How Newsletters Make Money | Trends by The Hustle

June 22, 2020

***

An overview of the newsletter business including: business models, key players, the secret sauce, challenges and opportunities.

***

Summary

- Great Margins: Newsletters are a famously simple yet profitable business (e.g., Ben Thompson’s Stratechery has a pretax margin of ~90% on 7-figure revenue)

- Ads or Subs: Core newsletter business models include ad-supported (The Hustle, The Skimm) and subscription-based (Stratechery, Sinocism, Trapital)

- Newsletter Media Firms Hitting 8-Figure Revenue: Notable media companies built through newsletter (The Skimm, Axios, Industry Dive) are doing $20-30m in revenue per year

- Multiple Business Lines: Media firms that begin as a newsletter can extend into other offerings (e.g., premium research, e-commerce, community forums, networking tools, podcasts)

- Secret Sauce: Newsletters have a number of strengths vs. traditional media including a direct relationship with end users, higher engagement, and lean operating costs

- What’s Next: Opportunities include B2B content niches and tools that provide curation (bundling) or paywall services

***

Table of Contents

- Intro

- History

- The Business Model

- Ad-supported

- Subscription-based

- Subscription-based (Substack)

- Secret Sauce

- Mass adoption of email

- Own distribution and end-user relationship

- Up-sell and cross-sell opportunities

- Stable medium

- Lean operating costs

- Key Players

- Challenges

- Spam laws

- Crowded space

- Subscription fatigue

- Limited search visibility

- Difficult to go viral

- Opportunities

- Content gaps (particularly in B2B)

- Curation, Bundling & discovery tools

- Paywall services

- Newsletter Management

***

1. Intro

Bob Pittman — the creator of MTV, former CEO of Six Flags, Time Warner, AOL, and Century 21 Real Estate and now current CEO of iHeartMedia — has had a hell of a career.

With an incredible background in the media business, Pittman turned heads in 2003 when he launched Pilot Group. The new venture was an incubator and investment fund for a business that many people wouldn’t have expected a media tycoon to get involved in: newsletters.

Trends readers have long expressed an interest in the nuts and bolts behind the newsletter business. This report will give you a behind-the-scenes look at how it works.

By doing so, we’ll answer why Pittman (along with thousands of other entrepreneurs) have flocked to this simple — but surprisingly profitable — business model.

2. History

In 1996, Microsoft released Internet Mail and News 1.0, a feature for its Internet Explorer browser. This was later renamed Outlook. That same year, other companies like Hotmail started offering free email services that could be used anywhere. And email was born.

Since then, email has become embedded in our culture (75%+ of US adults have an account).

In those early years, companies primarily used email as a way to send marketing material.

However, when Pittman entered the industry, he changed the perception of email. Specifically, he showed that email newsletters can be a standalone business.

Pittman & The Pilot Group

In December of 2003, Bob Pittman acquired DailyCandy, a trendy daily email for young women that featured tips on everything from restaurants and nightclubs to sample sales and beauty finds.

Pittman paid $3.5m for the business. At the time, DailyCandy consisted of 200k subscribers and a brilliant editor/founder named Danielle Levy.

The plan behind Pittman’s investment, say sources familiar with his strategy, was to help transform DailyCandy from a newsletter into a multimedia player that could extend its brand into magazines and books, stand-alone television shows, and perhaps even shopping or restaurant guides.

Over the next 5 years, DailyCandy went all-in on email. By 2009 the company grew to 2.5m subscribers and, according to Pittman, $25m in revenue with EBITDA of over $10m. That same year, Comcast acquired DailyCandy for $125m.

Following the acquisition, Pittman launched The Pilot Group, an incubator dedicated to launching DailyCandy for other verticals.

Pilot’s companies included Thrillist (now a $500m media company), PureWow ($25m in revenue before it was acquired for $40m), Business Insider (sold for $500m), and dozens more.

Most recently, individuals such as Ben Thompson (Stratechery) and Bill Bishop (Sinocism) have proven that single-person newsletter operations can generate 7-figures in annual revenue.

