nlopchantamang.com

Financial Tools to Power the Creator Economy

Amy McMillen

Source: Harris Poll Survey

The Signal: Forget outer space, kids want to be stars -- 30% of kids want to be YouTubers when they grow up, almost 3x more than astronauts.

Earning income as content creators is now a reality for 50m+ people, nearly 3x more than in 2017.

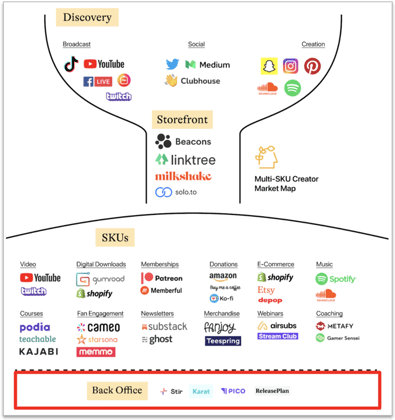

Creators were previously treated as individual entities monetizing from one platform (e.g., YouTubers, Instagrammers, TikTokers). Now, many of those individual creators have grown into full-fledged businesses, productizing and diversifying in numerous ways.

These are known as multi-SKU creators.

Entire ecosystems are emerging to support multi-SKU-creator businesses. In this Signal, we’ll look at the often-ignored back office of financial services for creators.

The Opportunity: BitClout, Clubhouse, and NFTs may be getting all the headlines, but as we reported in August 2020, fintech enablers are the next unicorns, with the industry expected to grow from ~$7.3B in 2018 to ~$43B by 2026.

When it comes to financial services for creators, opportunities include:

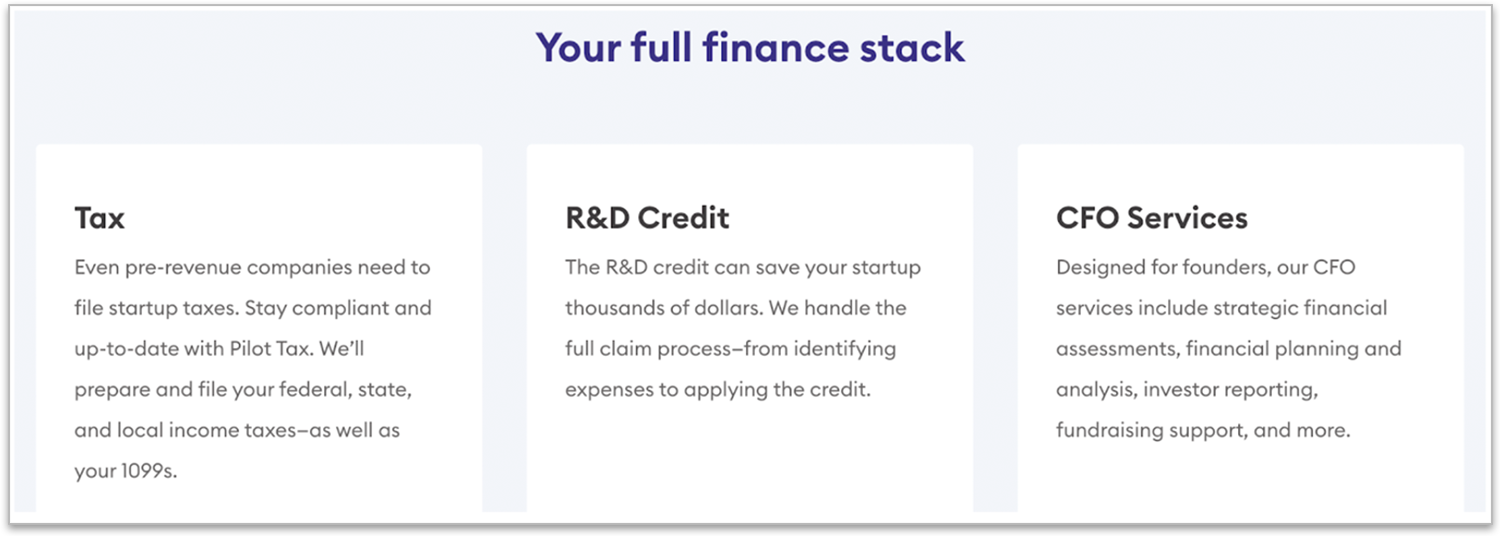

Accounting and Taxes: Full-time creators combine the individual nature of freelancers and the complexity of small businesses, establishing a need for a TurboTax or QuickBooks for creators.

Such tools could model bookkeeping software for startups. For example, Pilot caters to startups by offering services midsize companies often lack, like on-demand CFO services or help with claiming R&D tax credits.

Specific creator-centric features could incorporate the following:

- Collating tax policies across platforms (e.g., YouTube’s updates in reporting -- check out this video on tax tips for YouTubers with 25k+ views).

- Help with determining what counts as income sources, including product gifting, affiliate links, and more.

- Guidelines on what business expenses count as tax write-offs, including technology, trademark and copyright fees, and marketing costs.

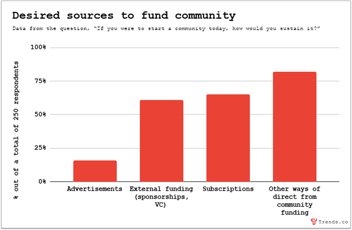

Income Share Agreements (ISAs): Two of the biggest roadblocks for creators are funding and education.

