Contents:

Putting a Price on Digital Privacy | Trends by The Hustle

As consumers have become more concerned with preserving their privacy, there is an opportunity for business owners and entrepreneurs to capitalize on providing exactly that: giving people the tools to control their information. In this article, we’ll discuss why privacy matters and then feature several businesses that are disrupting some of the world’s largest products by giving people back their privacy.

Why Privacy Matters

In 2020, people trade their data for free products and services every day. Each Google search. Each app download. Each connection to public WiFi. In prior decades, this information transaction may have been comparatively harmless, but widespread data breaches pose a substantial threat to the everyday internet citizen.

Patrick Ambron, CEO of Brand Yourself, warns that hackers can easily access information like your email or phone number, and with just “a few minutes and a couple bucks” they can access security question answers or private banking accounts.

Boldify: How a solo founder hit $4.5m in hair product sales in 3 years | Trends by The Hustle

The Trends Small Business Database houses hundreds of small businesses, along with their financials and unique stories. You can access the entire database here or read dozens of in-depth features here.

Mike Viskovich built Boldify into a $4.5m business in just 3 years. The secrets to his success? He started with a product he already used, and he leaned heavily on Amazon traffic.

Hair thickener might sound like an unusual product to build a company around, but Viskovich believed in it. The market for hair products typically features healthy margins.

Sterlings Mobile: How one company innovated hair service on the go | Trends by The Hustle

The Trends Small Business Database houses hundreds of small businesses, along with their financials and unique stories. You can access the entire database here or read dozens of in-depth features here.

When Kush Kapila thought about starting a mobile hair salon, he knew his business wouldn’t be the first. But he had a plan for differentiation.

“I looked at the landscape, and everyone did like a white truck or RV,” he says. “And then they would park on the side of the road like a food truck.”

How The Athletic Grew a Niche Audience to ~1m Subscribers in 4 Years |

In 4 years, the sports news website The Athletic has become a guide for modern and legacy media entities, as well as niche-driven subscription businesses in many other markets, both in terms of revenue model and content.

At a time when newspapers and online news sites were chasing page views, The Athletic introduced a subscription service, believing it provides more sustainable revenues and would allow journalists to focus on quality over quantity.

As of late 2019, The Athletic had nearly 1m subscribers paying ~$60 annually (many receive discounted rates), with ~$90m in funding. The company has grown from less than $100k in the first year to what Trends estimates to be ~$60m in revenue in year 4. As for journalistic accomplishments, The Athletic recently broke open the story of the World Series champion Houston Astros’ cheating scandal.

How One Company Made Billions From Manufactured Homes and RVs

Billionaire Sam Zell is considered the father of the modern real estate industry in the United States.

His empire began more than 50 years ago with the founding of Equity Group Investments. Over the decades, his real estate investment firm has — at some point — been the largest apartment owner in the US (Equity Residential) and the largest office owner in the US (EQ Office).

To round out the real estate dominance, Zell also controls Equity Lifestyle Properties (ELS), the largest campground, recreational vehicle (RV), and manufactured home (MH) park owner in America.

Simon Malls & The Big Business of Future Retail Trends | Trends by The Hustle

Brick ‘n mortar retail had a bumpy 2019.

A number of notable retailers — including Gymboree, Payless Shoes, Forever 21, Sugarfina, and Destination Maternity — declared bankruptcy and, collectively, closed thousands of stores.

While the transition to ecommerce (“Amazon effect”) is often cited as the death knell for physical retail, in-store sales still account for ~90% of the multi-trillion dollar US retail sector.

Physical retail remains a massive market and Simon Property Group (SPG), America’s largest mall operator, is at the front lines. The company generates >$60B in revenue and operates 206 US properties, including 107 malls.

By analyzing Simon’s retail innovation roadmap, we show you smart strategies for creating impactful products and services in the physical retail space.

In this report, you will find:

- Why brands are pursuing a multi-channel approach and how you can help digital retailers expand to digital storefronts via a “retail-as-a-service” model.

- Why location-based, offline-to-online, marketing and finance services are attractive opportunities for the next decade of physical retail.

- What you can do with underutilized retail space and resources to help you identify and lease such spaces.

Brick ‘N Mortar is Not Going Anywhere

How to Capitalize on the Fast-Growing Sports Gambling Industry | Trends by The Hustle

Remember when Nevada was the only state where you could place a legal, regulated bet on a sporting event? Neither do I, and that was just two years ago.