Furthermore, new media companies built through newsletters are generating healthy 8 figures in revenue:

A salient example of the growing trend in newsletters is the rise of Substack. The startup provides tools for writers to write, distribute, build community and monetize newsletters. It raised $18m from leading venture firm Andreessen Horowitz and, since the start of the coronavirus pandemic, has doubled its readership and the number of newsletters.

3. The Business Model

Warren Buffet loved newspapers. They were predictable and profitable. But now they suck. In their place, newsletters have stepped in, with all the upside (low-cost, direct-to-consumer benefits, with an opportunity to exploit many profitable niches) and little of the downside.

There are two primary business models in the newsletter business: ad-supported and subscription-based (see sample spreadsheet models here).

1. Ad-Supported (Examples: The Hustle, The Skimm, Axios)

For ad-supported newsletters, the key metrics include:

- Subscribers

- Sends

- Cost per mille (CPM): Advertising rate based on 1k (subscribers or emails sent)

- Open rate: % of emails opened by a unique subscriber

- Cost per open (CPO): Advertising rate based on a unique open

- Cost per click (CPC): Advertising rate based on the number of clicks

- Click through rate (CTR): # of clicks advertisers receive on their ads per number of impressions

And key ad types include:

- Native Ads: Basic advertising placement (standard copy from advertiser or copy written in the voice of the newsletter)

- Advertorial: Advertisement that is formatted like an editorial

- Takeover: An ad campaign that takes over a large segment (or entirety) of a newsletter

The sample ad-based model below looks at the monthly revenue for a newsletter sent 5 days a week with the following assumptions:

- # Sends: 1m

- Open Rate: 50%

- Cost-per-open (CPO, 1000 opens): $20

Based on these assumptions, the monthly ad revenue for this newsletter is $50k / day and ~$1m / month (5 days per week x 4 week = 20 days).

2. Subscription-Based (Examples: Stratechery, The Athletic, Trapital, 2PM, Trends, The Information)

A DIY subscription-based newsletter typically works in the following manner:

- A writer or team of writers provide content related to a specific niche in exchange for a monthly or yearly (discounted) subscription fee

- The writer will mail said content on a consistent schedule (e.g., every Monday and Thursday)

- To attract new subscribers, a writer will make X% of content free and paywall the remaining content

Stratechery, written by Ben Thompson, is a tech and business strategy newsletter launched in 2013. The content business provides one free weekly report and three additional pay-walled reports a week.

While he has not confirmed his subscriber count in a number of years, internet sleuths pin Thompson’s paying subscribers at a minimum of 25k, each shelling out $100-120 a year.

These estimates provide Thompson’s revenue figures and we can back out his expenses (tools he pays for) from the Stratechery Privacy Policy page.

Based on this fairly rough guesstimate, Thompson brings in revenue of $3m with a stellar 90% pre-tax profit margin ($2.7m net profit).

(You can change Stratechery subscriber assumptions here)

