Contents:

How 6 Businesses Managed a Coronavirus Pivot |

Last week, we profiled the business impact that coronavirus is having on 6 of our Trends community members. The mini case studies covered the marketing, events, cleaning, beauty, manufacturing, and newsletters industries.

This week, we followed up with 6 more readers across completely different industries to see how their businesses are coping:

- Restaurant: Fusian — a fast-casual sushi chain based in Ohio — has pivoted to grocery delivery amidst mandatory restaurant closures.

- Furniture: Deskmate — a London-based portable standing desk company — is sourcing new suppliers to meet rising demand for its product as people are forced to WFH.

- Printing: Everest Direct Mail and Marketing — a print shop that offers integrated direct mail marketing services — is trimming operational expenses, shifting future investments, and “collaborating down the line” with suppliers to help weather the storm.

- Catering: Topnotch Events — a catering and staffing company based in New York City — has seen business completely dry up and decided to make a hard coronavirus pivot towards a longtime passion: teaching theatre to kids.

- Pets: Pets in the City — a pet care company based in West Los Angeles — is adjusting to social distancing measures by experimenting with virtual dog training and digital content.

- Microbrewery: Gloucester Brewing Company — a small-town microbrewery specializing in ales — closed their taproom and switched to crowler and growler fill.

10 Minute Read

* * *

One Restaurateur Has a Pitch: To Stay Afloat, Become a Grocer

The business: Fusian, a fast-casual sushi chain based in Ohio

We Talked to 30+ Companies About Their Strategies for Coping with Coronavirus. Here Are Their Stories. | Trends by The Hustle

On March 12, 2020, Sam asked the Trends community, “How has your business been impacted by coronavirus? Grown? Hurt?”

We received dozens of insights from the community and have included them below as a resource for navigating these challenging times. We organized them based on who is experiencing the least and most pain.

Please note that these stories were posted last week, so some details might have changed. Where possible, we’ve added a note for material changes.

These Businesses Are Weathering The Storm

Novelty Goods – PopColors (Ben Bailey)

Deep Dive: How 6 Small Businesses Are Confronting Coronavirus |

In this article, we dive deep into 6 companies, exploring how they’re weathering the fallout from the novel coronavirus. The report looks at industries across the spectrum, zeroing in on the specific problems and solutions faced by these operators:

- Marketing: Scout Collective — a brand strategy and digital marketing studio — is helping clients get the most impact from their marketing dollars by crafting messages around loyalty, community, and empathy.

- Events: SnapBar — a custom photo and video booth rental company — is trying to navigate widespread event cancellations by repurposing its existing resources to launch new products.

- Cleaning: Hip Maids — an on-demand cleaning service — is having difficulty meeting new business requests as school closures are forcing its workers to stay at home.

- Beauty: The Sparkle Bar — a makeup and beauty studio — is transitioning to “tele-cosmetics” as social distancing is keeping customers away.

- Manufacturing: Get It Made — a manufacturing-as-a-service firm — has been able to weather the manufacturing slowdown with a diversified supply chain.

- Newsletter: Intelligent Prepper — a weekly newsletter chronicling threats including everything from riots to volcanoes — has become a useful coronavirus resource while also keeping a long view into the type of content that an audience will want when the coronavirus pandemic passes.

10 Minute Read

* * *

Amid Widespread Cancellations, a Marketing Agency Looks to Stays Relevant by Building Communities

- The business: Scout Collective, a brand strategy and digital marketing studio

- The challenge: Projects placed on hold; clients’ marketing budgets will likely shrink

- The solution: Develop brand messaging that builds customer loyalty, community, and empathy

Troy Monroe (center), with two of his employees (via Monroe)

Early last week, Troy Monroe received a Facebook notification highlighting a memory from 5 years ago. It was a post he had written about leaving a full-time job and how nervous and excited he was to launch Scout Collective, his brand and digital marketing studio.

