nlopchantamang.com

Carbon Limit Credit Cards

Ethan Brooks

The Signal: DOconomy, a fintech startup in Sweden, is introducing a new kind of credit card. Rather than a monthly dollar limit, this card will limit purchases based on the combined carbon footprint of the things you buy. The card, named DO Black, is designed to help eco-conscious consumers cut their carbon footprint in half by 2030.

Why it’s a Big Deal: Up to now, there’s been one major factor determining how companies do business: cost. Whether it’s cost of production, or cost to the consumer, dollars and cents drive action. Good environmental intentions often hold little sway when stacked against cost considerations.

By turning environmental impact into a second currency (and using it to limit purchases), DOconomy stands to change the incentive structure for businesses. Even inexpensive products with a high carbon footprint would be less "affordable," since they quickly deplete a buyer’s carbon limit.

Already, some companies are positioning themselves to thrive in this reality. Allbirds, for example, is developing a carbon-neutral shoe. Patagonia is cutting up to 80% of their materials’ carbon footprint by switching to recycled fibers. Even boutique vintners like Benevolent Neglect and Belong Wine Co. are certified carbon neutral.

170m Americans held credit cards in 2018 (many held several), with $4.3T in credit extended. If carbon-limit cards eventually captured just .1% of that market (170k people), they could represent $4.3B in buying power.

That economic muscle could cause serious shifts in the consumer economy, creating interesting opportunities for:

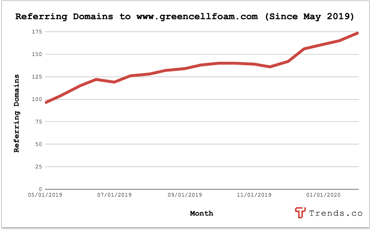

Marketplaces: Since the carbon price of a product isn’t yet listed on the package, consumers may want to know what their best options are before buying. One idea for builders: Create a website that curates low-carbon-footprint versions of everyday household products.

Carbon Offsets for the Common Class: If visibility into carbon costs leads consumers to change their buying habits, small- to medium-sized business owners may need simple carbon offset solutions to keep their products "affordable."

Products like venture-backed Patch, which offers an API that allows small businesses to automatically calculate and purchase carbon offsets, may be in higher demand.

Consumers may also want an easy way to offset their purchases themselves, either to "pay down" the carbon limit on their credit card, or simply to feel better about their impact on the planet.

DO it Yourself: DOconomy is not really a credit card company. They’re a data company that happens to offer a credit card. Their main product, the Åland Index, tracks the environmental cost of consumer purchases.

If you had the banking connections, and wanted to replicate their idea, you could simply pay for access to the Åland Index API, and use it to launch a carbon-limit credit card of your own.

The New Personalization: Aside from CO2 production, consumer industries also drive problems like water pollution, deforestation, human and animal suffering, and more -- each with a dedicated following of activists fighting for a change. Using ESG data from companies like Akadia, you could produce other budgeting apps, credit cards, or product marketplaces designed to help concerned consumers put an end to the problems they care about.

Leave a Comment