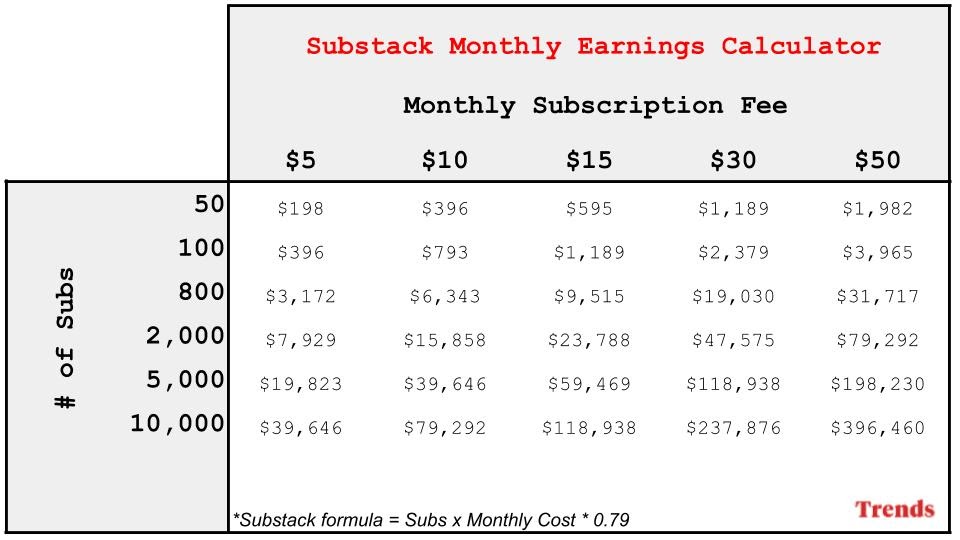

3. Substack Subscription-Based (Examples: Sinocism, Petition, TrueHoop)

Another subscription-based newsletter option for creators is Substack. As seen in the Stratechery example, a newsletter entrepreneur needs to be familiar with a number of tools (membership, forums, payments, content delivery networks, hosting, etc.) to successfully operate a newsletter business.

Substack has created a platform that offers a turnkey solution for these back-end services for creators (thus, allowing them to focus on content creation):

- For paid newsletters, Substack takes a 10% cut of revenues

- With additional payments (e.g., transaction fees), the Substack revenue calculator shows an ~80% profit margin for creators.

For those wondering “when is it a good time to monetize“, Substack has a great article based on the platform’s data (You’re Guide To Going Paid); the article is well worth reading and here are some notable bullet points:

- Start with a revenue target that feels right to you. Remember to adjust for income tax, as well as Substack’s and Stripe’s fees (10% + 2.9% plus 30 cents per transaction, respectively).

- Estimate your number of paying subscribers, based on the size of your free list. We commonly see conversion rates of 5–10%.

- Divide your revenue target by your number of paying subscribers to get to your annual price, then work backwards to a monthly price.

- We often see writers charge $5/month for newsletters in the personal interest category and $10/month for those in a business category, but challenge yourself to charge more than you think is possible. Set your price 20% higher than you normally would; you can always offer a 20% discount for your earliest subscribers.

Additionally, to make the subscription more appealing, here are some functionalities that Substackers offer:

- 1:X ratio of free-to-paid posts: Judd Legum of Popular Information publishes four days a week, Monday through Thursday: 1 free post and 3 paid posts.

- Weekly paid posts with free previews: Richard Rushfield of The Ankler writes an insiders’ newsletter about the entertainment industry. He publishes paid posts 1-2x/week and occasional free posts (1x/month), as well as a free preview version of his paid posts.

- Private member community: Nadia Bolz-Weber of The Corners publishes occasional free posts (1-2x/month). Paying subscribers get behind-the-scenes access to Q&As, community discussion threads, quarterly book clubs, and guest posts.

- Exclusive bonus material: Flow State publishes free good-for-working-to music recommendations every weekday. Paying subscribers get access to curated Spotify playlists.

In addition to Substack, there is an alternative “newsletter-as-a-service” platform called Ghost. The firm charges $29/month for its services and takes no transaction fee.

And, of course, there are more traditional mass email sending platforms (Mailchimp, Revue and Convert Kit) which have increasingly more “newsletter-as-a-service” functionality.

Additional Considerations For DIY Subscription vs. Substack:

While Substack provides a turnkey solution, the platform has a number of notable limitations for those looking to rev up paid subscription businesses:

- The 10% fee is quite steep, especially when annual revenue gets into 7 figures

- There is limited customization options

- Newsletter websites typically have to use the ________.substack.com domain, which can hurt branding

- Substack’s current offering doesn’t allow for additional revenue products (e.g., ecommerce) or audience-building tools (e.g., referral programs)

4. Secret Sauce

Mass Adoption of Email

There are 3.9B active email users in the world, as compared to 3.5B social media users. Annual growth in email users is projected at a steady 2-3% over the next three years, bringing more end users into the email universe.

Better Engagement Than Social Media

In addition to the wide (and still growing) adoption of email, the channel has better engagement than the largest social networks:

- vs. Facebook: Organic reach on Facebook is under 10% while the average open rates for email marketing are between 20-30%

- vs. Twitter: Click-through-rates on tweets are less than 1% while email open rates are typically in the 3% range

Own Your Distribution and Relationship With Readers…

Late last year, the entrepreneur and investor Naval Ravikant tweeted that “building a following on Twitter is building a castle out of sand.” Large tech platforms such as Facebook, Twitter, Linkedin, and Google are famous for “changing algorithms” that can overturn the fortune of a media business overnight (e.g., Buzzfeed).

