Contents:

Futurist Q&A: Jamie Metzl on the Changing World Order | Trends by The Hustle

Which industries do you foresee this crisis affecting the most in the long term?

This crisis is going to affect every industry, our entire economy, and the superstructure of the entire world.

What we’re seeing is not a little blip. This is not the equivalent of a snow day, where we just wait it out and the snow melts, and we go back to the world as it was. This is, in many ways, a fundamental break between the world before the crisis and the world after the crisis, and our economy is going to reset.

How Brex Launched a Multibillion-Dollar Brand with OOH Marketing | Trends by The Hustle

One of our most popular reports last year was a deep dive on the out-of-home (OOH) advertising market.

The article provided a thorough macro overview of the industry, but we wanted to expand on the piece with on-the-ground actionable intel.

To do so, we reached out to Kasper Koczab, Brex’s head of OOH media. Named one of Brex’s “power players” by Business Insider, Koczab previously worked at one of America’s leading OOH advertising firms (Clear Channel Outdoor) and is a veteran of the industry.

The Hygiene Industry: Opportunities and Changes | Trends by The Hustle

Picture this: It’s April 2021 and you’re meeting a friend for dinner. You can’t decide where to go because your favorite tapas place is closed — communal food is a thing of the past. You eventually agree on a spot, but it’s hard to get a reservation since restaurants are only accommodating half their normal number of patrons.

While you might make the 6pm train, you call an Uber instead because you don’t want to risk having to squash yourself into a crowded subway car. Your health and wellbeing are worth the extra money.

Perceptions and behaviors relating to hygiene have changed forever thanks to the coronavirus pandemic. Although we might not yet know exactly how things will change, one thing’s for sure: You can say goodbye to hugging and shaking hands with strangers. And you might not want to press that elevator button or touch that restaurant menu — at least not without sanitizing.

Why Josh Wolfe Wants to Back Society’s Outcasts | Trends by The Hustle

Josh Wolfe believes that society’s outcasts are the ones who hold the secret to human progress. And he’s dedicated his life to spotting them early.

Wolfe is the co-founder and managing director of Lux Capital, a New York City-based early-stage venture firm whose guiding philosophy is “the more ambitious, the better.” Lux recently raised $1B across two new funds to invest in frontier technology companies that focus on areas such as neurostimulation, nuclear energy, and synthetic biology. (You can see Lux’s portfolio companies, including biotech startup Kallyope and 3D virtual reality firm Matterport, in action here.)

Although Lux has maintained a relatively low profile over the years, the firm had a banner year in 2019 as two of its portfolio companies were scooped up in massive acquisitions. Auris Health sold to Johnson & Johnson for $3.4B, and CTRL Labs sold to Facebook for somewhere between $500m and $1B, producing big returns to the firm’s outside investors.

Solving the Interactive Podcast Mystery | Trends by The Hustle

The Signal: You can add “interactive podcasts” to the list of interactive digital experiences that will stick in the post-COVID world. This new genre of media, which blurs the lines between narrative and gaming, was gaining popularity before the pandemic.

