nlopchantamang.com

Could the LTSE replace the SPX or DOW? IDK.

Aja Frost @ajavuu

The Signal: Just a few months ago, the stock market was flying high, Wall Street revolved around quarterly earnings reports, and the concept of universal basic income was hypothetical (i.e., could a society thrive with UBI?). Now we’re becoming accustomed to wild swings in the market while millions of people are losing their jobs, scores of companies are pulling back earnings guidance, and the Federal Reserve has started buying non-investment grade assets (making WeWork’s community-adjusted EBITDA look reasonable).

In other words, anything is possible.

(By the way, if this stuff interests you, you may want to check out the 60+ slide deck we sent out last week. We’re constantly updating it with advice on how to navigate a post-COVID-19 world.)

The Opportunity: Although this pandemic is unprecedented, it gives space for untraditional ideas to surface.

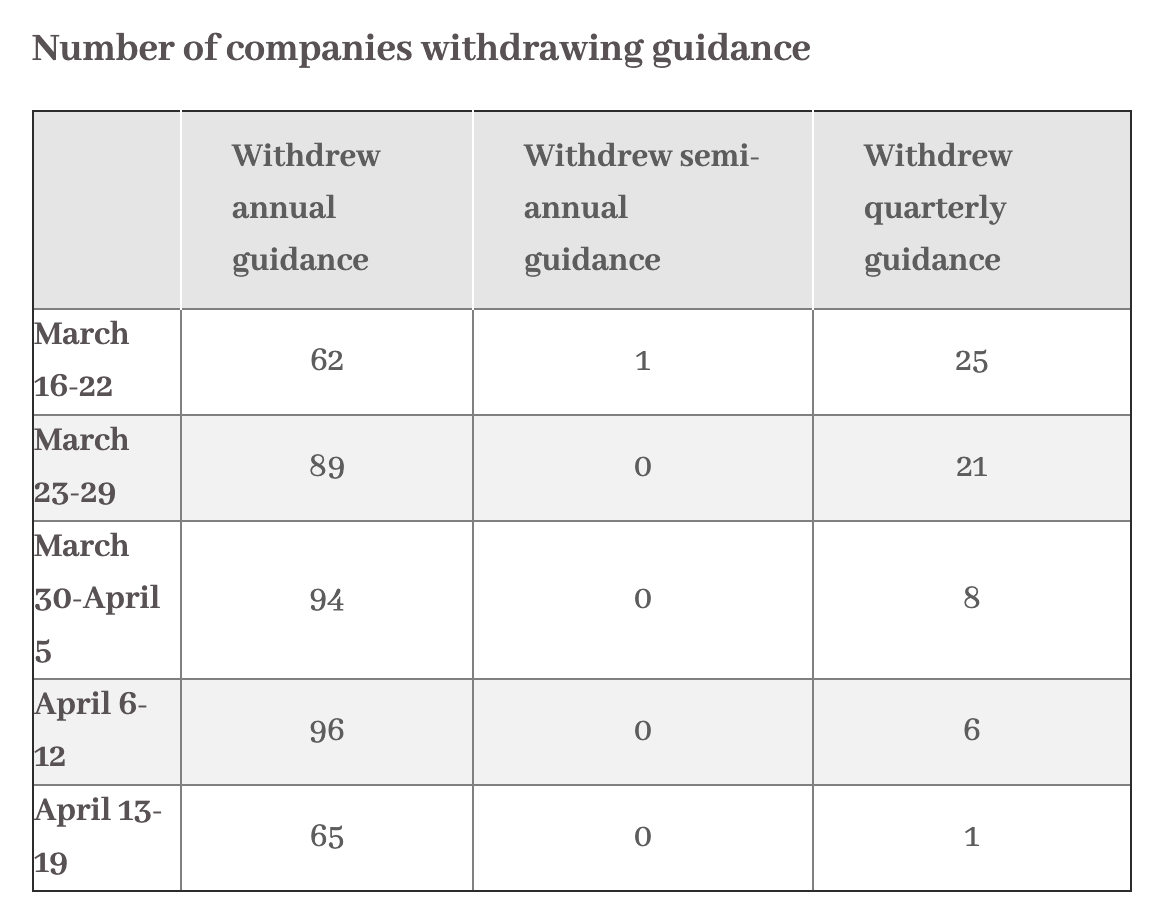

The long opportunity: Nearly every day in April, more companies have withdrawn earnings guidance, while others have cut their dividends to help stay solvent. Companies like Verizon, Uber, Bed Bath & Beyond, Jack in the Box, Abbott, GoPro, and IBM are just a few of the many that have decided that 2020 is just too unpredictable to issue regular guidance to shareholders. Even companies that have hit recent all-time market highs (Dominos, anyone?) are withdrawing guidance.

One earnings analyst, John Butters, estimates that only 40% of S&P 500 companies will report profits. According to INR magazine, over 400 companies have withdrawn annual guidance, with another 46 withdrawing quarterly guidance. At least 73 companies have suspended their dividends.

Warren Buffett, one of the most prominent investors of our time, and Jamie Dimon, the respected JPMorgan Chase CEO, have been pushing companies for years to stop issuing quarterly earnings guidance. The reasoning is simple: If companies allow themselves to be judged so closely every 3 months, they might allow their long-term goals to be overshadowed by short-term efforts like sending a push notification to increase active users before a quarter end. (Yes, this stuff happens…)

