Contents:

Dollar Stores Struggle to Adapt to the E-Commerce Age | Trends

What You Need To Know:

- Dollar stores, which have flourished in recent years, face slowing growth amid growing competition from low cost retailers, including Walmart, Target, Big Lots, and Wish.com.

- Dollar stores will need help building e-commerce infrastructure along with ways to track inventory and target consumers through mobile devices.

How you can capitalize:

- Buy online, pick up in store. This model has allowed brick and mortar retailers to use inventory from physical stores fill online orders, in effect turn existing stores into mini-warehouses for digital commerce. Many dollar stores must still build out their websites and mobile apps to allow consumers to search for product/price information. They also need to create inventory systems that match online orders with available merchandise.

- Digital marketing. Dollar stores attract a good deal of traffic, a captive audience that retailers can reach to boost in-store sales through mobile devices. Research shows that dollar stores consumers often use paper coupons but would overwhelmingly prefer digital coupons if the retailer offered them. Dollar stores need a system that can target specific consumers with coupons via smartphones based on their purchase histories.

- Opportunistic inventory. Dollar stores have been upgrading the quality of their merchandise by purchasing excess inventory from both national brand manufacturers and struggling retailers who need to liquidate their inventories to pay off creditors. Dollar stores could use a system that helps them predict and track these special situations to acquire inventory at fire-sale prices.

The last big holdout to e-commerce is about to fall.

How Unsplash Grew From 10 Free Photos to 11 Billion Monthly Views |

TAKEAWAYS

- Relentless focus is the key to scaling an early-stage startup.

- Provide a tool that helps creators create and you can have a massive business.

- Building and launching side projects is an underrated and effective way to grow revenue.

When his company was running low on cash in 2013, Unsplash founder and CEO Mikael Cho and his team set up a basic website that offered 10 free HD photos that anyone could download.

That site — Unsplash.com — now receives more downloads than all of the major stock photography companies combined, including Getty, Shutterstock, and Adobe Stock.

Ep 5: The First Viral Website: "Hot or Not" | Trends by The Hustle

Shaan Puri: Okay, so what is this? So something that entertains me. And so I wanted to create a podcast which was first and foremost, just an excuse to hang out with people who I haven’t been able to hang out with as much. So, now one way is to say, “Hey, let’s go grab a coffee.” And the other way is to say, “What if we recorded this so that other people could be a fly on the wall and hear stories or chatter about random stuff.” And I’m not trying to do it educationally. So for me it’s stories.

Shaan Puri: So the podcast is called My First Million. And the reason I picked that is because, the audience that listens to this they are entrepreneurs already or wantrepreneurs kind of thinking about, “Hey, that’s the dream. I’d love to sort of quit my job and start a business someday.” And I remember for me, and I think this applies to many people, which is the idea of a million bucks is like a magic number. Even today when everyone’s a billionaire, still if you’re a thousandaire, a million bucks sounds like all the money.

James Hong: Totally understand.

The Million-Dollar Business You Can Build From Your Living Room | Trends

What you need to know:

- In 2017, global revenue for used smartphone sales was close to $20B. It’s expected to hit $44B by 2025.

- The used smartphone market is expected to grow 4-5x faster than the overall smartphone market, with an anticipated 50% YoY growth in units sold.

- As of 2016, analysts predicted about 50% of old smartphones were traded in for new smartphone credits with manufacturers or carriers, while the remainder were sold to retail shops, second-hand device specialists, or online.

How you can capitalize:

- For sellers: A phone retailing at $880 new can fetch as much as $440 in a secondary sale — particularly on newly-mobile overseas markets in India and China.

- For builders: Fixing and flipping newer phone models can generate 54%+ profit margins per unit. To make $1k a month, you’d need to fix and flip about 25 cracked iPhones (a little over eight hours of labor).

- For investors: The market is still highly fragmented. There’s plenty of room at the top for brands that can win buyer/seller trust and own the end-to-end repair and resale process.

* * *

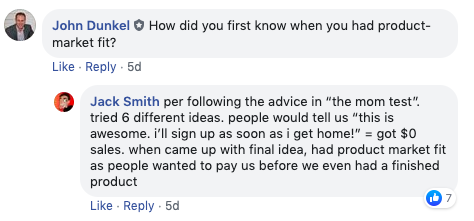

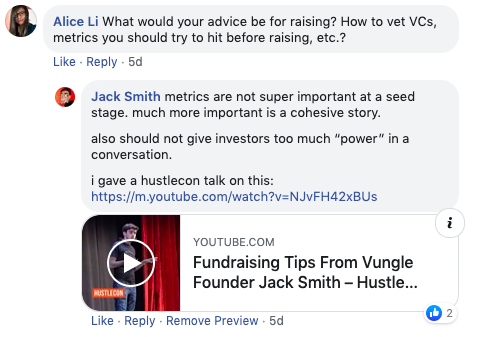

How to Build a $750+ Million Business: 6 Takeaways from Jack Smith |

Private equity giant Blackstone acquired the video advertising startup Vungle last week in a reported $750m deal.

Jack Smith, a co-founder of Vungle, joined us for an exclusive Trends AMA the next day.

Below are 6 takeaways from the Q&A, in which Smith answered questions about how he got his start, what helped him scale the business, and what trends he sees next in advertising.

1. “Stress test” your relationship before going into business with someone you know.

2. Follow the “Mom Test” to determine the viability of your idea.

3. The best way to acquire customers? Pound the pavement.

4. Metrics don’t matter in the early stages.

Prepaid Phone Service Moves Into the Mainstream | Trends by The Hustle

Billions of people looking for reliable, unlimited data at reasonable rates are expected to help the prepaid phone business grow by 4% a year through 2026. It might not sound like huge growth, but consider the market:

- More than two-thirds of the world’s 7.6B people have a mobile phone, the majority of which carry data plans.

- And there are roughly 2.5B people without a mobile phone that form an equally enticing market.

Until now, prepaid, or pay-as-you-go plans, have mostly appealed to lower-income consumers, or people who have trouble obtaining credit.

MetroPCS, a T-Mobile subsidiary, built its brand around younger, urban crowds that prefer to pay month-to-month at lower prices, rather than getting locked into an annual contract. There’s a MetroPCS down the street from me, and it shares the same building as a check-cashing store and a vape shop. That paints a vivid picture of the customer base the company targets — but that demographic may change.

Warren Buffett for Startups, Andrew Wilkinson | Trends by The Hustle

Andrew Wilkinson has sold only two of the 20-plus companies he has founded. In a different world, one where private equity groups and hedge funds didn’t act like the private equity groups and hedge funds they are, he might have sold all of them.

“There have been many times I would’ve sold,” Wilkinson says, “but they made it too complicated.”

It seemed like the buyers only cared about numbers on a spreadsheet. Once a deal was reached, after three to four agonizing months, they wanted to re-negotiate. There was a culture clash, too: The private equity guys wore Patagonia vests over starched button-downs and seemed to look askance at the startup uniform of a t-shirt and sneakers.

How Coffee Meets Bagel Disrupted the $3B Dating App Industry | Trends

Just the thought of online dating elicits a collective groan among anyone who’s done it. And that’s precisely why Dawoon Kang and her two sisters founded Coffee Meets Bagel: They wanted to improve one of the most anxiety-filled stages of people’s lives with technology that makes them forget the pain points.

Thanks to an intelligent algorithm that makes cupid jealous, the social networking site serves as a shortcut to meaningful conversations for all the ready-to-settle-downers.

Kang’s story is an inspiration to female and minority entrepreneurs. Among her career highlights:

- She and her sisters, Arum and Soo, started the app in 2012, using in-depth profiles and funky icebreakers to transform online dating.

- The sisters famously turned down a $30m buyout on Shark Tank in 2015. Their annual revenue now exceeds that amount.

RVs are out, #vanlife is in | Trends by The Hustle

There was a time when I nearly succumbed to the siren song of #vanlife. My wife was working as a travel nurse—I tagged along as a writer/entrepreneur—which meant that, for two years, we moved to a new city every three months. I thought about purchasing an RV on numerous occasions. It would’ve made a ton of sense over short-term apartment rentals, but I couldn’t bring myself to put down the cash—or take showers under a bag with a hole poked in it.

Nevertheless, during my research of the RV industry, I couldn’t help but notice a trend: We’re smack dab in the middle of a one-hundred billion dollar industry undergoing a transformation.

According to a 2019 study by the RV Industry Association, the RV industry has an economic impact of $114B—that’s 2.2% of the entire US GDP. Nearly 25 million Americans—equal to the entire population of Australia—travel the open roads in an RV every year.

Ep 3: Making Millions off an Email Newsletter?! Sam Parr from The Hustle Tells All | Trends by The Hustle

Sam Parr: A big CEO of a huge media company that you know of told me this business will never make more than $2 million dollars a year. And it wasn’t until like six months ago where I was like, “Man, there’s like a path to make literally $100 million a year in revenue.”

Sam Parr: (Singing)

Sam Parr: Yeah this is cool.