nlopchantamang.com

Male Grooming Is Getting a Makeover

Shân Osborn

Sources: Euromonitor; GlobeNewswire

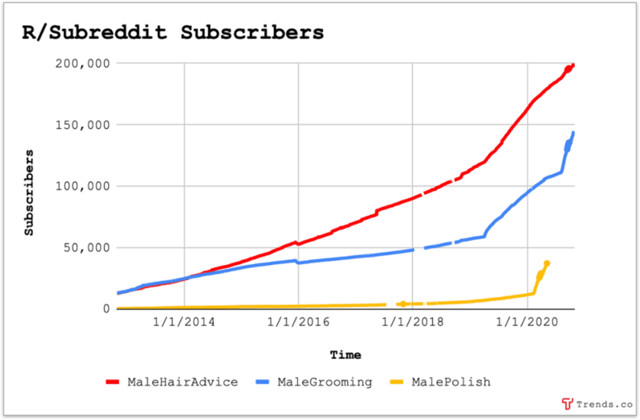

The Signal: It’s been a slow burn for the male grooming market -- until now. The industry has ballooned 130%+ higher in 2020 than originally forecast.

Male personal care options once deemed “alternative” are now receiving soaring interest. Increase in internet searches from 2019, according to Trendalytics:

- Men’s moisturizer +324%

- Beard growth kit +233%

- Men’s anti-aging +42%

- Men’s skin care +34%

The Big Picture: The industry has come a long way since Old Spice launched in the 1930s. The “Smell like a man, man” approach has had to keep pace as the concept of masculinity evolves.

From Dollar Shave Club’s (DSC) wildly successful back-to-basics, comedic approach to David Beckham’s suave House 99 campaign, male grooming now dons many hats.

One thing established brands have in common is that they ask the basic question, “How can we create a product that makes the male grooming experience significantly better?"

Key to the viral success of firms like DSC has been knowledge of target audience, and relatability. Previous razor brands either marketed to the debonair gentleman or portrayed men as hairy Neanderthals in need of a groom; DSC spoke authentically to men looking for a convenient, affordable solution to a daily task.

Personalization, straightforward messaging, and education are ways to provide a seamless experience for men buying products they’re unfamiliar with.

Makeup: Male cosmetics are being propelled into the mainstream by high-profile beauty influencers and K-pop stars. But it’s not just online or in the East that the trend is gaining traction.

