relocation Management Companies (RMCs). RMCs act as a single worldwide point of contact for multinationals and outsource the delivery of destination services to local agents – DSPs.

While the international relocation services industry is dominated by a few big players (e.g., Cartus Corporation is a $300m annual revenue company in the US), there is still space in the market for challengers to emerge.

Jobbatical, a European talent relocation startup which has raised $8m to date, announced a further €2.6m (~$3m) round led by the New York-based investment firm Union Square Ventures. Jobbatical, which focuses on international relocations, offers employers an end-to-end relocation service for their employees, including:

- accommodation search

- bank account opening

- doctor registration

- address registration

- tax registration

- educational support for spouses and children (e.g., language learning support)

It costs employers ~$1k-$1.7k per relocation to relocate an employee and their family using Jobbatical, plus a monthly platform fee starting at ~$115 for up to 3 relocations.

Like Jobbatical, many players in this space have historically focused on the B2B market for international relocations. But there are 2 fundamental market shifts accelerated by COVID that have created a gap for new service offerings to dominate in this space: 1) an increased interest in domestic migration; and 2) an increase in solo practitioners such as contractors, freelancers, and “digital nomads.”

Even before the pandemic accelerated the remote work trend in 2018, 17m Americans (independents and traditional workers alike), said that they planned to become location-agnostic digital nomads. A further 42 million said that they were considering it.

These changing market conditions have unearthed opportunities to create a relocation service platform focused on both B2B and B2C (solo practitioners) domestic relocations. An end-to-end service, leveraging partnerships with other service providers where necessary, could include:

- home sales (e.g., home marketing assistance)

- home searches (e.g., find properties for rent or purchase and assist with negotiating leases or sales)

- temporary housing for shorter-term assignments

- moving and storage, including pet relocation and car shipment

- orientation and settling-in services (e.g., finding a doctor or a church)

Leave a Comment