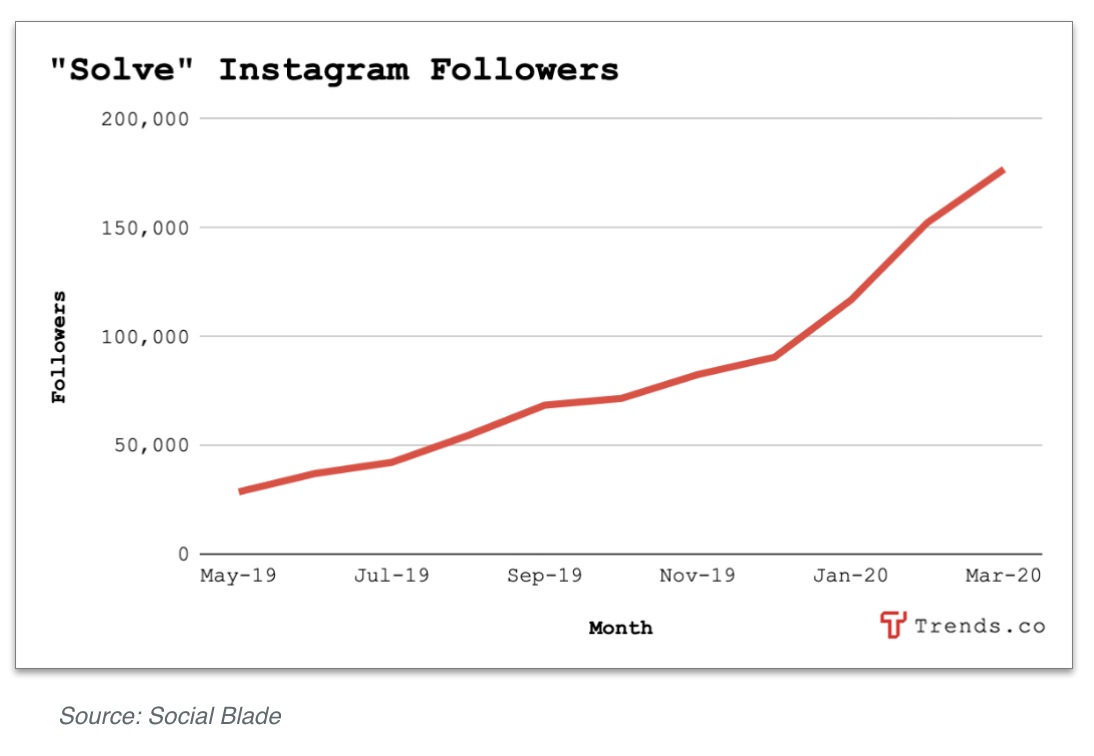

Solve is the first-of-its-kind interactive podcast in which listeners solve real-life true crime cases by using social media and other platforms to interview suspects and analyze evidence.

The show debuted as an original Snapchat show in 2018, reaching more than 30m viewers. In 2019 the company launched a podcast and raised $20m in funding. That’s almost as much as podcast network Gimlet Media raised ($28.5m) before it was acquired by Spotify for $200m in 2019.

Post-Coronavirus Regulation Will Force Companies to Spend Billions On Compliance. Here Are The Opportunities. | Trends by The Hustle

The Signal: The coronavirus crisis is forcing governments in the US and Europe to make regulatory changes on the fly.

The post-crisis world will see significant regulatory changes in regard to health care and disaster preparedness. And these changes will cost companies billions in compliance costs.

