nlopchantamang.com

Fitbits for Pigs: New IoT Opportunities in Animal Tech

Aja Frost @ajavuu

Source: Microsoft Dynamics 2019 Manufacturing Trends Report

Signal: The average cost of an IoT sensor has decreased dramatically in recent years. From 2012 to 2020, the average cost almost halved from $0.70 to $0.38. Not only have sensors become less expensive, but also they are a lot smaller and more powerful.

With these changes, the adoption of IoT sensors and devices more generally is set to explode as use cases emerge in low-margin industries. There’s one industry niche in particular that has caught our eye. The industry: agriculture. The niche: livestock tech.

Background: Livestock tech leverages robotics, artificial intelligence, IoT, machine learning, and other disruptive innovations to help farmers monitor the health of their herds in real time, optimize nutrition, prevent disease outbreaks, and improve efficiency by reducing labor time and costs.

Historically, tech adoption in livestock agriculture is highest among dairy farmers, who make ~$600 in milk production per cow per year. At this rate, farmers are willing to spend between $25 and $100 on tech per cow, according to David Hunt, founder of animal tech startup Cainthus. A few other players in beef and dairy farming wearables, many of which are based in Europe, are Cowlar, Moocall, CowManager, and Connecterra.

But in less-value-per-animal systems like pigs, where farmer profits typically range from $100 to $500, one Fitbit-like device per animal was simply not an option. Until now.

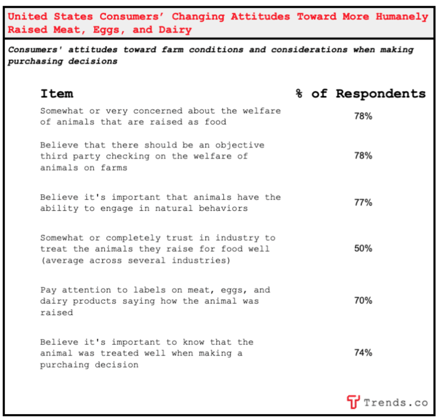

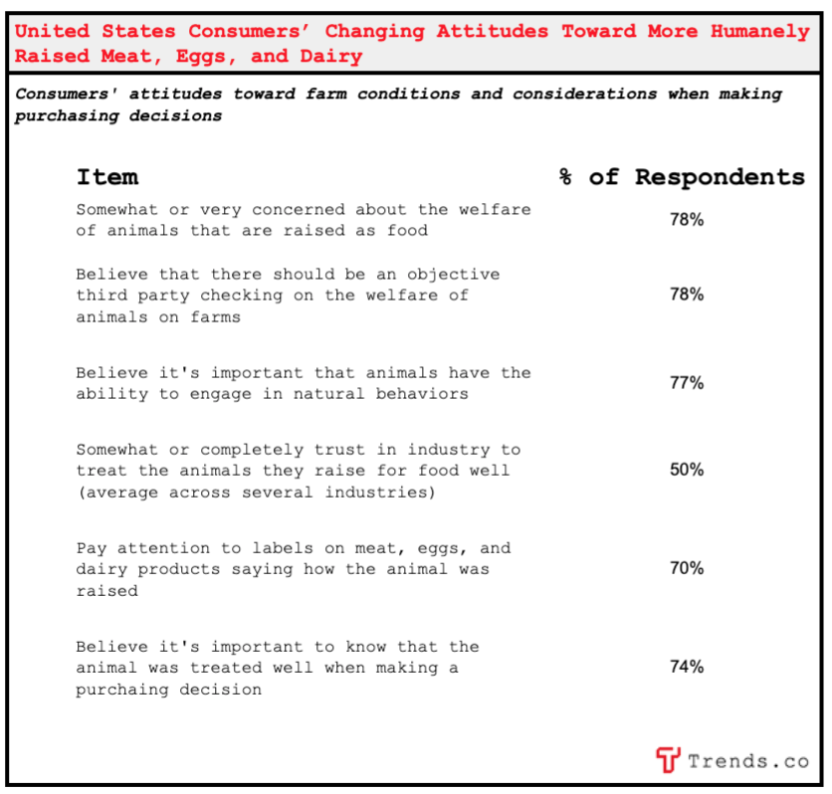

Big Picture: Despite a recent surge in vegetarianism and the development of meat alternatives and synthetic meats, meat production and consumption is predicted to grow in years to come. However, meat eaters are increasingly concerned about the humane treatment of livestock, and this concern affects their purchasing decisions.

Concern for animal welfare and food safety and hygiene will only be heightened by the coronavirus crisis, since 70% of new diseases infecting humans in recent decades, including SARS and COVID-19, are believed to have come from animals -- according to the UN.

The Opportunity: The livestock industry in the US was worth a combined ~$113B in 2017, and is made up of cattle ($50.2B), poultry ($42.6B), hogs and pigs ($19.2B), and sheep and goats ($844m). Add another $38B to that number for milk from dairy cows.

The livestock monitoring market that serves this massive industry includes hardware, software, and services, and is expected to grow at a compound annual growth rate (CAGR) of 10.9% from $1.5B in 2020 to $2.5B in 2025. The largest piece of the pie belongs to hardware, given the increasing adoption of devices, such as wearables, on livestock farms.

In addition to behavioral and medical monitoring, livestock wearables can be used to solve for specific pain points in different sectors.

We spoke to Matthew Rooda, founder and CEO of the award-winning startup SwineTech, which created Fitbit-style devices designed to reduce the incidence of piglet deaths. According to Rooda, 15% of all piglets die within 21 days of being born. Of those, 60% -- about 160m pigs worldwide -- die as a result of being crushed by their mother.

SwineTech’s product, which costs $1,000 and has a payback period of 1 year, successfully leverages audio and behavioral algorithms and wearable devices to detect crushing incidents and reduce them by ~30%.

When we asked Rooda where he sees the opportunity in the space, he mentioned 2 things:

- Using wearables to tell a story: Particularly for smaller producers, there is a need to differentiate their produce. Wearables help farmers to “market [their product] like craft beer,” by telling a story about the animals and how they lived. There are opportunities for services to emerge that interpret the data collected by wearables to signal product quality to consumers and create a marketing story for smaller producers.

- Traceability: In a related topic, Rooda sees opportunities for startups to use wearables and other technology to increase transparency throughout livestock supply chains. New levels of traceability on all kinds of supply chains, from honey to diamonds, is now possible thanks to blockchain technology. Livestock wearable technology creates a unique opportunity to connect data from farms to the blockchain to enhance transparency. One company already doing this is GoGo Chicken in China, which leverages GPS tracking and facial recognition in combination with blockchain technology to track and record the lives of free-range chickens. Consumers are able to track a chicken’s movements, view its profile and photos, and even see what food it had been eating.

Leave a Comment