Because email is an open standard, when you build an audience via email newsletters, you directly own the relationship with the reader and are not at the whim of an algorithm change.

…Which Helps To Control Customer Acquisition Costs

Further, there is less of a reliance on paying Facebook (to get “boosted” on the news feed) or Google (to rank high in searches). While these ad prices have fallen during the pandemic, Facebook and Google ads regularly outpace inflation. Relying on them in the long-term is an expensive game.

Build A Community

The direct relationship with the end reader is also the perfect jumping point for building a broader community of like-minded people.

As 2PM’s Web Smith puts it:

Upsell and Cross-sell Opportunities

When you own a direct relationship with readers, you can sell additional products through the distribution channel:

- Stratechery offers a paid podcast

- Trapital offers 1-on-1 consulting services

- The Hustle offers a premium research product (how meta 😉)

Stable Medium

Related to the previous point, email is a well-established standard. It has not changed very much since its initial rise in the 90s. Moving forward, there will continue to be innovations in email clients (e.g., Superhuman, Hey), but the underlying standard is stable.

Lean Operating Costs…

As demonstrated by Ben Thompson’s Stratechery example in the previous section, newsletters can be an extremely lean business. A single individual writing expertly on a valuable subject can secure a high standard of living.

…With Opportunity To Ad On A Sales Team

While this may seem counterintuitive to the notion of lean operating costs, certain ad-supported newsletters can leverage sales teams effectively. Currently, there are no effective newsletter ad networks. A sales team with a good understanding of its audience and advertising can offer highly valuable contextual advertising that performs better than other ad options.

5. Key Players

Ad-Supported

- Daily Candy

- Year Founded: 2000

- Key People: Dany Levy

- Theme: Pioneer daily email newsletter providing readers with hip and trendy events in their specific cities (started with NY and grew to dozens of other US cities).

- Notes: Sold in 2009 for $125m (was doing $25m EBITDA) to Comcast. Shut down in 2014.

- The Hustle

- Year Founded: 2015

- Key People: Sam Parr, Adam Ryan

- Theme: Daily business and technology newsletter written in a fun and irreverent voice.

- Notes: The Hustle also operates a popular annual conference (Hustle Con) and a subscription research product (Trends…so so meta).

- The Skimm

- Year Founded: 2012

- Key People: Danielle Weisberg, Carly Zakin

- Theme: Daily newsletter (7m subscribers) summarizing news in an approachable manner and targeting young female millennial professionals

- Notes: The Skimm has raised ~$30m in venture capital, including from investors such as GV (Google Ventures), Shonda Rhimes, Tyra Banks, and Sara Blakely. Estimated revenue = $30m.

- Industry Dive

- Year Founded: 2012

- Key People: Sean Griffey, Ryan Willumson, Eli Dickinson

- Theme: Media offering that provides 19 B2B newsletters (e.g., Banking, Biopharma, CFO, CIO, Construction, Education, Transport). In addition to ads, the firm also runs marketing services and a brand studio to help corporates (e.g., IBM) with content marketing initiatives.

- Notes: Industry Dive was acquired by a PE firm in September 2019 for an undisclosed price. At the time, the firm was doing $22m in revenue, and acquisition estimates are in the $60-70m range.

- Front Office Sports

- Year Founded: 2014

- Key People: Adam White

- Theme: A newsletter providing news and insights at the intersection of sports and business.

- Notes: In October of 2018, the company received an undisclosed investment from PE firm Stein’s. The firm has a number of additional offerings including video, podcast, webinars, and sports-related jobs listings.

- Axios

- Year Founder: 2016

- Key People: Dan Primack, Jim VandeHei, Mike Allen, Roy Schwartz

- Theme: Media firm with 21 newsletters covering business, tech and politics

- Notes: Axios content is known for punchy, bullet-point summaries of the news. The entire media offering has an estimated revenue of $25-30m.