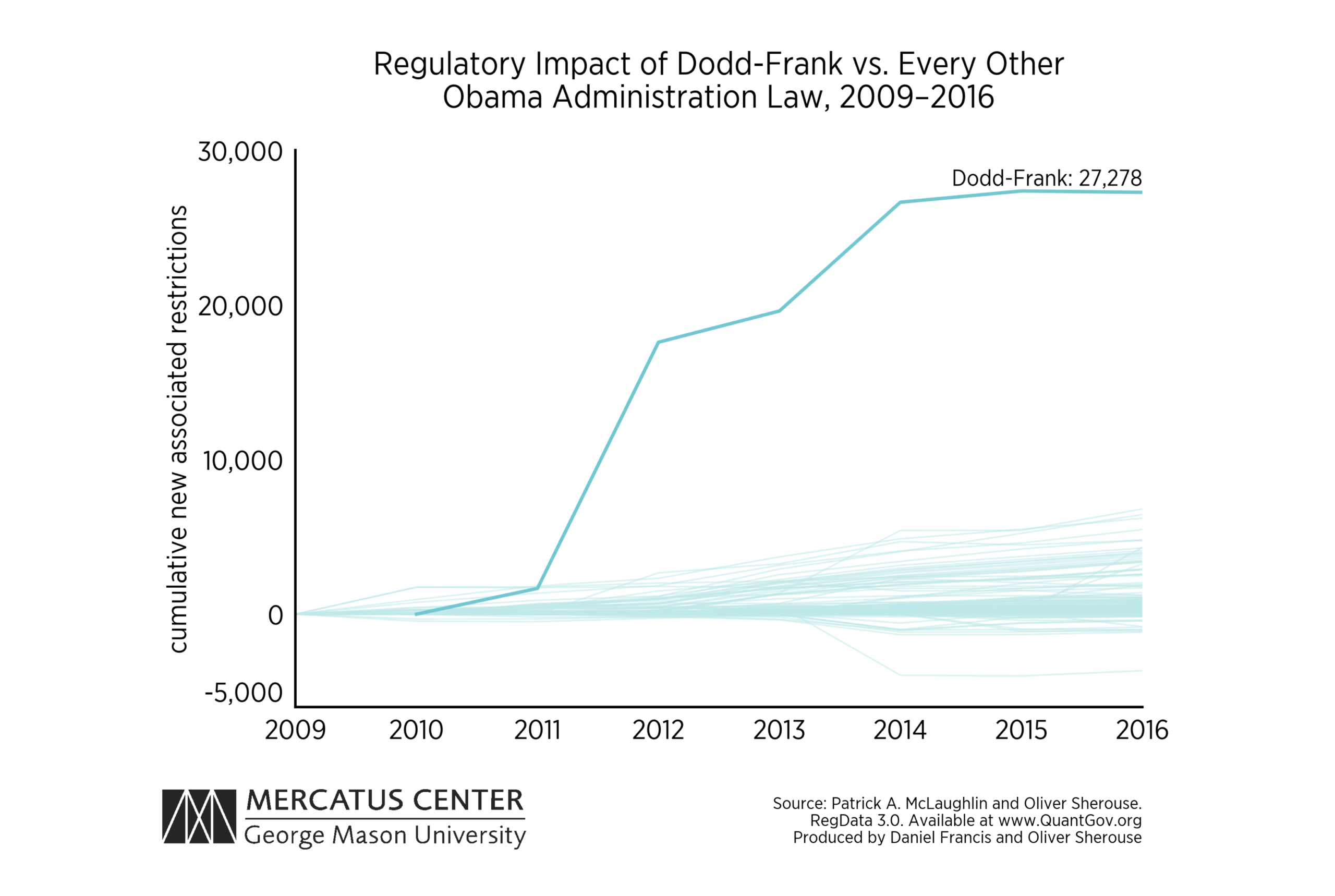

According to research by Rice University, the Dodd-Frank Wall Street Reform & Consumer Protection Act following the 2008-09 financial crisis “roughly doubled the number of regulations applied to U.S. banks, which hiked their compliance costs by more than $50 billion per year”. Costs included compliance salary expenses, auditing, consulting, data processing and legal fees.

Further analysis by George Mason University showed that the number of new regulatory restrictions created by the Dodd-Frank Act dwarfed the combined impact of every other Obama-era administration law.

In addition to the fact that there is significant coronavirus-related changes coming to global regulatory regimes, existing compliance training have 2 underlying factors that make the industry ripe for disruption:

- Major corporations have to pay for it: As a way to head off future liabilities, corporations spend millions of dollars every year on compliance training according to research by the Harvard Business Review (HBR).

- Current compliance training programs are ineffective: According to the same HBR research, many training programs have end goals that are very light on information (eg. completion of a program is considered sufficient vs. actual understanding). Further, because of these seemingly trivial outcomes, employees find the programs a waste of time.

The Opportunity: Moving forward, the compliance industry will only grow with corona-related bills adding to the likes of the aforementioned Dodd-Frank Law as well as Health Insurance Portability & Accountability Act (HIPAA), Sarbanes-Oxley, the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

Our research identifies 4 categories of compliance training that present opportunities to create new solutions:

Testing Business Ideas With Andrew Hogan | Trends by The Hustle

Andrew Hogan, a London-based paid marketing professional with 10 years of travel and ecommerce experience, set the Trends Facebook group on fire with this post: “Today, I will help validate your idea with Google search data.”