Enter Income Share Agreements, which offer funding for education that students pay back after they get a job.

A Lambda for creators has enormous revenue potential -- there are almost 2x as many creators as software developers worldwide, and YouTube alone has paid out $30B+ to creators over the last three years.

One existing ISA model is Podfund, which grants podcasters between $25k and $150k along with mentorship, community, and technology for growth. Creators retain 100% of ownership while sharing anywhere from 7-15% of income for 3-5 years.

Similar models could be applied across creator mediums, focusing on growth and scalability.

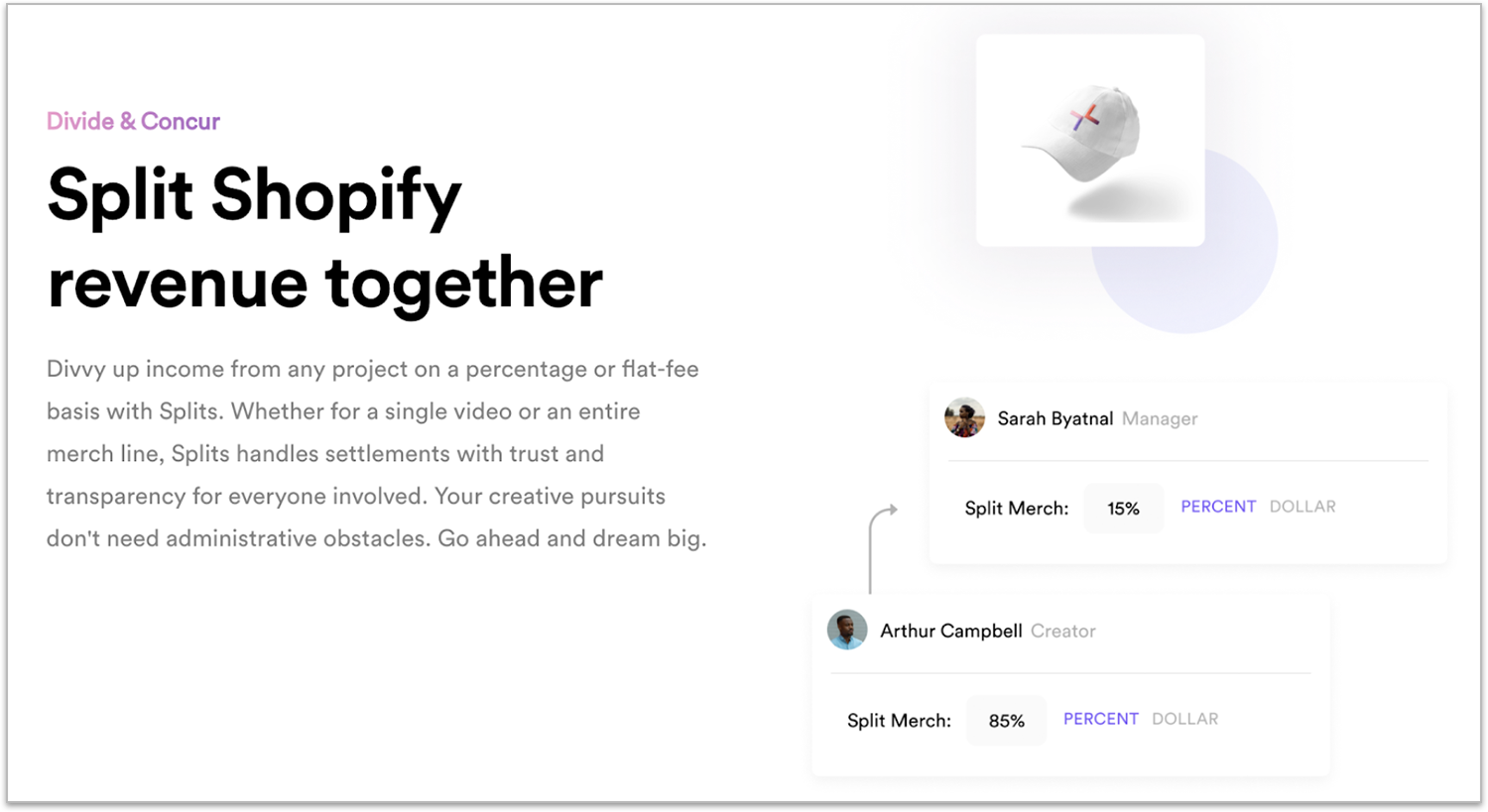

Revenue Sharing: The rise of creative collaborations (e.g., the Every bundle or The Audio Collective for Clubhouse) brings with it a whole host of financial questions around splitting earnings and/or ownership.

One startup solving for this is Stir, which is valued at $100m and about to raise a Series A led by Andreessen Horowitz.

Stir combines financial and audience data across platforms and collaborators, and easily splits revenue between YouTube, Shopify, Newsletters, Podcasts, and Twitch.

There’s still room to apply Stir’s revenue-sharing model to other creator platforms like TikTok, Instagram, and blogs.

Stir helps with revenue sharing but doesn’t address company equity, meaning there’s also an opportunity for a creator-first version of Carta.

Carta makes it easy for companies, investors, and workers to manage startup equity agreements. They've achieved $150m ARR and are valued at ~7B.

Leave a Comment