Contents:

Edtech Market: The Boom in Online Learning | Trends by The Hustle

The COVID-19 pandemic has rocked each sector of the economy, but few realms have felt the effects more than education. With campuses closed across the US, preschoolers and PhD candidates alike are cooped up at home, trying to keep learning in the midst of the crisis.

Most students, teachers, and institutions are new to or relatively inexperienced with remote education. Before the pandemic, according to the latest available data, only 15% of US college students enrolled exclusively in online courses and fewer than 1% of K-12 students enrolled full-time in online schools — but suddenly, almost all students are taking classes entirely online.

Some lack the devices and internet connections they need to learn from home, while many teachers are struggling with digital systems they don’t fully understand. Plenty of schools and colleges scrambled to set up distance learning tools, only to be embarrassed when naked strangers Zoombombed classes.

How The Athletic Grew a Niche Audience to ~1m Subscribers in 4 Years |

In 4 years, the sports news website The Athletic has become a guide for modern and legacy media entities, as well as niche-driven subscription businesses in many other markets, both in terms of revenue model and content.

At a time when newspapers and online news sites were chasing page views, The Athletic introduced a subscription service, believing it provides more sustainable revenues and would allow journalists to focus on quality over quantity.

As of late 2019, The Athletic had nearly 1m subscribers paying ~$60 annually (many receive discounted rates), with ~$90m in funding. The company has grown from less than $100k in the first year to what Trends estimates to be ~$60m in revenue in year 4. As for journalistic accomplishments, The Athletic recently broke open the story of the World Series champion Houston Astros’ cheating scandal.

How to Capitalize on the Fast-Growing Sports Gambling Industry | Trends by The Hustle

Remember when Nevada was the only state where you could place a legal, regulated bet on a sporting event? Neither do I, and that was just two years ago.

As 2020 begins, according to Legal Sports Reports, 20 states have legalized and regulated sportsbooks after a landmark Supreme Court ruling in 2018. Seven of those states allow online sports gambling. About 20 other states have or had pending legislation regarding sports gambling, signaling the potential for it to become legal in the majority of the country.

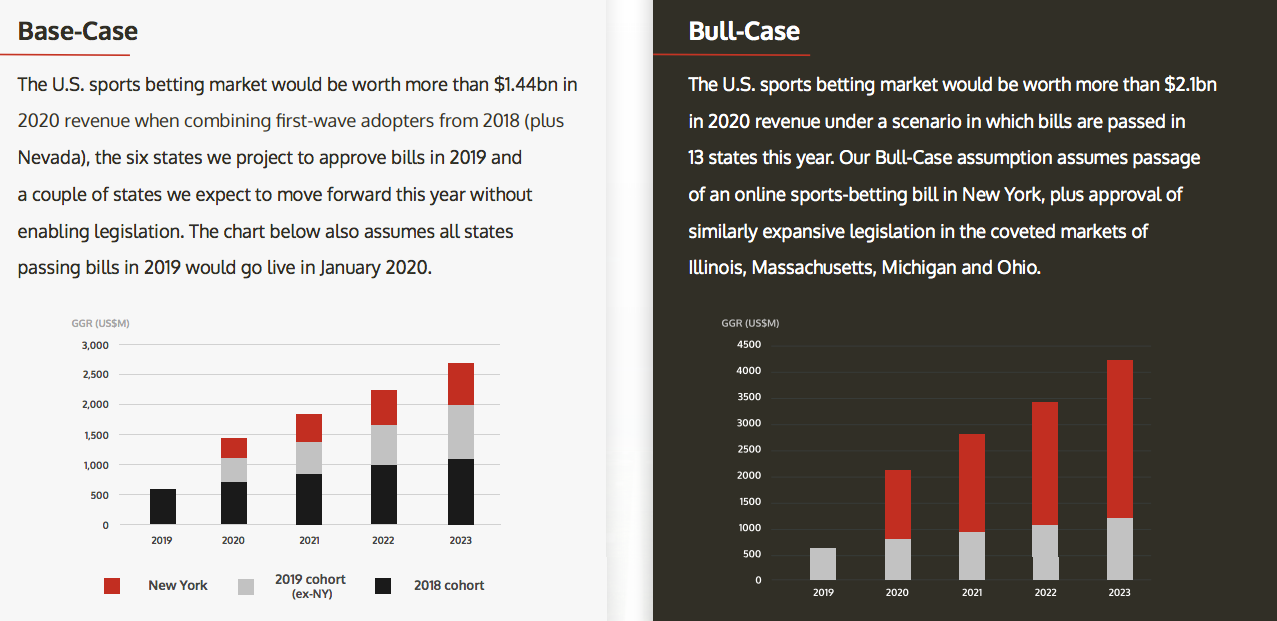

Even with just the 20 states, the US sports betting market is expected to be worth about $1.5B next year and ~$2.75B by 2023, according to a study by GamblingCompliance. The future market could be vast. By 2030, H2 Gambling Capital estimates it to be worth $81B. According to the American Gaming Association, some $150B is wagered illegally on sports — through bookies, offshore sites, etc. — by Americans every year. That number, $150B, nearly matches the current market size of the regulated global sports gambling industry, which is centered mainly in Europe, Asia, and Australia.