The post has 180+ comments and dozens of business idea submissions.

In exchange for testing business ideas, Andrew was allowed to post his findings publicly for the group to see. (Not a bad tradeoff!)

Lecture Lessons: Launching a Product 101 with Nik Sharma

Lecture Lessons provides actionable takeaways from our Trends Lectures series. This entry is based on Nik Sharma’s Product Launch 101 webinar. You can find him at Sharma Brands, follow him on Twitter or contact him via text (917-905-2340).

***

As an operator, investor and advisor, Nik Sharma has worked with leading names in the direct-to-consumer (DTC) space including Hint, VaynerMedia, Judy, and Haus.

In this article, we’ve gathered the most actionable insights and resources (there are a lot) from his Trends Lectures Product Launch 101 webinar including:

- An overview of earned, owned and paid media

- How to be ‘native’ to each social platform

- How to do cold outreach for press and influencers (sample messages here)

- How to make effective FB/Instagram ads

- How to make effective Google ads

- How to track your audience (Measure by Quantcast)

- How to optimize your landing page to convert

- How to put together the ideal DTC tech stack

- How to prepare your pre and post launch emails (email cheat sheet here)

- How to ensure influencers properly rep you brand (influencer cheat sheet here)

- How to work with influencers (influencer tracking sheet here)

10 Lessons From Small Businesses That Survived the Great Recession | Trends by The Hustle

Last week, we sent out a survey inviting businesses that made it through the Great Recession to tell us how they did it. We got hundreds of responses, creating a database that shows the mix of strategies they used to cope with the economic fallout.

The database includes the names of more than 100 companies, with detailed information about how their businesses were impacted, what they did to stave off financial difficulties, and the lessons they learned along the way. Trends subscribers can see the data here.

In addition, we analyzed more than 100 survey responses, pulling out 10 key takeaways that could help your company navigate uncertain times:

How 7 Thriving Businesses Pivoted in Hard Times |

This week we’re publishing our third (and likely final) installment of our “Coping with Coronavirus” series (here’s part 1 and part 2).

The final mini-case studies, all from new industries, cover 7 thriving businesses forced to pivot during an unprecedented era:

- Foodware: Final — a reusable foodware company that makes collapsible straws — was preparing to launch a reusable fork. But as the consumer landscape shifted sharply, the company decided to launch a Kickstarter campaign for much-needed reusable sanitizing wipes. (Sign me up for a box…)

- Family Club: The Lane — a social club for kids and their families — opened a 7,880 square-foot space just as coronavirus was breaking out in the US. It quickly created a virtual version of its service to support its new members and avoid layoffs.

- Nursing: Next Move — an agency that places travel nurses — has been rapidly hiring administrative staff to keep up with demand for its services.

- Veterinarian: Pawzy — a search tool that connects people to vets in their area — launched a telehealth alternative as its physical location was seeing decreased traffic. (See our Signal below on telemedicine.)

- College Education: Knack — a peer-to-peer tutoring platform — typically works with students in-person. But with social distancing measures, the company is promoting its online-only features and giving away its technology to impacted colleges that were forced to close their in-person tutoring centers.

- Sport Beverages: LIFEAID Beverage Company — a beverage business that makes functional sports drinks for athletes — lost one of its biggest distribution channels with the closure of gyms. But a surge in sales from other outlets has helped it reinvest profits back into its partner gyms to help them weather the storm. (We’ll drink to that!)

- Transportation: Swoop — an event transportation app — saw its business evaporate overnight and is pivoting to develop a business management app for its operators.

10 Minute Read

* * *

A Reusable Foodware Company Pivots to Wipes

The business: A reusable foodware company that makes collapsible straws; before the coronavirus pandemic hit, the company was about to launch a travel fork.