Some companies like Google have managed to balance both the short and the long by implementing policies like their 20% time rule, encouraging employees to spend 20% of their week outside of their core responsibilities. The result? Gmail, Google Maps, AdSense, and Google News, to name a few. But what about the loads of other public companies that have to please their shareholders next quarter, and the next, and the next...?

All these uncertainties have helped an idea like the Long-Term Stock Exchange (LTSE) take off. Founded by Eric Ries, author of the The Lean Startup, the LTSE describes itself as "a network of institutional investors and companies that share our mission of empowering long-term-focused thinking."

The concept is simple: an exchange already approved by the SEC with a long-term outlook. In this model, the longest-tenured asset holders get the largest voting power, incentivizing investors to stay around for the long haul.

The LTSE fits nicely with the new wave of non-traditional VC brands, which spend less time looking for breakout unicorns and more time trying to find long-term profitable businesses. And its execs have Wall Street cred: The exchange’s CEO and VP of operations, Zoran Perkov, was previously the VP of global operations at NASDAQ.

The Long-Term Pitchbook (LTP): If you can’t create a long-term exchange of your own, there are other long-term investment avenues to explore. For example, you could create a product focused solely on analyzing public companies’ quarterly and annual financial reports to quantify their R&D expenditure, patent disclosures, and other long-term bets. The long-term Pitchbook, per se. Or you could create a social network matching entrepreneurs and investors with the same long-term approach.

The Long-Term Education Exchange (LTEE): Just as companies focus on the earnings they need this quarter to ensure a thriving stock, people often are focused on the skills that they need right now that will get them hired today. There is nothing wrong with the former or latter, but you can imagine a similar education model that incentivizes people to learn skills that will pay personal dividends long into the future (hence, LTEE).

Also, as high-quality online education becomes a commodity, people may seek ways to differentiate the "best" from the rest. For instance, what will the online equivalent of Harvard be? One possibility: A long-term incentive program that rewards people who continuously upskill. In other words, a person with a 4-year degree may be less valuable than a person with 4 1-year degrees.