As 2020 begins, according to Legal Sports Reports, 20 states have legalized and regulated sportsbooks after a landmark Supreme Court ruling in 2018. Seven of those states allow online sports gambling. About 20 other states have or had pending legislation regarding sports gambling, signaling the potential for it to become legal in the majority of the country.

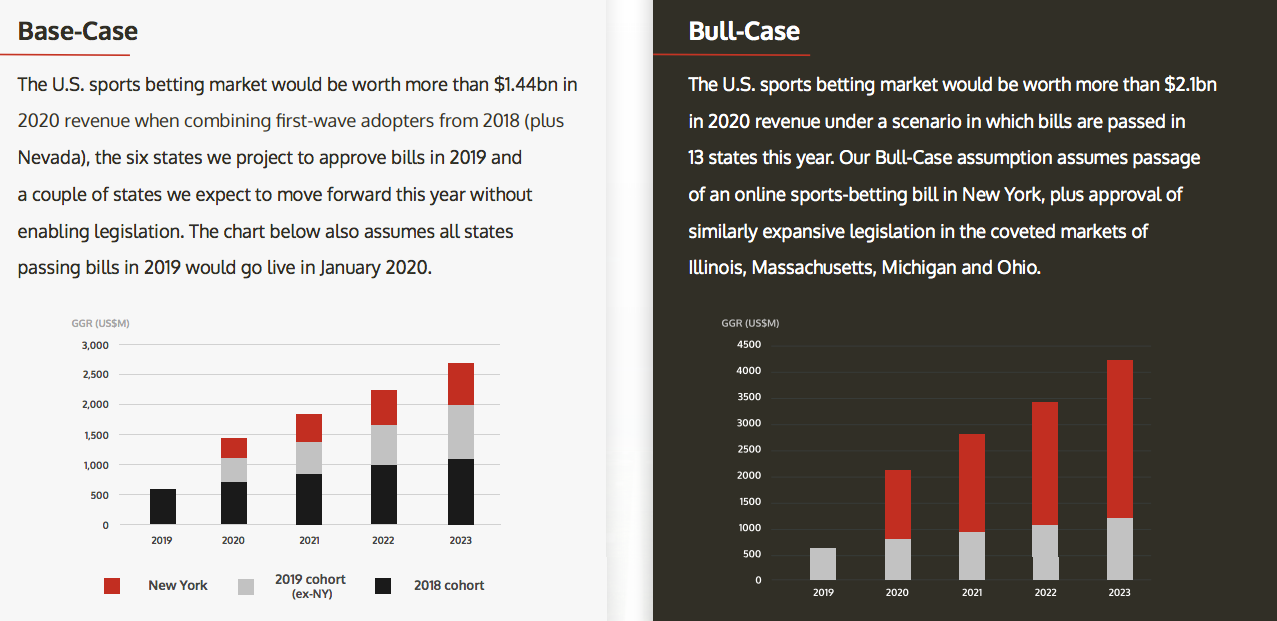

Even with just the 20 states, the US sports betting market is expected to be worth about $1.5B next year and ~$2.75B by 2023, according to a study by GamblingCompliance. The future market could be vast. By 2030, H2 Gambling Capital estimates it to be worth $81B. According to the American Gaming Association, some $150B is wagered illegally on sports — through bookies, offshore sites, etc. — by Americans every year. That number, $150B, nearly matches the current market size of the regulated global sports gambling industry, which is centered mainly in Europe, Asia, and Australia.

Trends Small Business Database | Trends by The Hustle

Fast Growing Businesses in 2019 | Trends by The Hustle

The trend: Two Christian-inspired entrepreneurs created an Instagram-friendly bible and in their second year sold 10k copies. Similar overhauls can be done for other classic works.

Looking ahead: Previously copyrighted material enters the public domain every year; anyone can profit on it with the right approach. In 2020, some of the works going public include literature by Mark Twain, H.G. Wells, Edith Wharton, and more, as well as songs by Irving Berlin and George Gerswhin.

Online Plant Sales Are Set to Bloom

The Best Upcoming Business Trends 2020 Predictions | Trends by The Hustle

What are the biggest trends you see in 2020? We reflected on that question ourselves and shared it with entrepreneurs, investors, futurists, and Trends members.

Here are some of the best responses, along with a few curated predictions:

Brian Breslin, Trends member: I think we will see advances in insurance and health providers aimed at freelancers and gig workers. We will also see more tools to support remote work teams. That is becoming more and more normalized.