nlopchantamang.com

The Menopause Moonshot: Opportunities in an Underfunded Industry Garnering VC Attention

Aja Frost @ajavuu

Signal: The women’s health and femtech space has boomed in recent years. Femtech alone is projected to grow by 16.3% per year from $17B in 2018 to $50B in 2025. Previously taboo topics like menstruation, fertility, and female sexual health and pleasure have hit the mainstream, and institutional money has followed. Last year, femtech had its first billion-dollar year of VC funding.

There is one category in women’s health that has been underserved and underfunded historically: menopause.

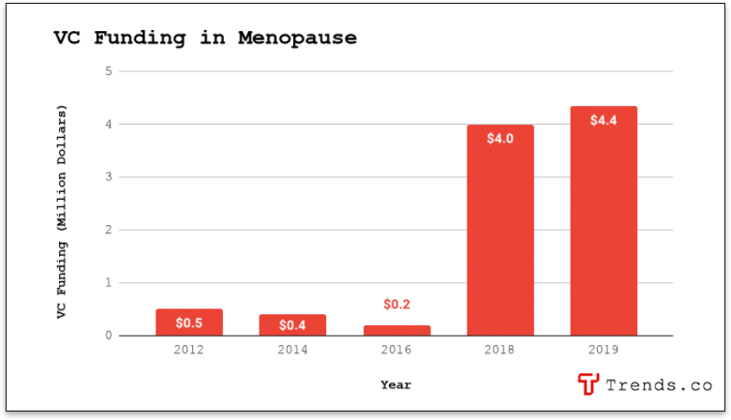

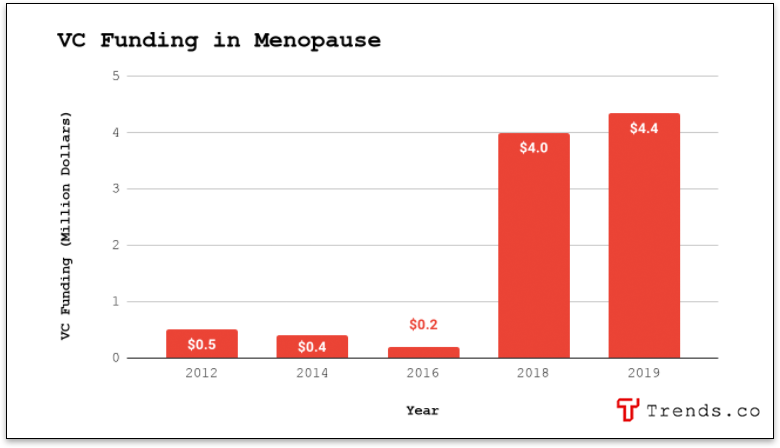

But the tide is changing, and VC money is finally starting to notice that billion-dollar opportunity as well. The hot flashes market alone -- which services just one symptom of menopause -- is expected to be worth $5.3B by 2023. Some notable investments in the last 2 years include:

- Gennev ($4m): A telemedicine service provider for women experiencing menopause

- Madorra ($4m): Created the first hormone-free medical device to treat vaginal dryness for postmenopausal women

- MenoLabs ($350k): Produces natural prebiotic and probiotic supplements for women going through perimenopause and menopause

Menopause, and menopause tech in particular, is poised to become “the next big opportunity in femtech.” There are 3 underlying trends driving this movement:

- A large market...: There will be over 1B women in the world experiencing menopause by 2025. This represents 12% of the world’s global population.

- ...with high spending power: Women in almost every age group consistently spend more than men on healthcare. Women over 50 in particular account for 27% of all consumer spending -- 3% more than men of the same age. These “super consumers” have been described as “the healthiest, wealthiest, and most active generation in history.”

- ...that is tech-savvy: Most women who are in their late 40s and approaching menopause are used to managing their lives digitally. More than that, women are 75% more likely to use digital tools for healthcare than men.

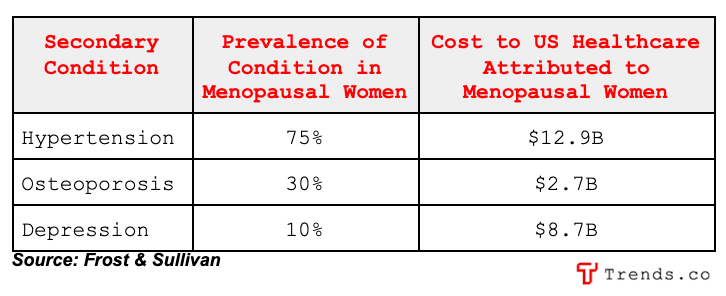

The Opportunity: Historically, menopause treatment has been limited to hormone replacement therapy (HRT) and low-tech cooling sprays. But the symptoms and secondary conditions of menopause are wide-ranging and are a significant burden on the American healthcare system:

Telehealth: Safe to say that by now we are all convinced of the massive potential of telehealth (virtual urgent care appointments have increased by more than 600% since the pandemic). Opportunities abound for companies that tailor their virtual offering to women experiencing symptoms of menopause. A service offering could include diagnostics, prescriptions, education, support, and personalized treatment plans.

There are only a handful of companies in this space at the moment, including Elektra Health, CurieMD, and Gennev. Given the size of the opportunity, there is plenty of room for other challengers to emerge.

Devices and Wearables: Cooling wristbands such as the Embr Wave (and the Grace bracelet, which is still in development) will set you back $300 a piece -- almost as much as an Apple Watch Series 3. Women are also buying other hot-flash-relief devices such as the Moona thermoregulating pillow for $400.

The popularity of search terms such as “Embr Wave reviews” (5.4k searches/month) and “hot flash relief” (2.4k searches/month), coupled with consumer willingness to pay hundreds of dollars per device, signals that there are opportunities for other DTC brands to enter the menopause device market. Lightweight, portable cooling devices and accessories based on certain behaviors/occasions (such as this one for exercising) could be one place to start.

An advantage of products like these is that they are not limited to menopausal women. The Moona pillow, for example, is positioned as a product to help anyone who struggles to sleep as a result of temperature changes. It was only during product testing that the company noticed that the pillow was popular with women experiencing menopause. This niche is an interesting target market with which to build brand loyalty and awareness before branching out.

Support and Communities: Menopause can be a socially isolating time for women. A 2017 survey found that 33% of menopausal women feel less outgoing in social situations and 23% feel socially isolated. Despite this, there are only a handful of online communities and social networks for women experiencing menopause.

London-based Peanut is an app that began as a tool for finding new mom friends that has evolved into a female-focused social network with 1.6m users. Last month, the company raised $12m on the heels of significant growth in online social networking spurred by COVID. Peanut recently announced plans to launch a new community focused on the “untapped” menopause market.

There are opportunities for others to enter the fray to provide community and support for menopausal women -- a social networking app like Peanut for the American market is an obvious one. An app that is more regionally focused could also facilitate meetups, match-making, and support groups (virtual or in-person).

Leave a Comment