Contents:

We Talked to 30+ Companies About Their Strategies for Coping with Coronavirus. Here Are Their Stories. | Trends by The Hustle

On March 12, 2020, Sam asked the Trends community, “How has your business been impacted by coronavirus? Grown? Hurt?”

We received dozens of insights from the community and have included them below as a resource for navigating these challenging times. We organized them based on who is experiencing the least and most pain.

Please note that these stories were posted last week, so some details might have changed. Where possible, we’ve added a note for material changes.

These Businesses Are Weathering The Storm

Novelty Goods – PopColors (Ben Bailey)

Get a Room: Finding Opportunities in the $18B Boutique Hotel Industry |

It’s been nearly 5 years since Marriott Hotels & Resorts shook up the travel world by announcing its intention to acquire Starwood, its high-end hotel competitor.

When the deal closed in the fall of 2016 for $13.6B, Marriott had created the world’s largest branded hotel chain, accounting for 1 in 7 hotel rooms in North America.

While the recent spread of coronavirus has put a chill on the hotel and travel industry, the long-term macro trends that motivated Marriott CEO Arne Sorenson to complete the Starwood acquisition remains.

“The story is that hundreds of millions of new people a year with resources to travel [are entering the market],” he said in 2017. “By 2030, the number of international trips is expected to reach 1.8 billion, [a 50% increase from 2017].”

The two main groups driving this travel trend?

- wealthier citizens from emerging markets (especially China)

- and the growing affluence of the experience-seeking millennial demographic

Today, the total revenue for US hotels and motels is estimated at $200B.

Breaking Into the $15B Executive Recruiting Industry |

Over the past few weeks, the topic of the executive search and recruiting industry has sparked quite a bit of interest within the Trends community.

Sam posted an initial report in the Trends Facebook Group and then discussed the topic with Shaan on a “My First Million” Dollar Brainstorm podcast (February 6th, 2020; 21-minute mark).

Based on interest in the topic, we set out in this report to:

- Give a broader overview of the executive recruiting industry, and

- Analyze Google search data to identify recruiting opportunities within:

- High-paying job functions (physicians, nurse practitioners, in-house counsel, data scientist, UX professionals)

- Fast-growing industries (3D printing, marijuana, clean energy)

$15 Billion Industry Dominated By 5 Firms

Cash is King: Using the Cash Conversion Cycle to Finance Your Operations |

In 2014, the Harvard Business Review published an oft-cited article titled “At Amazon, It’s All About Cash Flow.” The article set out to address the sentiment that Amazon “didn’t make any profit.”

In analyzing Amazon, the article argues that observers should focus on the e-commerce company’s free cash flow rather than its net profit, which doesn’t properly take into account investments in capital goods.

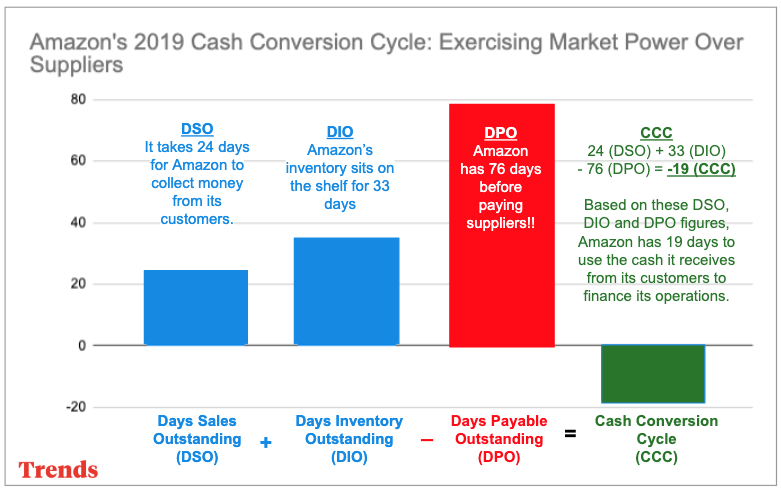

The article continues by identifying the best metric to measure a company’s ability to generate cash: the cash conversion cycle (CCC).

“…the key metric of a company’s cash-generating prowess is the cash conversion cycle, which is days of inventory plus days sales outstanding (how long it takes your customers to pay you, basically), minus how many days it takes you to pay your suppliers [days payable outstanding].

Super-efficient retailers such as Walmart and Costco have been able to bring their CCC down to the single digits. That’s impressive. But at Amazon last year, the CCC was negative 30.6 days.

In Amazon’s case, all this cash is being used to finance the company’s continued explosive growth. The company doesn’t need to borrow, it doesn’t need to issue stock. It can just keep spending its own cash to attack new sectors and upgrade its offerings.”

Here is the breakdown for Amazon’s cash conversion cycle (CCC) in 2019:

How One Company Made Billions From Manufactured Homes and RVs

Billionaire Sam Zell is considered the father of the modern real estate industry in the United States.

His empire began more than 50 years ago with the founding of Equity Group Investments. Over the decades, his real estate investment firm has — at some point — been the largest apartment owner in the US (Equity Residential) and the largest office owner in the US (EQ Office).

To round out the real estate dominance, Zell also controls Equity Lifestyle Properties (ELS), the largest campground, recreational vehicle (RV), and manufactured home (MH) park owner in America.

AppFolio Shows That Niche SaaS Ideas Are Big Business | Trends by The Hustle

Let’s play a quick game of “Which one of these does not belong?” Facebook. Amazon. Netflix. Google (Alphabet). AppFolio.

If you guessed AppFolio, congratulations. You are correct and we owe you a set of steak knives.

Like the famed FANG group of stocks (FB, AMZN, NFLX, GOOGL), AppFolio (APPF) is a tech company. Unlike FANG, AppFolio is not a consumer-facing business servicing billions of people.