Get a Room: Finding Opportunities in the $18B Boutique Hotel Industry |

It’s been nearly 5 years since Marriott Hotels & Resorts shook up the travel world by announcing its intention to acquire Starwood, its high-end hotel competitor.

When the deal closed in the fall of 2016 for $13.6B, Marriott had created the world’s largest branded hotel chain, accounting for 1 in 7 hotel rooms in North America.

While the recent spread of coronavirus has put a chill on the hotel and travel industry, the long-term macro trends that motivated Marriott CEO Arne Sorenson to complete the Starwood acquisition remains.

“The story is that hundreds of millions of new people a year with resources to travel [are entering the market],” he said in 2017. “By 2030, the number of international trips is expected to reach 1.8 billion, [a 50% increase from 2017].”

The two main groups driving this travel trend?

- wealthier citizens from emerging markets (especially China)

- and the growing affluence of the experience-seeking millennial demographic

Today, the total revenue for US hotels and motels is estimated at $200B.

These Anti-Spam Solutions Mint Money by Blocking Scammers |

This article is part of our “Brainstorm Breakdown,” in which we riff off ideas Sam & Shaan have discussed on their “My First Million” brainstorms. Here, we dive deep into spam tech that’s designed to fight the scourge of unwanted calls and texts.

This report was based on the February 19, 2020 episode of “My First Million” (32-minute mark).

Sam and Shaan were discussing business models that save people money through “small hacks.”

They brought up a number of interesting anti-spam companies, including Sweden-based anti-spam firm Truecaller.

5 Minute Read

* * *

What is Truecaller?

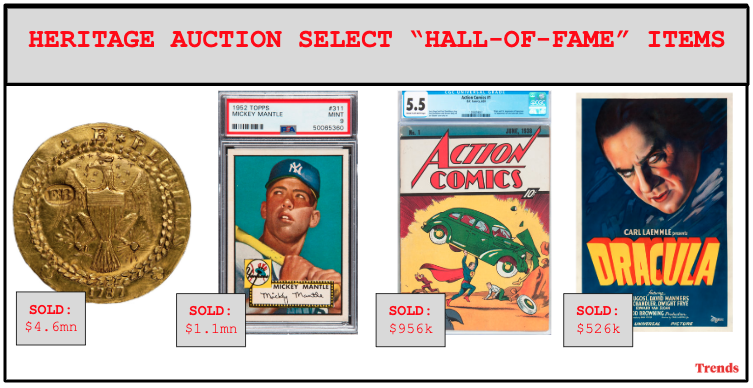

How the World’s Largest Collectibles Auction Business Makes $800m+/Year from Nostalgia |

This report is part of our “Brainstorm Breakdown,” in which we riff off ideas Sam & Shaan have discussed on their “My First Million” brainstorms. Here, we explain how to make money from nostalgia by breaking down the growing business of Heritage Auctions.

This report was based on the February 20, 2020 episode of “My First Million” (53-minute mark).

5 Minute Read

* * *

What is Heritage Auctions?

Founded in 1976, Dallas-based Heritage Auctions (HA) is the world’s largest collectibles auctioneer. With additional locations in New York, Beverly Hills, San Francisco, Houston, and Geneva, HA is also the world’s 3rd-largest auction business (behind Christie’s and Sotheby’s).

Breaking Into the $15B Executive Recruiting Industry |

Over the past few weeks, the topic of the executive search and recruiting industry has sparked quite a bit of interest within the Trends community.

Sam posted an initial report in the Trends Facebook Group and then discussed the topic with Shaan on a “My First Million” Dollar Brainstorm podcast (February 6th, 2020; 21-minute mark).

Based on interest in the topic, we set out in this report to:

- Give a broader overview of the executive recruiting industry, and

- Analyze Google search data to identify recruiting opportunities within:

- High-paying job functions (physicians, nurse practitioners, in-house counsel, data scientist, UX professionals)

- Fast-growing industries (3D printing, marijuana, clean energy)

$15 Billion Industry Dominated By 5 Firms

Don’t Snooze on these Sleep Industry Trends

It’s widely known that sleep is important, yet somehow this essential restoration period is often de-prioritized. Whether it’s because people struggle to snooze, would rather get a little less sleep to do a little more of X, or they’re just not educated on how destructive a lack of sleep can be… 35% of adults don’t get enough sleep.