Fast Growing Businesses in 2019 | Trends by The Hustle

The trend: Two Christian-inspired entrepreneurs created an Instagram-friendly bible and in their second year sold 10k copies. Similar overhauls can be done for other classic works.

Looking ahead: Previously copyrighted material enters the public domain every year; anyone can profit on it with the right approach. In 2020, some of the works going public include literature by Mark Twain, H.G. Wells, Edith Wharton, and more, as well as songs by Irving Berlin and George Gerswhin.

Online Plant Sales Are Set to Bloom

The Ultimate Business Trends 2020 List

What’s going to happen in 2020 in the business and tech world?

One of the best ways to answer that question is to look back at emerging trends from the last several months and see which have the potential to explode further in the new year.

The Trends team went through public year-end reports of companies like Reddit, Pinterest, and Facebook to highlight some major business trends and markets to watch in the upcoming year.

Business Advice from Entrepreneurs at HustleCon | Trends by The Hustle

Would you like business advice from Pandora co-founder Tim Westergren? How about The Athletic’s Alex Mather or ThirdLove’s Heidi Zak?

We’ve got you covered. They were among the many speakers at Hustle Con last week, and we picked the best, most practical business advice for entrepreneurs and investors.

How to get a manufacturer when you’re starting out

It’s not easy for anyone. Manufacturers typically don’t want to work with companies they’re not familiar with or who don’t have large orders. “You just pitch a lot of people,” says ThirdLove’s Heidi Zak. “It’s kind of like pitching investors. You need your gameface on.”

What you should study to be an entrepreneur

Step by Step: An MBA Students Tumbler Business | Trends

Stainless steel blenders and tumblers are everywhere. People get them as free giveaways at conventions or as corporate gifts. But they’re not always easy to carry around, often having no lids or requiring a lid that won’t fit exactly right on another model of tumbler.

Joe Losito wanted to make a lid that would fit on the most popular of them, including Yeti and RTIC. He got the idea in January and by the summer had started his company, Matrix Lids. It sells lids, as well as tumblers. Losito, who is also working on his MBA at Texas Christian University, says he’s been making about $2k to $3k in sales each month.

This is how he went from idea to product in just a few months:

The idea phase

The Rent Everything Industry | Trends by The Hustle

How you can capitalize

- Market a rental goods company to college students, the most mobile populations in the United States. Or market toward boomers, who are scaling back on possessions but have been mostly neglected by current startups.

- With other companies renting furniture, focus on interior design and make good use of VR.

- Build a logistics platform that makes it easy for companies to rent, clean, and return items.

The United States is changing into a country that favors mobility, sustainability, and convenience — not permanence — and not enough businesses are keeping up.

According to Pew, there were more renters in the United States in 2016 than at anytime in the previous 50 years. The total number, 43m, has increased 26% since 2006. Meanwhile, the number of homeowners is about 75m, which has stayed flat since 2006.

The New Craze in the Protein Market | Trends by The Hustle

What you should know

- The global protein market, valued as high as $50B, is expected to grow at a 6% CAGR in the next several years.

- The supplement and plant-based protein portions of the market are expected to have the longest-lasting growth.

How Matt Tortora Made a Local Food Delivery Business | Trends by The Hustle

At Jamestown Fish in Rhode Island, where Matt Tortora was a chef, customers demanded fresh, premium ingredients. The restaurant typically bought them from distributors. “I could pick up the phone, give them a call, and in some cases, same day, get what I needed,” Tortora says.

But the distributors the restaurant worked with were sourcing food from all over the country. The ingredients were rarely local and often not as fresh as they could be.

Tortora and co-founders Erin Tortora and William Araújo set out to solve this problem. Their business, WhatsGood, launched in 2015 and matches restaurants with local farmers. It also recently started offering regular consumers a delivery service of farmers market goods and now has 20k consumers signed up, with a monthly growth rate of about 30%. The company recently closed its seed round of funding at $6.9m, with $5.8m coming recently and $1.1m at launch.