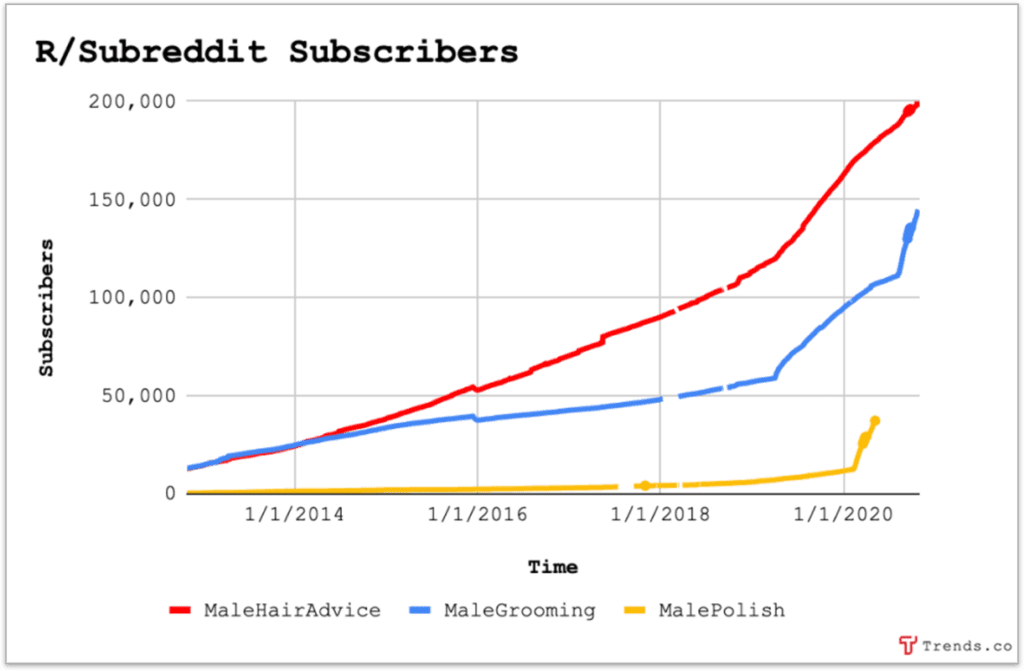

UK department store chain John Lewis enjoyed a highly successful trial of men’s cosmetics line War Paint earlier this year, and then announced the opening of a permanent male makeup counter.

According to a 2019 US poll, ⅓ of men under 45 say they would consider trying makeup. Drugstore giant CVS responded this summer by adding male cosmetics line Stryx to a quarter of its stores.

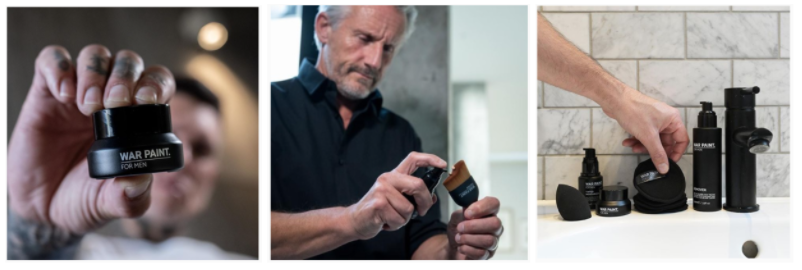

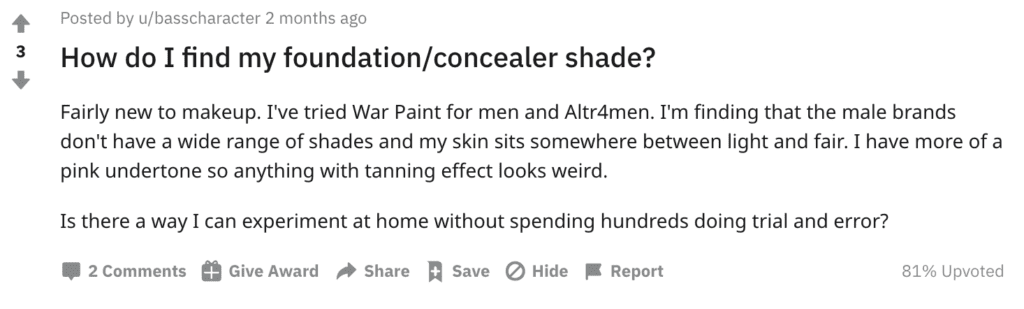

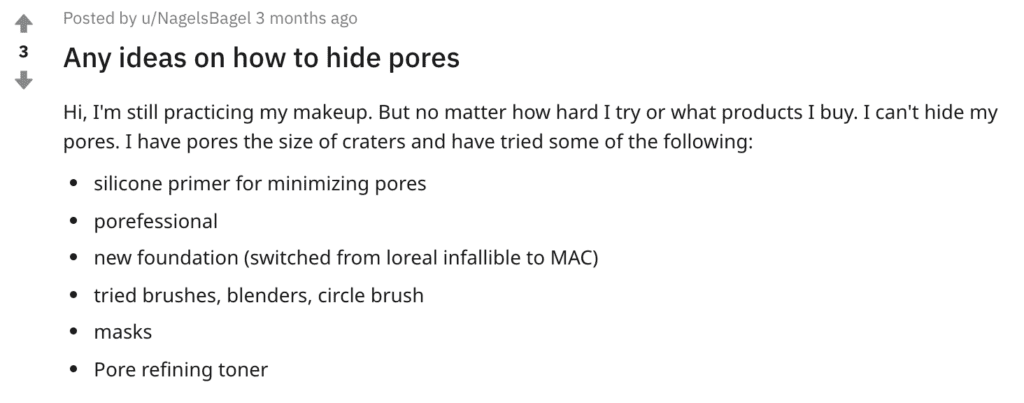

While the r/MakeUpForMen subreddit is still a small community, there are already a number of questions around how to use makeup.

