nlopchantamang.com

It’s Raining Rabbits and Reptiles

Aja Frost @ajavuu

The Signal: When it comes to furry friends and pet ownership, it’s dogs and cats galore. But there’s a growing population of underrepresented and underserved home pets: small animals.

Small animal subreddit growth is being driven by increased adoption by US households. Ownership of fish (remember the rising at-home aquarium trend we reported on last year?), birds, rabbits, reptiles, and other small animals (think iguanas, ferrets, hamsters, and gerbils) has skyrocketed from 2012 to 2020:

- Fish: 7.2m households → 13.1m households (↑82%)

- Birds: 4.6m → 5.7m (↑24%)

- Reptiles: 1.8m → 4.5m (↑150%)

The Big Picture: The notoriously recession-proof pet industry has more than doubled in the last 10 years from $48.35B in 2010 to $99B in 2020.

Even more impressive is the fact that the industry hasn’t seen a single year of negative growth since 1995 (pet-care spending actually grew by 29% during the 2001 recession and 17% during the 2008 financial crisis).

The number of pet-owning households only grew 17% from 2012 to 2020, which means that pet parents are spending (way) more on their fur babies.

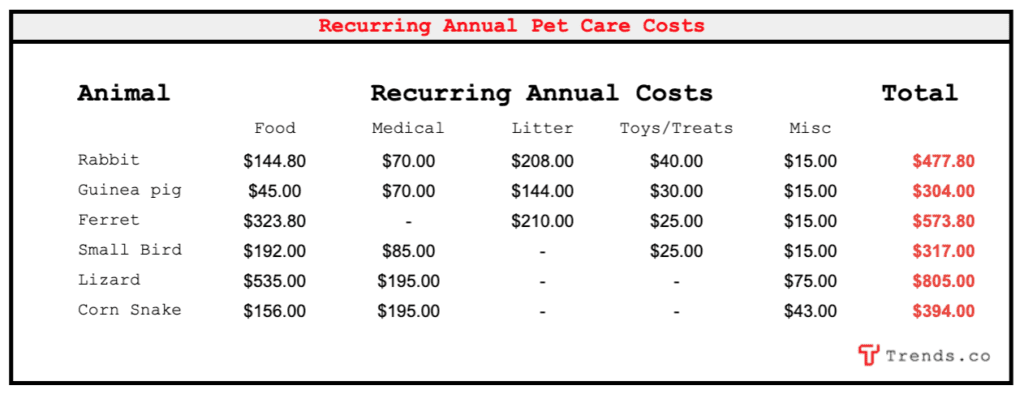

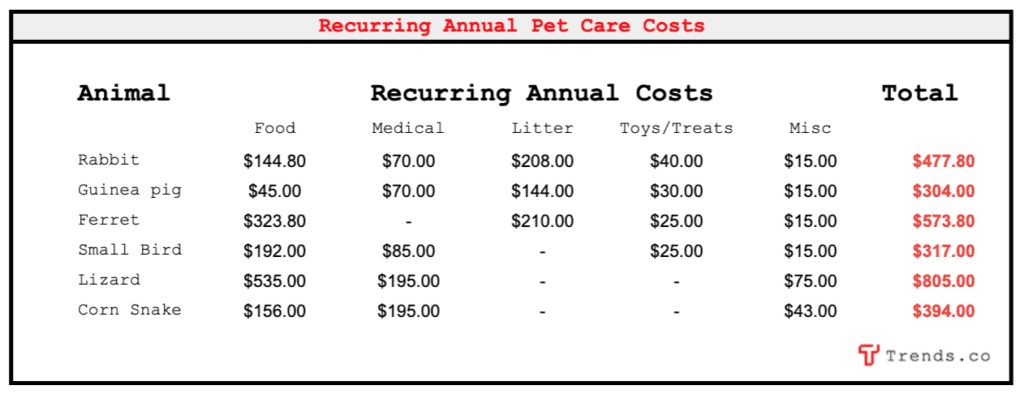

That spending is not limited to Fido and Fluffy. Small animals and reptiles get their fair share, too. In fact, lizard owners spend ~$800/year, which is the same as cat owners ($809), and more than small dog owners ($737).

Assuming an average annual cost of $600/reptile, $450/small animal, and $300/bird, we’re looking at 3 billion-dollar industries in the US ($5.6B, $6.3B, and $6B respectively). These numbers don’t include upfront costs (e.g., cages, lights, feeding bowls), which are as high as $400 for a lizard.

The Opportunities: There are opportunities to provide products and services to small animal owners, who represent an overlooked and underserved multibillion-dollar industry.

Health Care: Pet medication is an ~$8.6B industry in the US, and vet care is still one of the highest costs associated with pet ownership. It ranges from 15% of annual costs for rabbits to as much as 50% in the case of corn snakes.

