nlopchantamang.com

AutoZone Shows Why Repair Businesses Perform Well During Recessions

Trung Phan

The Signal: US stocks have gone through one of the wildest rides in recent weeks as the coronavirus pandemic has spread across the globe. At the bottom of the market, the S&P 500 officially entered bear market territory (a 20% index decline) for the first time in more than a decade.

Over this span, two of the worst-performing segments of the S&P 500 have been:

- Travel: Cruise liners (Carnival, Norwegian Cruise, Royal Carribean) and airlines (American Airlines, United, Delta, Alaska) have tumbled as the travel and tourism industry have abruptly shut down.

- Energy: A Saudi-initiated oil price war has shaken the oil and gas industry, with oil prices falling some 30%.

But two other sectors have (relatively speaking) weathered the storm better:

- Consumer Staples: Firms that provide basic consumer goods -- particularly items that are apt to be stockpiled -- have outperformed the market (e.g., Kroger, Campbell’s, Clorox, General Mills).

- Healthcare: A number of pharmaceutical companies (Gilead, Regeneron, Eli Lilly) that are searching for coronavirus treatments have also outperformed.

One other outperformer stands out: AutoZone. The Memphis-based company is America’s largest seller of aftermarket auto parts and accessories.

AutoZone performed well during the 2008-09 financial crisis and -- with the odds of a recession recently rising sharply -- we looked into the firm’s old financials to see how it was able to navigate the previous crisis.

According to the AutoZone’s 2009 annual report, its post-crisis performance was buoyed by the fact that consumers -- with tighter pockets -- were delaying new purchases and opting to repair and do maintenance on existing cars:

"During [2009] as the economy was challenged with higher unemployment, our product sales shifted noticeably to maintenance-related categories and away from more discretionary purchases. As purchasing behaviors changed, we focused our marketing efforts on helping customers properly maintain their vehicles….[including] late-model parts coverage."

The Opportunity: In the event of another recession, it is highly likely that consumers will shift from new purchases (especially big-ticket items) to repairs and maintenance.

The opportunity around this change in consumer behavior is predominately in three buckets: 1) supplying parts and tools for DIY repairs; 2) offering repair services; 3) creating repair video content.

Aside from auto parts, other big retailers provide replacements for appliances, lawn and garden tools, HVAC and related home parts. They include Repair Clinic ($57m revenue), PartSelect ($24m), AppliancePartsPro ($44m), Parts Inc. ($21m), and Marcone ($150m). And, of course, Amazon has over 100k items in its "replacement parts store."

Based on reviews for the replacement part companies, there seems to be a major need for accurate parts listings. Reviews for Repair Clinic on a third-party review website express frustration with parts on offer and delivery times, which suggests that a localized option in large markets may be worthwhile.

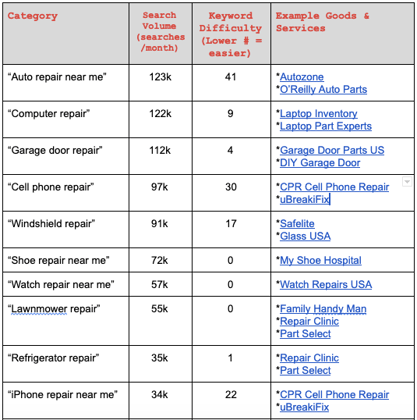

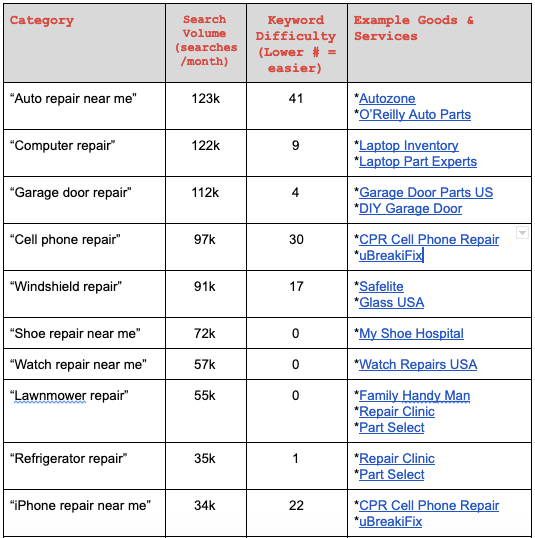

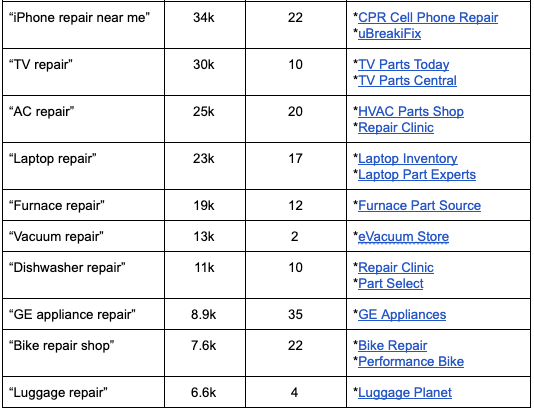

With major disruptions in existing supply chains, there is a clear opportunity to source and bring relevant parts to market: Using Ahref’s search data, we identified the following categories that may see increasing demand for repair services during a recession.

Leave a Comment