Online options for women are plenty, from apps like TroveSkin to Clinique’s guide to matching foundation to skin tone. Why not do the same for men and save them the in-store trip altogether (e.g., Birchbox for men, but specifically for makeup)?

Entrepreneurs could also create a “no makeup” makeup line (which research suggests is what men want). Think concealers, blemish balm (BB) creams, and eyebrow gel.

Monthly search volumes, according to Keywords Everywhere:

- Makeup for men: 33.1k

- Concealer for men: 6.6k

- BB cream for men: 5.4k

- Foundation for men: 3.6k

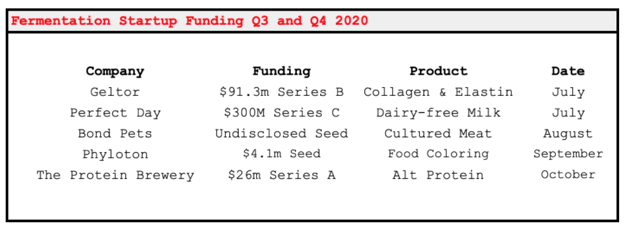

Or you could focus on niches. For example, the skin care industry for ethnic and racial minorities is ripe for innovation. UK startup 4.5.6 Skin just raised €700k to develop products for women of color, who are still underserved by the industry.

The recent success of Black-founded and Black-focused male grooming firms like Bevel suggest it’s only a matter of time before demand for cosmetics for men of color soars.

Beyond Cosmetics: Entrepreneurs might ask what other female-focused products men could get value from, but are unlikely to search for in-store -- things like cuticle oil, face masks, and pore serums.

Hair products, specifically those tailored to beards, have soared on Amazon: Viking Revolution generates $517k+/month in revenue from a single beard wash and conditioner set, according to Jungle Scout.

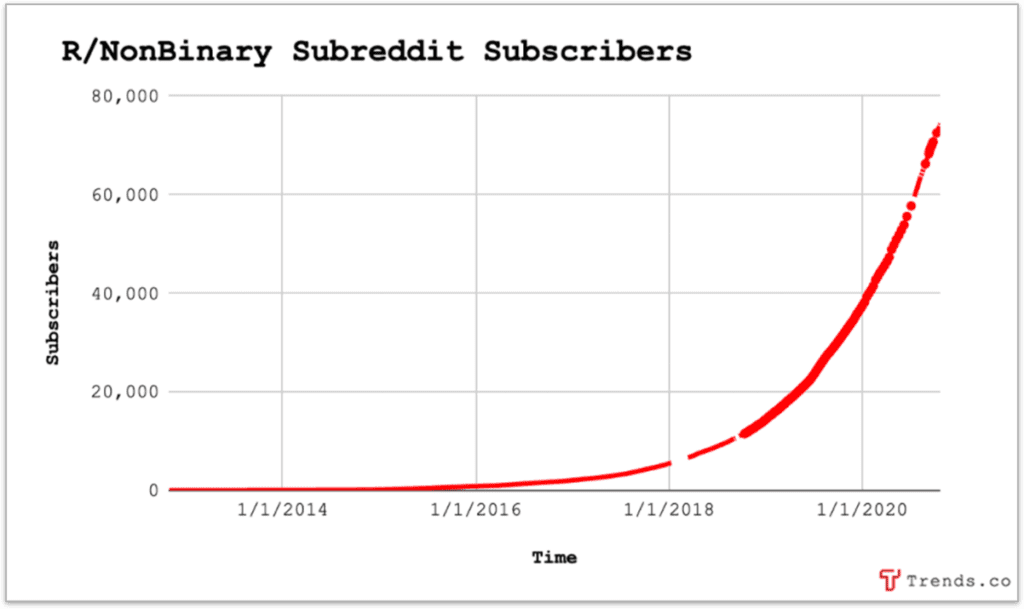

A Genderless Future: Calls for gender-neutral options have already shaken up the fashion and perfume industries; personal care is next in line.