- Morning Brew

- Year Founder: 2015

- Key People: Alex Lieberman, Austin Rief

- Theme: Daily email newsletter covering the latest news from Wall St. to Silicon Valley.

- Notes: The Morning Brew currently has three dedicated newsletters (daily, emerging tech, marketing).

Subscription-Based

- Stratechery

- Year Founded: 2013

- Key People: Ben Thompson

- Theme: Leading tech strategy (hence name) newsletter that is considered a pioneer in the space of “individuals can make a living writing newsletters.”

- Price: $12/month or $120/year

- Notes: As noted above, a conserative estimate places the newsletter’s revenue at $3m a year.

- 2PM

- Year Founded: 2013

- Key People: Web Smith

- Theme: Daily newsletter that provides news and analysis on the intersection of business and media.

- Price: $20/month or $180/year

- Notes: A newsletter product that also offers data tools, networking opportunities, and curated expert insights.

- Trapital

- Year Founded: 2018

- Key People: Dan Runcie

- Theme: Business strategy analysis of the hip hop industry.

- Price: $100/year (UPDATE: Dan no longer offers a paid subscription option)

- Notes: A newsletter and podcast offering that provides the world’s best hip hop industry analysis. Trapital has recently added a strategic consulting service for other media brands.

- The Athletic

- Year Founded: 2016

- Key People: Alex Mather, Adam Hansmann

- Theme: Sports media that covers professional and college sports teams in 20+ North American cities, with recently expanded international soccer coverage.

- Price: $9.99/month or $59.99/year

- Notes: The Athletic is trying to unbundle the sports section from newspapers. The company has raised ~$140m in funding (valued at $500m) and aggressively hires sports reporters in each city it enters. There are questions around the viability of its business model, particularly the company’s above-market salaries for hundreds of sports reporters.

- Van Trump Report

- Year Founded: Early 2000s

- Key People: Kevin Van Trump

- Theme: Newsletter providing commodity price intelligence for investors and agriculture professionals.

- Price: $60/month or $600/year

- Notes: In addition to a newsletter, the Van Trump report offers real-time cash sale signals, risk management strategies, a B2B network, and podcast. It is estimated that the firm makes $5m+ a year.

- Agora Financial

- Year Founded: 1978

- Key People: Bill Bonner

- Price: N/A

- Theme: Publishing firm that offers newsletters (including free), books, and research on financial service and capital market predictions.

- Notes: Firm is known for aggressively upselling its various market prediction products which can range from hundreds to thousands of dollars a month. The firm is privately held and reputed to make $500m+ a year across its products.

- The Information

- Year Founded: 2013

- Key People: Jessica Lessin

- Price: $59/month or $300/year

- Theme: In-depth and exclusive tech stories read widely by the tech and investment community (~20k subscribers).

- Notes: The Information is known for breaking tech-related news stories, producing comprehensive tech company org charts, and cultivating an influential network of tech professionals.

Subscription-Based (Substack)

- The Dispatch

- Year Founded: 2019

- Key People: Stephen Hayes, Jonah Goldberg

- Price: $10/month or $100/year — or $1.5k (lifetime)

- Theme: Political news publication that focuses on original reporting and insights with a staff of 10+.

- Notes: The Dispatch is currently the top paid publication on Substack, with tens of thousands of subscribers. The publication passed $1m in annual subscription revenue in March 2020.

- Sinocism

- Year Founded: 2015

- Key People: Bill Bishop

- Theme: Daily newsletter analyzing all-things China.

- Price: $15/month of $168/year

- Notes: Bishop is one of America’s leading observers of China. Sinocism was founded in 2015 (prior to Substack) and became one of the most-followed publications on the social, economic, and political events in China. The publication has thousands of subscribers and 7 figures in revenue.

- Petition

- Year Founded: 2016

- Key People: Anonymous Team

- Theme: Bankruptcy and restructuring newsletter that provides insights in an imminently readable and snarky voice.

- Price: $49/month or $499/year

- Notes: Another 7-figure Substack publication with thousands of legal and finance professional subscribers.