And it’s not just a matter of feeling more tired. Researchers have found that an individual sleeping 6 hours or less has a 13% higher mortality rate, and lack of sleep costs the United States $411B each year. For those and other reasons, the CDC has identified sleep disorders as a public health epidemic.

Why We Sleep, a 2017 New York Times bestseller, has helped fuel an important conversation about the science of sleep, including how a lack of sleep can contribute to serious short- and long-term impairments, such as diabetes and Alzheimer’s.

Lunya: An innovative sleepwear brand scales to $25m | Trends by The Hustle

The Trends Small Business Database houses hundreds of small businesses, along with their financials and unique stories. You can access the entire database here or read dozens of in-depth features here.

In 2012, Ashley Merrill found herself going to sleep wearing an outfit she had donned hundreds of times before: her husband’s oversized clothes. She was finally tired of it. Is this what it’s going to be?, she asked herself.

Merrill wanted more. But the market was flooded with sleepwear that didn’t feel right — too sexual, or too matronly, or not functional enough. So in 2014, she created “the ultimate business-school project.” A new kind of sleepwear brand.

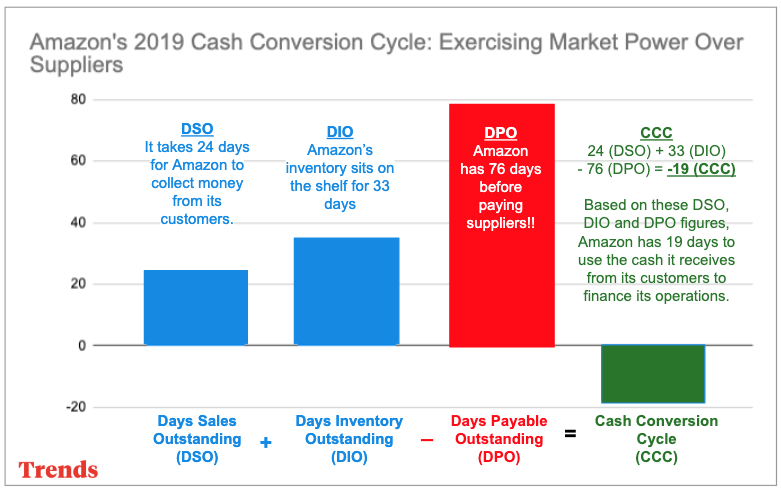

Cash is King: Using the Cash Conversion Cycle to Finance Your Operations |

In 2014, the Harvard Business Review published an oft-cited article titled “At Amazon, It’s All About Cash Flow.” The article set out to address the sentiment that Amazon “didn’t make any profit.”

In analyzing Amazon, the article argues that observers should focus on the e-commerce company’s free cash flow rather than its net profit, which doesn’t properly take into account investments in capital goods.

The article continues by identifying the best metric to measure a company’s ability to generate cash: the cash conversion cycle (CCC).

“…the key metric of a company’s cash-generating prowess is the cash conversion cycle, which is days of inventory plus days sales outstanding (how long it takes your customers to pay you, basically), minus how many days it takes you to pay your suppliers [days payable outstanding].

Super-efficient retailers such as Walmart and Costco have been able to bring their CCC down to the single digits. That’s impressive. But at Amazon last year, the CCC was negative 30.6 days.

In Amazon’s case, all this cash is being used to finance the company’s continued explosive growth. The company doesn’t need to borrow, it doesn’t need to issue stock. It can just keep spending its own cash to attack new sectors and upgrade its offerings.”

Here is the breakdown for Amazon’s cash conversion cycle (CCC) in 2019: