nlopchantamang.com

$32m for Niche Last Mile Delivery Business Model

Ethan Brooks

Source: VC News Daily

The Signal: A mail delivery startup called Fetch landed $18m in Series B funding recently to address a surprisingly lucrative challenge: delivering packages to apartments.

Fetch is the world’s 1st last-mile delivery company focused exclusively on managing packages for apartment buildings. Rather than being piled in the leasing office, residents’ parcels are dropped at a Fetch warehouse, a notification goes out, and recipients use the Fetch app to schedule a drop-off at their door from one of Fetch’s drivers.

Their funding -- $32m in total so far -- coupled with trends in ecommerce and package delivery, suggest that this is a large and valuable market for those who can get the logistics right.

Background: Parcel management can be expensive for apartment complexes. Packages are often dropped at a central hub like the leasing office, where the staff must then organize and stow shipments, notify individual residents, and avoid losing or damaging anything, all in addition to their main job of managing the property.

According to Fetch’s ROI calculator, an apartment complex with 100 units could spend as much as 2 hours of employee time per day managing packages -- time not spent showing apartments, collecting rents, and tending to tenant relationships -- costing property owners thousands.

All of this was before COVID-19 boosted ecommerce 55% YoY, while straining supply and delivery lines. Fetch has seen a 497% YoY increase in the number of apartments it serves, and a 59% surge in package volume per home in the months since lockdowns began.

Opportunity: The trend in ecommerce is unlikely to reverse (case in point: 11% of Americans signed up for Walmart Plus in its first 2 weeks) meaning that opportunities in this space will continue to expand, including:

Direct Competition: In a recent press release, Fetch was called the “first and only off-site package solution for apartment communities.” But if the market is as promising as it appears to be, someone is going to have to give Fetch a run for their money. Just 4 years in, they already serve ~120k individual apartment units, and are on track for $20m in run-rate by the end of 2020, up from ~5k units and ~$1m ARR in 2018.

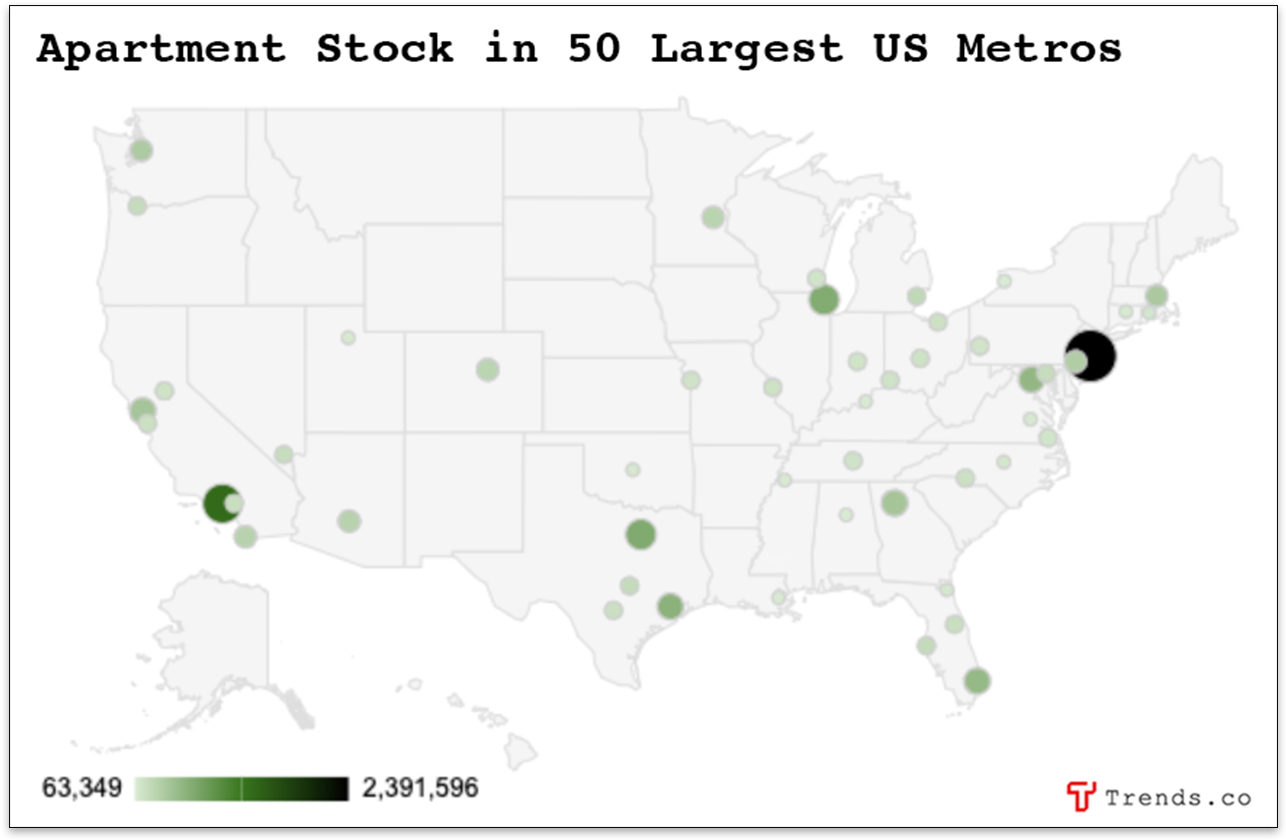

With recent data from the National Multifamily Housing Council (NMHC) reporting 21.4m apartment units in the US alone, there’s still plenty of room for new entrants in this market. The only real question is where to launch.

Source: National Multifamily Housing Council

Fetch says it operates in 15 metro areas: Atlanta, Austin, Charlotte, Chicago, Dallas, DC, Denver, Houston, Jacksonville, Orlando, Phoenix, Portland, San Antonio, Seattle, and Tampa.

Data from NMHC shows a total of ~5.3m apartment units between those cities, meaning that with ~120k units, Fetch has reached ~2% penetration so far. One option would be to launch a competitor in one or more of these cities.

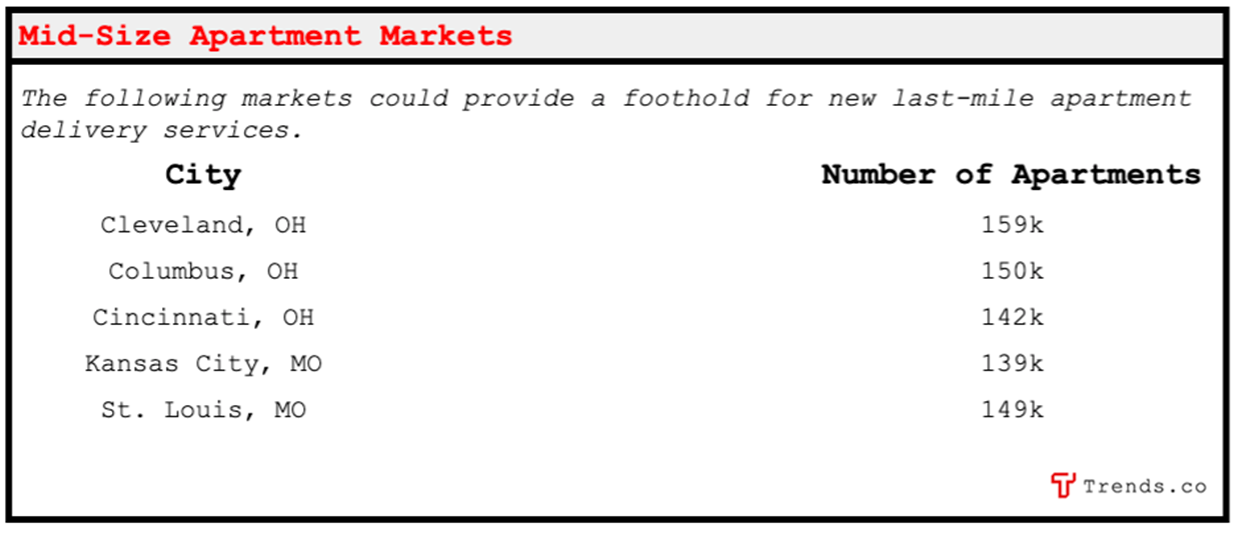

Fetch has also paused expansion into other markets, meaning new entrants have an opportunity to gain a foothold elsewhere in the US.

Source: National Multifamily Housing Council

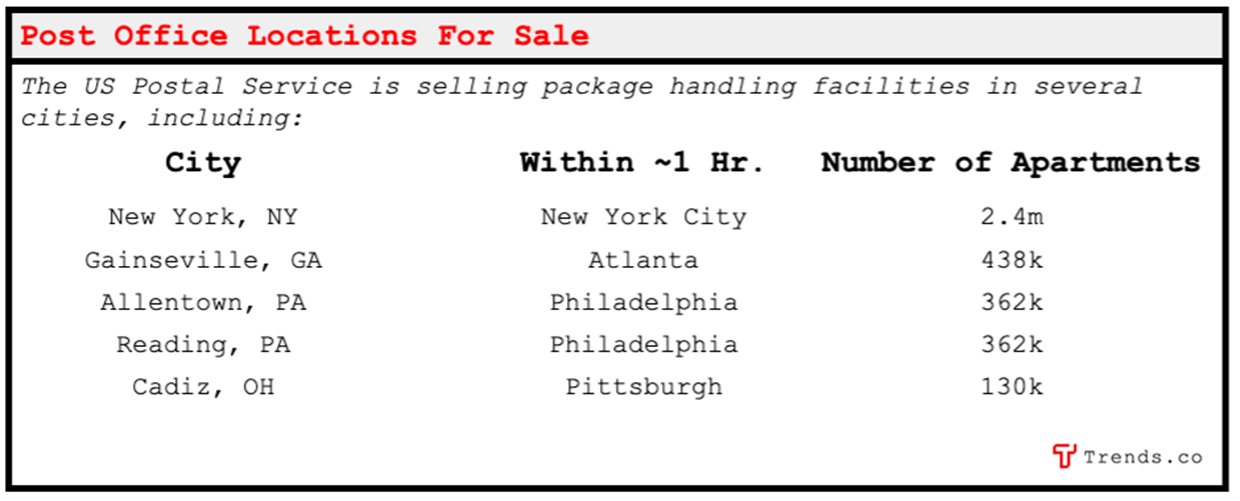

Fetch doesn’t currently serve several of the cities with the most apartment stock (NYC, LA, Miami, SF, Boston) perhaps due to the difficulty of finding warehouse space to store parcels. But the US Postal Service maintains a list of hundreds of properties for lease or sale, and is currently selling several post offices near large metro areas with lots of apartment units.

Source: USPS Property Search

NMHC’s list of the 50 Largest Apartment Owners offers insight into some of the country’s largest potential clients.

Direct to Resident: Fetch specifically targets apartment property managers with the promise of saving them time and money. But there could be an opportunity to target individual renters as well. Outside of the US, there are several markets where mail delivery is frustratingly unreliable.

In Germany, for example, rather than leaving a package at the door, it’s common for drivers to drop a person’s parcel at a (sometimes-faraway) neighbor’s house or even a local shop, with little or no notice to the recipient. Nightmare stories are common, and residents in these areas may readily pay a subscription to a service that will accept their orders reliably and schedule a convenient in-person delivery on their terms.

Other Communities: Fetch wisely focused exclusively on a single type of client: apartment communities. But there are other types of niche communities that handle mail for tenants and could benefit from a service like this -- especially during the pandemic, when sending people to a centralized mail room is frowned upon.

Examples include offices and coworking spaces, college campuses, and even extended-stay hotel chains that cater to professionals on the move, like Hilton’s Homewood Suites or Home2.

Leave a Comment