- Popular Information

- Year Founded: 2016

- Key People: Judd Legum

- Theme: A political reporting newsletter that is sent four days a week.

- Price: $6/month or $50/year or $150/year (founding member pricing with additional features)

- Notes: Written by Judd Legum (founder and editor of the now-defunct ThinkProgress and Hillary Clinton’s 2008 Presidential campaign research director). The publication often breaks political and business-related scandals.

6. Challenges

Spam laws

The rise of increasingly stringent digital privacy laws (GDPR in Europe, CCPA in California, CAN-SPAM in Canada) has forced companies to closely follow anti-spam rules including: 1) user permissions; 2) honest headlines; 3) clear identification for ads; 4) opt-out options and more.

Very Crowded Space

Every major publication has a number of newsletter offerings (e.g., New York Times, Washington Post, WSJ). Further, with the rise of turnkey services like Substack, countless newsletters are being launched every day. The newsletter opportunity is as big as ever, but it’s very important to find the content gaps (more on that below).

Subscription Fatigue

As more written content goes behind a paywall (not to mention paid audio and video streaming services), there is concern that readers will develop subscription fatigue. In recognition of this issue, some Substack publications are bundling together their offerings so readers only have to make one purchase decision.

Limited Search Visibility

For subscription-based newsletters, the existence of paywalls means that the content is often hidden from search engine bots crawling the web. As a result, the content doesn’t show up in searches for relevant queries.

Difficult To Go Viral

Another related challenge is that gated content has a harder time going viral, as people are less likely to share items that hit paywalls.

7. Opportunities

Marie Dollé — a French-American digital strategist — put together a fantastic market map of newsletter-related products. We will touch on some of these categories below, but here is the graphic for inspiration:

Content Gaps (Particularly B2B)

There are countless content niches that could use a dedicated newsletter.

The B2B space is particularly ripe for disruption and offers high revenue potential as industry insiders will pay top dollar for analytics and insights (aka the “corporate credit card effect”).

As Petition — the Substack bankruptcy newsletter — shows, there is great appetite to give traditionally dry, industry-specific trade publications a more approachable voice.

A Google search of popular trade publications shows dozens of opportunities, including:

- AdWeek (advertising)

- Crane Today (crane industry)

- Game Industry Report Magazine (gambling)

- Australian Dairy Foods (dairy)

- Design News (designers)

- Engineering News-Record (construction)

- Architectural Digest (architecture)

- Hairdressers Journal International (hairdressers)

- Global Custodian (custody and asset management)

- Coach & Bus Weekly (transportation)

- Gavin Report (radio industry)

- Heritage 365 (museums)

Curation, Bundling & Discovery Tools

As noted by Ben Thompson, whenever an industry goes from scarcity to abundance, there is great value in services that facilitate discovery and curation. Newsletter Stack is a recently launched platform that allows individuals to curate their favorite newsletter. Similarly, Substack’s internal discovery tool ranks the top paid and free publications.

Other discovery tools include:

- To be launched Letterdrop (“Discover and share newsletters daily”)

- Letterlist (“Discover the best newsletters for [pick subject]”)

We touched on the idea of bundling earlier and, in many ways, it falls under the “curation” umbrella. Packaging together complementary newsletters or writers into one package is an act of curation.

Here is more from tech and innovation consultant, Ari Lewis:

Paywall Services

One of the key decisions for any subscription business is to decide how much free content is made available.

- Freemium: Business Insider offers a lot of free content but also has a premium offering

- Metered Paywall: The New York Times uses a metering policy whereby you can read X amount of articles before you hit a paywall

- Hard Paywall: The Financial Times and The Information provide zero free content. You must subscribe to read

Because of these varying strategies, there is an appetite for digital solutions that can register and subscribe readers as well as predict churn (or other related analytics) for paywalled content.

Piano is one such firm. But, based on the Trends team’s experience with the service, there is clearly an opportunity for a superior offering. (Message us if you have ideas!)

Newsletter Management

Management tools are needed to handle the abundance of newsletter. There are a number of solutions that curate newsletter feeds (Feedly, Newsletry, Feedbin) and newsletter reading apps (Stoop, Slick).