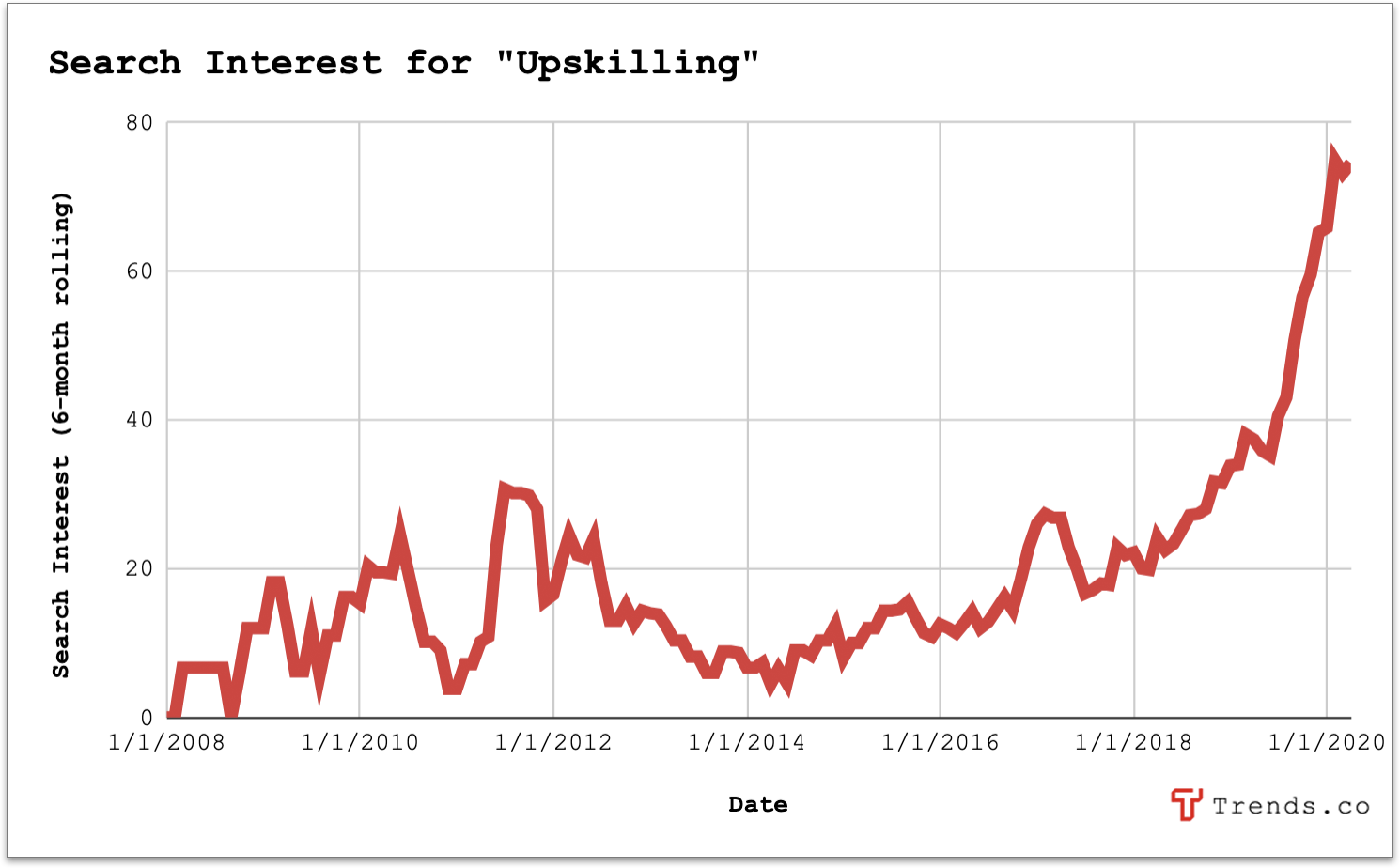

Unsurprisingly, upskilling was a term that seemed to emerge around 2008, amid the peak of the last financial crisis. Upskilling becomes more important during economic downturns, as many people are looking for new streams of income.

That’s never more important than now, as more than 30m people have filed for unemployment in recent weeks. There is reason to believe that the same need will be true during this downturn. Products that help both companies and individuals upskill will be as recession-proof as any.

Leave a Comment