Over ⅔ of Gen Z males are more interested in gender-neutral beauty products than those with traditional male packaging. In 2016, nearly 1 in 5 men wanted skin care products suited to their gender; now only 1 in 10 do.

Digital natives, led by the androgynous likes of Harry Styles and Jaden Smith, don’t want to be boxed in. And they are forecast to become the largest US consumer population by 2026.

Marketing strategies like that of War Paint are not going to cut it for this demographic. Entrepreneurs could develop gender-neutral skin care lines, cosmetics, and services in the space.

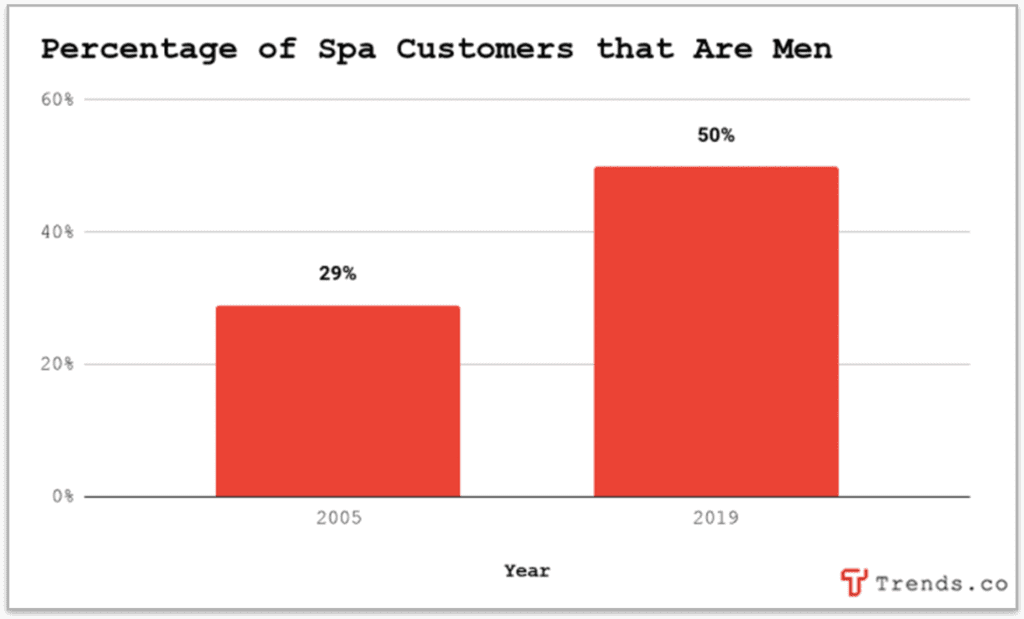

Services: Speaking of services, global male spa treatments were already worth $50.4B in 2018, and have soared to ~$60.7B this year -- a 20%+ increase. Google searches for “spa for men” currently sit at 22.2k/month, according to Keywords Everywhere.

Entrepreneurs could get behind the growing male-only spa trend (e.g., Hammer & Nails, and Golden Door).

You could also develop better male-focused marketing and services for unisex spas, which have seen an increase in male clientele despite their predominant marketing toward women.

The most popular men’s spa treatment is massage, but interest in beauty treatments is rising. Back acne is a common male concern; some spas have begun to offer “bacials” (back facials). Monthly Google search volumes for enticing treatment options:

- Waxing for men: 18.1k

- Facial for men: 12.1k

- Back facial: 4.4k

- Threading for men: 1.3k

Another attractive service opportunity is male makeup artists for weddings and other events (the idea for Stryx was born after founder Devir Kahan awoke with an unsightly pimple on his wedding day, and no solutions). The LGBT wedding industry we forecasted in February may also generate demand.

Leave a Comment