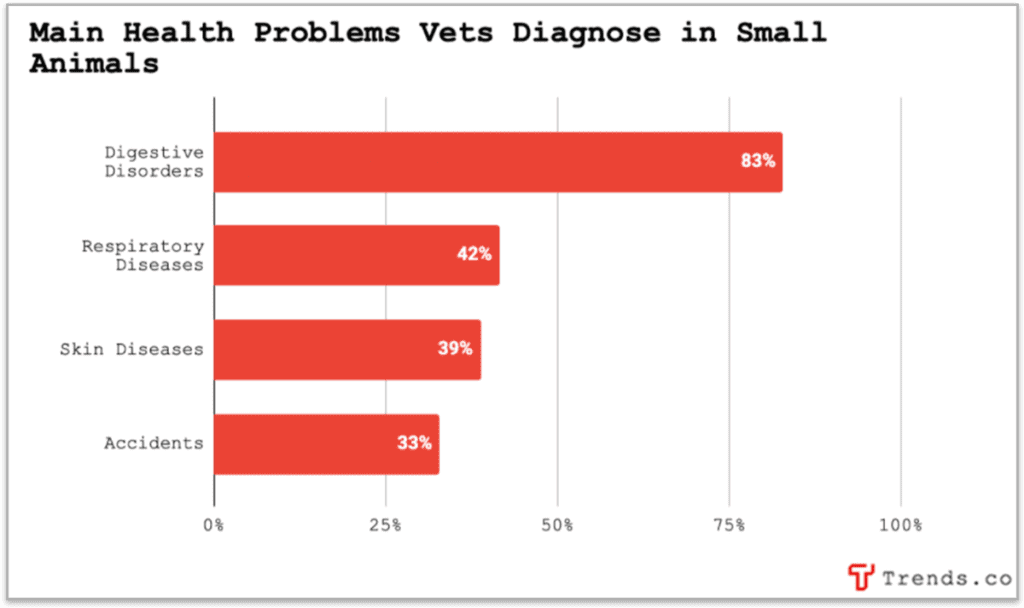

Small animal vet care (exotic or avian vets) can be even more costly because of the specialized knowledge required and lack of geographic availability. Routine and acute wellness is not a readily available category for small pet owners.

There’s an opportunity to bridge this gap by offering on-demand telehealth to small, exotic, and avian animal owners, much like telehealth is now growing for standard veterinary practices.

Pawp, for example, is a $19/month subscription model that combines pet insurance and telemedicine to deliver on-demand care for dogs that’s raised $3m. A similar model could be reproduced for small animal care.

Care Education: According to a survey of vets who treat exotic animals, one of the main reasons that owners visit the vet is to get advice on keeping and feeding their animals.

YouTube videos about small and exotic animal care have hundreds of thousands of views, such as this one on ferret care (114k+ views), this one on what to feed a hamster (353k+), and this one on safe foods for guinea pigs (467k views).

There is clearly demand for content (videos, newsletters, tutorials, and virtual or in-person courses) on how to care for small and exotic animals.

Kid-friendly content is especially important since owners of fish, reptiles, and small animals are much more likely to have children under the age of 18 in their households compared with pet owners who have cats and dogs exclusively (57% vs. 34%). In the case of hamsters, the proportion is as high as ~90%.

Personalized Subscription Food: The largest category spent in pet expenditures is food. A number of companies have started offering personalized fresh food for dogs, allowing owners to create a blend specific to their pet.

Meals are allergen, age, breed, and health-complaint specific. The entire process takes place online -- starting with a survey about your beloved pet’s specifics and ending with door-to-door delivery.

The fresh pet food industry, which is expected to accelerate at a CAGR of 24% over 2019 to 2023, attracted serious institutional money in 2020:

- PetPlate: $9m in February

- Ollie: $29.3m in March

- Spot & Tango: $4.2m in April

- Smalls: $9m in August

There is an opportunity to provide the same personalized fresh food experience to the world of small pets.

Exotic pets are known to be much harder to care for than dogs and cats because of their specific nutrient needs. Taking nutrient needs and unbundled food supplies, reptiles alone could be a $1.8B/year market (assuming an average of $450/year on food).

Niche, Quality Goods: Niche and specialized brands for specific small animal categories is a great way to enter the market since large generalists (Petco, PetSmart, etc.) can’t capture the market in the same way niche brands can.

TJs Chinchilla Supplies, ranked No. 4 on Google for “chinchilla supplies,” looks like the site hasn't been updated in 2 decades (no offense, TJ).

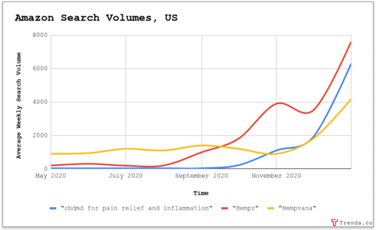

There’s opportunities in an animal category like rabbits, guinea pigs, or even specific breeds such as parakeets, to rank high quickly and capture a niche. According to AMZScout, “rabbit toys” has a low visibility score (1) compared with a high demand score (7).

Leave a Comment